GPF Withdrawal Form - Summary

Hello, Friends! Today, we are sharing the GPF Withdrawal Form PDF to assist you. If you are searching for the GPF Withdrawal Form in PDF format, then you have come to the right place! You can easily download it from the link provided at the bottom of this page.

Everything You Need to Know About GPF Withdrawal

If you are a government or private employee who has subscribed to the provident scheme from your employer and want to withdraw your GPF from the PF account, you will need the GPF Withdrawal Form PDF. This form can be collected from the nearest PF office or directly downloaded using the link given below.

GPF Withdrawal Eligibility

- Any permanent government employee who is an Indian resident can subscribe to GPF.

- All temporary government employees with an employment record of 1 year or more are eligible for GPF.

- Government employees working in organizations under the EPF Act, 1952 can also benefit from this PF.

- Any retired government pensioner who has been re-employed and is not eligible for the Contributory Provident Fund can subscribe to GPF.

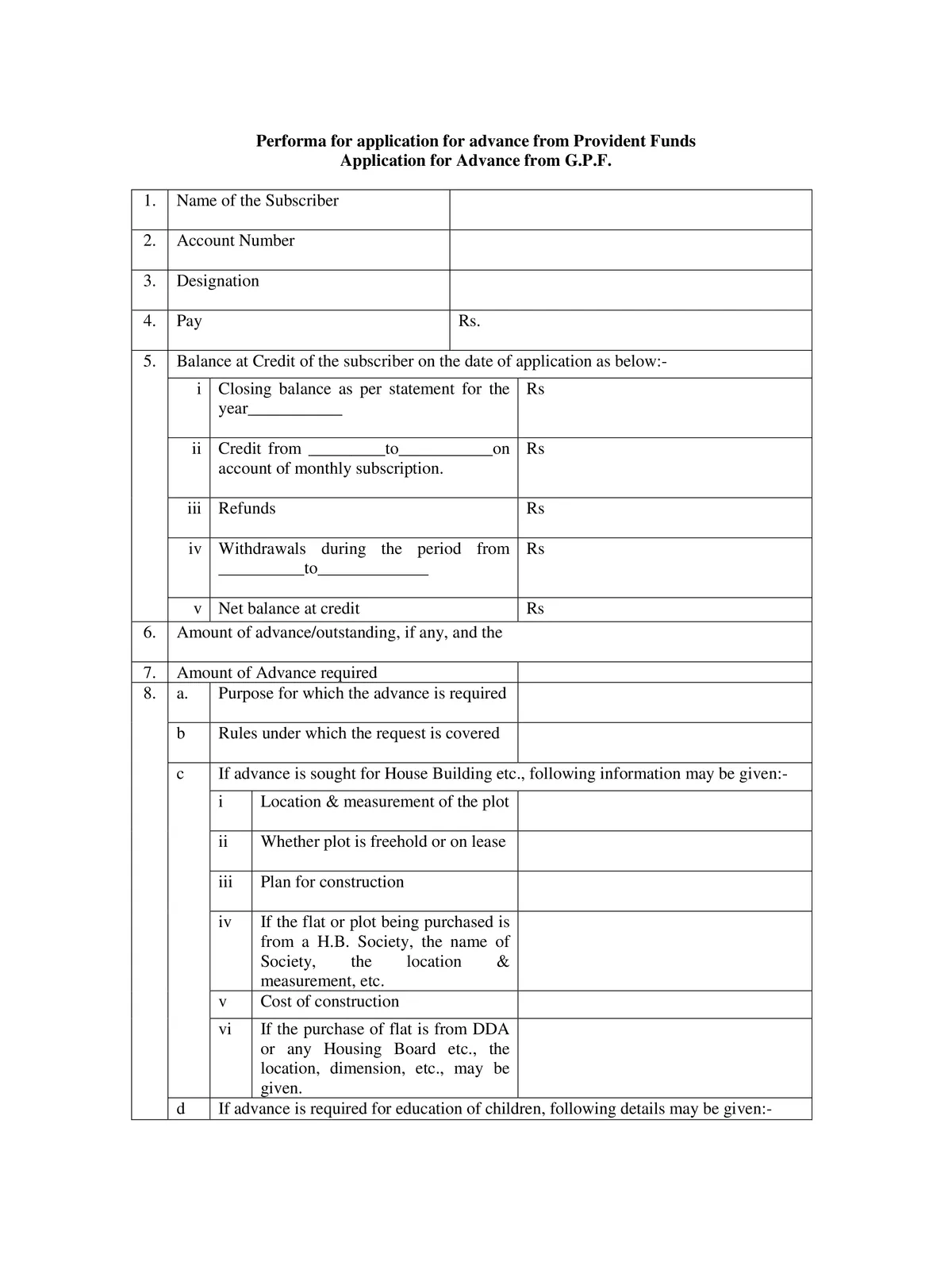

How to Write an Application for GPF Withdrawal

- Name of the Subscriber

- Account Number

- Designation

- Pay

- Balance at credit of the subscriber on the date of application

- Any other details.

GPF Withdrawal Rules

The main rule is that individuals must complete at least 10 years of service to be eligible to withdraw from their GPF. Before 2017, this limit was 15 years. You can make withdrawals from the GPF for the following reasons:

- Post high-school education in India or abroad for the subscriber or their children, including travel costs

- Children’s marriage

- Medical treatment of the subscriber or their family, including travel expenses

- Buying items like a TV, washing machine, cooking range, geyser, or computer

- Building or purchasing a house or repaying a home loan

- Renovating a house

- Purchasing an insurance policy or a pension approved under GPF rules

An employee can withdraw their accumulated GPF funds for various reasons, but the mandatory condition is to complete 10 years of service or be within 10 years of retirement on superannuation, whichever comes first. This applies only if the employee has not left the government service.

You can download the GPF Withdrawal Form PDF format using the link provided below.