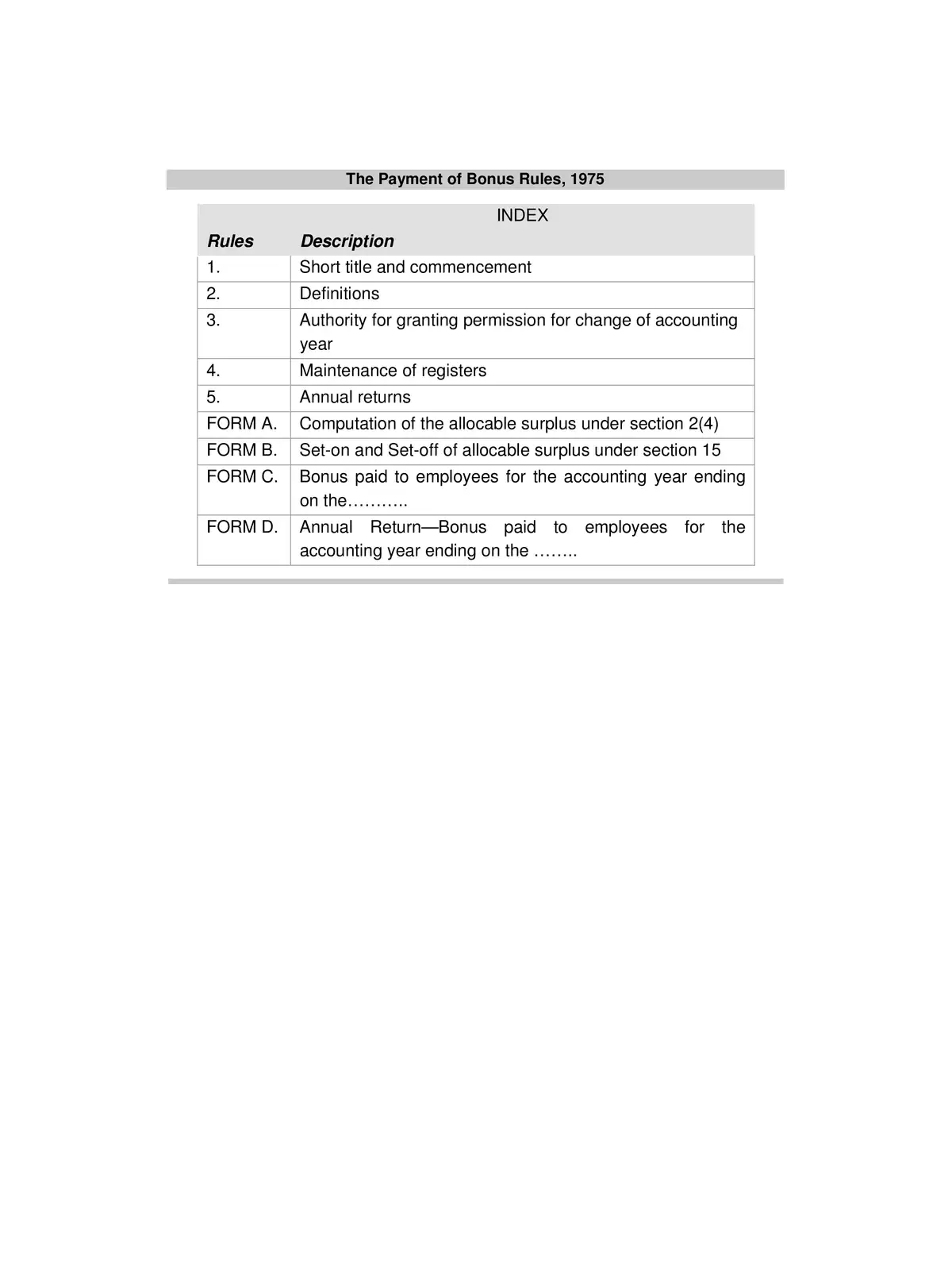

The Payment of Bonus Rules, 1975 - Summary

Under The Payment of Bonus Rules, 1975, an “employee” is defined as any individual hired for wage or reward, whether their employment terms are written or implied. This definition includes supervisors, managerial, and administrative staff earning up to Rs. 21,000 per month.

It is important to note that the definition also includes the concept of dearness allowance, which refers to the cash payment made to an employee to help them cope with rising living costs.

Understanding the Application of the Payment of Bonus Rules

The Payment of Bonus Rules primarily apply to:

Every Factory

Any business that employs twenty or more people on any single day during the accounting year falls under this rule.

Important Time Limits

The time limits for bonus payment include:

- Payment must be made within a month of the award becoming executable or the settlement taking effect.

- Bonus payments should be completed within eight months from the end of the fiscal year.

Bonus Eligibility and Details

Every employee who earns less than Rs. 21,000 per month and has worked for at least 30 days in an accounting year is eligible for a minimum bonus of 8.33 percent of their salary or wages. This rule applies even if the establishment incurs losses. The maximum bonus an employee can receive is 20% of their salary or wages for that accounting year.

To learn more about the Payment of Bonus Rules, 1975, and its benefits, you can easily download the PDF file link below. 🌼