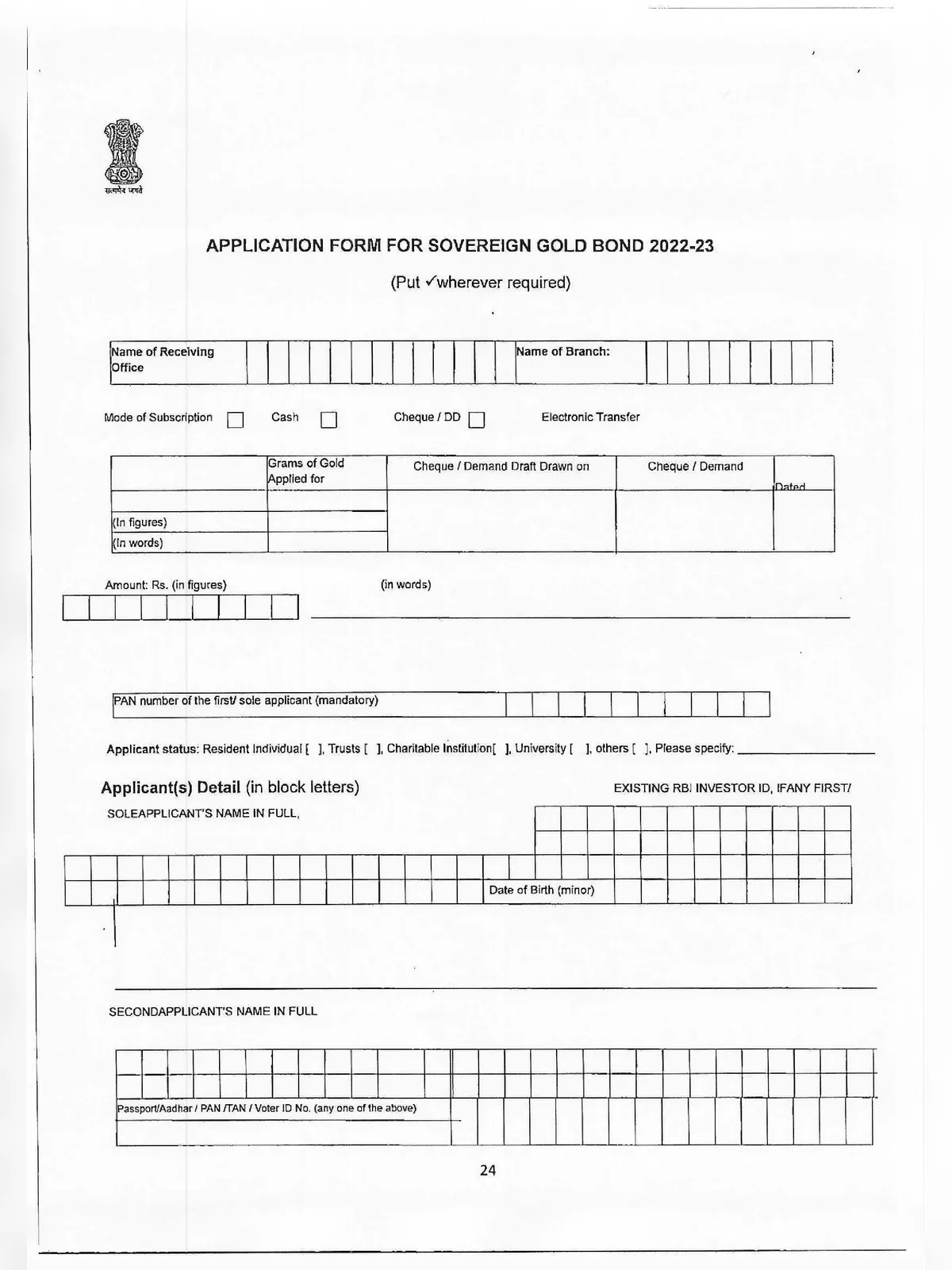

Sovereign Gold Bond Scheme Application Form 2022-23 - Summary

The Sovereign Gold Bond Scheme is a government initiative in India that allows individuals to invest in gold in a digital and paperless form. Under this scheme, the government issues bonds denominated in grams of gold, providing investors with an alternative to physical gold.

Here are some key points about the Sovereign Gold Bond Scheme. You can download the Sovereign Gold Bond Scheme Application Form in PDF format by using the given link at the bottom of this page.

Information for Investors of Sovereign Gold Bond 2022-23

| Item | Sovereign Gold Bond 2022-23 |

| 1) Category of Investor | The Bonds will be restricted for sale to resident Indian entities including individuals, HUFs, Trusts, charitable institutions and Universities. |

| 2) Limit of investment | Minimum subscription of 1 Gram and Maximum investment of 4kg for individuals and HUF & 20kg for trust and similar entities per investor per annum. |

| 3) Date of Issue of bonds | Date of receipt of bond will be the same which is inscribed on the holding certificate. |

| 4) Forms of Bonds | De-mat and Physical (Certificate of Holding) |

| 5) Interest Option | Half yearly intervals. Interest will be credited directly in to the account mentioned in the application form or in the Account linked with the Demat a/c. |

| 6) Post Maturity Interest | Post Maturity Interest is not payable. |

| 7) Bank account | It is mandatory for the investors to provide bank account details to facilitate payment of interest /maturity value |

| 8) Nomination Facility | The sole Holder or all the joint holders may nominate a maximum of two persons as nominee. |

| 9) Maturity period | 8 years from the date of issue. |

| 10) Premature redemption | On the coupon dates after the 5th year of issuance. |

| 11) Tradability | Trading of these bonds on stock exchanges shall be notified. |

| 12) Loans from banks against the security of these bonds | The holders of the said securities shall be entitled to create pledge, hypothecation or lien in favor of scheduled banks. |

| 13) Application forms | Branches of all the scheduled commercial banks, designated Post offices, SHCIL and authorized stock exchanges |

Instructions for Investors/ Applicants for Sovereign Gold Bond Scheme

- The application should be complete in all respects.

- Incomplete applications may be rejected or delayed till full particulars are available.

- In case the application is submitted by a Power of Attorney (POA) holder, please submit original

POA for verification, along with an attested copy. - In case the application is on behalf of a minor, please submit the original birth certificate from

the School or Municipal Authorities for verification, together with an attested copy. - Please note that nomination facility is available to a Sole Holder or all the joint holders

(investors) of an SGB. - In case the nominee is a minor, please indicate the date of birth of the minor and a guardian can be

appointed. - The nomination facility is not available in case the investment is on behalf of the minor.

- Please provide bank account details for receiving payment through Electronic mode.

- Please notify the change of bank account, if any, immediately.

- POST MATURITY INTEREST IS NOT PAYABLE.

- Indicate your date of birth.

Download the Sovereign Gold Bond Scheme Form 2022-23 in PDF format online from the link given below.