PF Withdrawal Form - Summary

PF Withdrawal Form is an important document that enables individuals to access their hard-earned savings accumulated in EPFO accounts. If you need to make a final P.F settlement or pension withdrawal, this form is crucial, especially if you have less than 10 years of service. You can conveniently download the PF Withdrawal Form from the link provided below. The form is also available in Hindi.

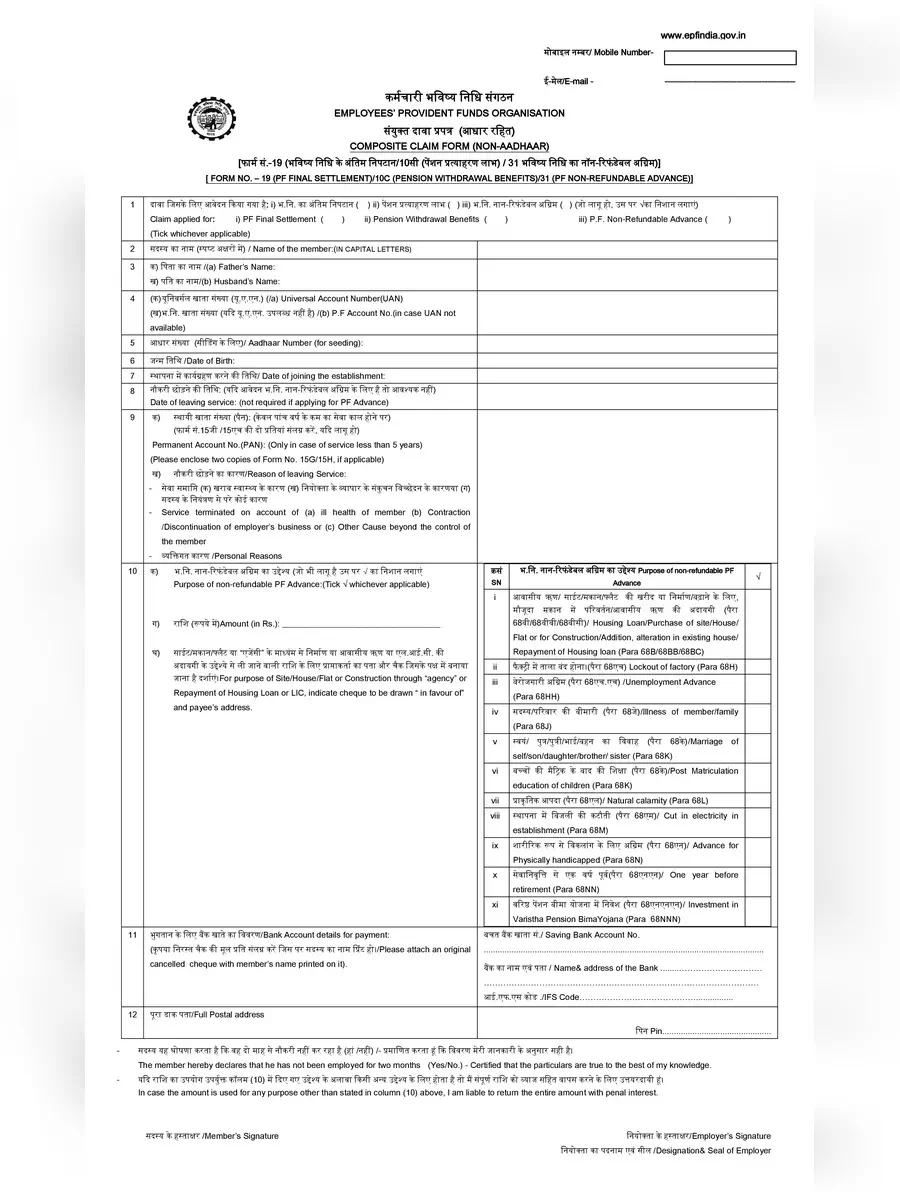

Understanding the PF Withdrawal Form

A Provident Fund withdrawal form, formerly known as a PF withdrawal form, is a document that allows concerned individuals to access the funds accumulated in accounts related to EPFO schemes. Individuals can also utilize their accumulated corpus to meet specific financial obligations.

Details to be Mentioned in the PF Withdrawal Form

- Name of the member and personal details

- Kindly mention the 12-digit Universal Account Number

- PF Account Number

- 12 digits Aadhaar Number

- Date of joining the establishment

- Date of leaving service: (not required if applying for PF Advance)

- Permanent Account No.(PAN): (Only in case of service less than 5 years)

- Bank Account details for payment

- Full Postal address

- And other details

Documents Required for PF Withdrawal Form

- Form 19.

- Form 10C and Form 10D.

- Form 31.

- Two revenue stamps.

- Bank account statement.

- Identity proof.

- Address proof.

- A blank and cancelled cheque (IFSC code and account number should be visible).

- And any other details.

Online PF Withdrawal Procedure

You can easily withdraw your PF online through your UAN by visiting the EPFO e-SEWA portal. Follow these simple steps:

- 1. Login to the portal – Visit the EPFO e-SEWA portal and login using your UAN and password, entering the captcha code. If you’ve forgotten your password, you can reset it via an OTP sent to your registered mobile number.

- 2. Visit Online Claims section – After logging in, locate ‘Claim (Form-31, 19, 10C & 10D)’ in the ‘Online Services’ section.

- 3. Enter bank account details – Once this section opens, enter the correct bank account number (seeded with UAN) for verification purposes.

- 4. Confirm Terms & Conditions – After verifying your details, confirm the ‘Terms and Conditions’ as stated by EPFO, and click on ‘Proceed for Online Claim’.

- 5. Select reason for withdrawal – Choose the reason for withdrawing from your PF account from the dropdown menu. You will only see the options for which you’re eligible.

- 6. Enter details and upload documents – After selecting the reason for withdrawal, enter your complete address. You may need to upload your cheque/passbook details if you’ve chosen ‘Advance Claim’. Accept further ‘Terms and Conditions’ and request a one-time password (OTP) for verification.

- 7. Get Aadhaar OTP – After confirming your details and accepting the ‘Terms and Conditions’, request an OTP sent to the mobile number registered with your Aadhaar. Enter this OTP to submit your claim application.

You can download the PF Withdrawal Form in PDF format using the link given below.