Negotiable Instrument Act

The Negotiable Instruments Act PDF of 1881 mandates that when a promissory note or bill of exchange has been dishonoured by non-acceptance or non-payment, the holder of such instrument may cause such dishonor to be noted by a notary public upon the instrument or upon a paper annexed (or attached) thereto, or partly upon each of them.

A negotiable instrument is a piece of paper that guarantees the payment of a certain sum of money, either immediately upon demand or at any predetermined period and whose payer is typically identified. It is a document that is envisioned by or made up of a contract that guarantees the unconditional payment of money and may be paid now or at a later time.

Negotiable Instrument Act

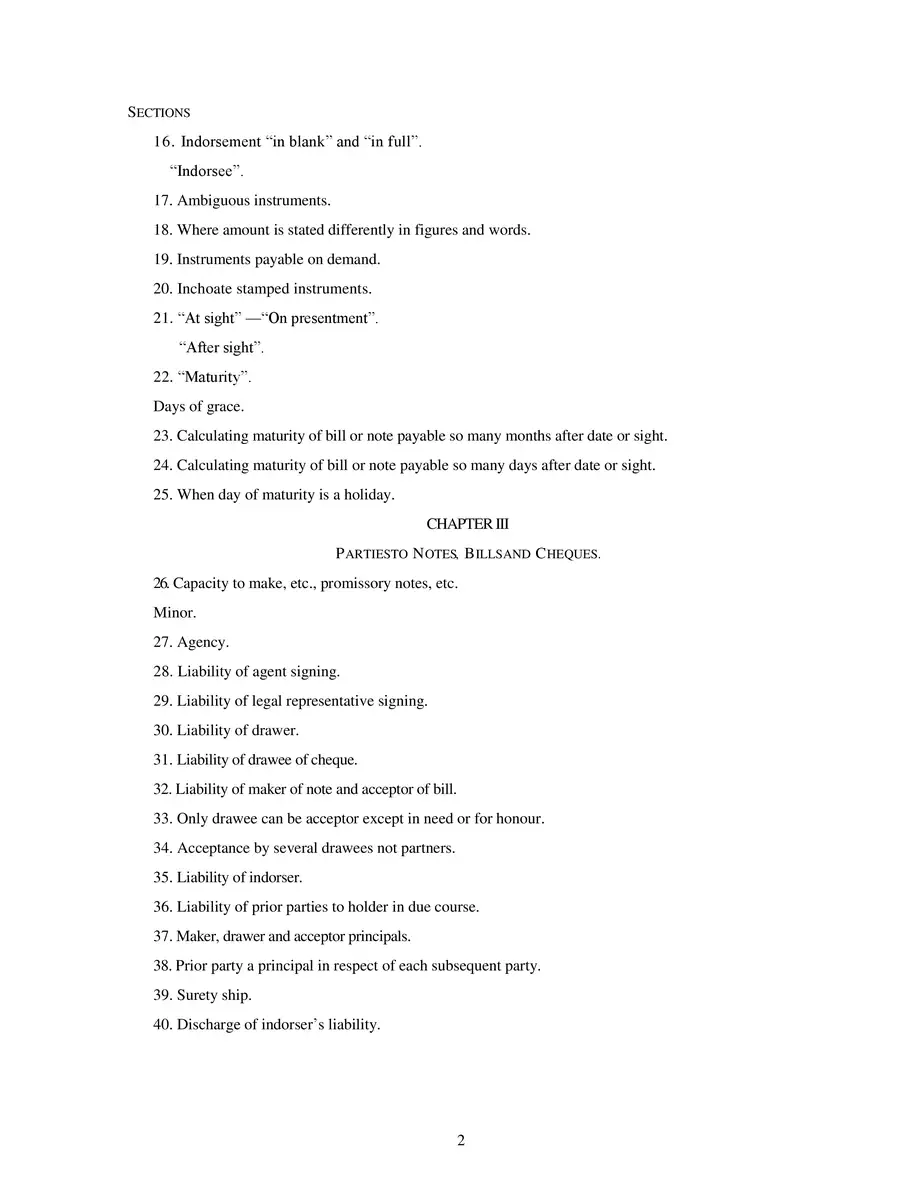

The Negotiable Instruments Act, of 1881 is a significant law that governs the use of negotiable instruments in India. It provides for the regulation of promissory notes, bills of exchange, and cheques. The Act was enacted to provide a uniform legal framework for the use of negotiable instruments in India. The Act has been amended several times to ensure that it is in line with the changing business practices and legal requirements.

- Promissory Notes: A promissory note is a written promise to pay a specific amount of money to the person named in the document. The person making the promise is called the ‘maker,’ and the person to whom the payment is to be made is called the ‘payee.’ The promissory note can be transferred by endorsement and delivery.In the case of State Bank of India vs. Gangadhar Ramchandra Panse, the court held that a promissory note must contain an unconditional promise to pay a specific amount of money. If the promise is conditional, the document will not be considered a promissory note.

- Bills of Exchange:A bill of exchange is a written order by the maker to the payee to pay a certain amount of money to a third party. The person who issues the bill is called the ‘drawer,’ and the person to whom the payment is to be made is called the ‘drawee.’ The person in whose favor the payment is to be made is called the ‘payee.’ The bill of exchange can be transferred by endorsement and delivery.In the case of Bank of India vs. O.P. Swarnakar, the court held that a bill of exchange is a negotiable instrument that can be transferred by endorsement and delivery. The transfer of a bill of exchange is valid even if the transferor does not own the instrument at the time of transfer.

- Cheques: A cheque is a written order by the drawer to the bank to pay a certain amount of money to the payee. The bank is required to pay the amount mentioned in the cheque to the payee or their authorized representative. The cheque can be transferred by endorsement and delivery.

You can download the Negotiable Instrument Act PDF using the link given below.