Atal Pension Yojana (APY) Form - Summary

Atal Pension Yojana (APY) is a popular pension scheme designed mainly for the unorganized sector, including maids, gardeners, delivery boys, and others. This scheme replaced the Swavalamban Yojana, which did not receive a good response from the public. The main goal of the Atal Pension Yojana is to ensure that every Indian citizen can live without fear of health issues, accidents, or diseases during old age, providing a sense of security.

The pension amount is determined based on the individual’s age and the contribution made. If a contributor passes away, their spouse can claim the pension. If both the contributor and their spouse are no longer alive, the nominee will receive the accumulated corpus.

Eligibility for Atal Pension Yojana

APY Form – Requirements

To benefit from the Atal Pension Yojana, you must meet the following eligibility criteria:

- Be a citizen of India.

- Be between 18 to 40 years old.

- Make contributions for a minimum period of 20 years.

- Have a bank account linked with your Aadhaar.

- Possess a valid mobile number.

If you are already benefiting from the Swavalamban Yojana, you will be automatically transferred to the Atal Pension Yojana.

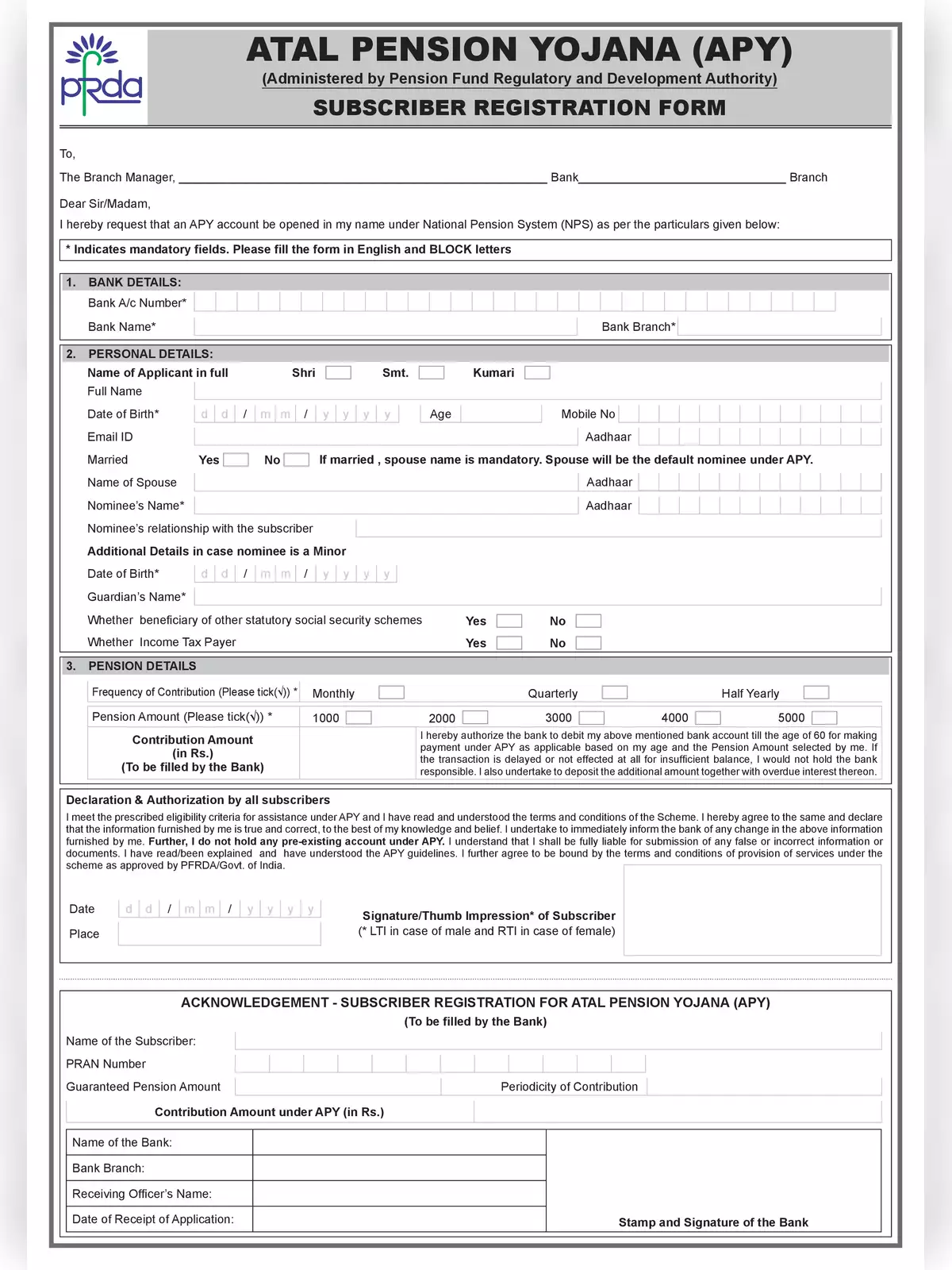

How to Apply for Atal Pension Yojana

Follow these steps to apply for the Atal Pension Yojana:

- Visit any nationalized bank that offers the scheme to open your APY account.

- APY forms are available both online and at the bank. You can download the form from the official website.

- Forms are accessible in English, Hindi, Bangla, Gujarati, Kannada, Marathi, Odia, Tamil, and Telugu.

- Complete the application form and submit it at your bank.

- Provide a valid mobile number if you haven’t done so already.

- Submit a photocopy of your Aadhaar card.

Documents Required for the APY Form

When applying for the Atal Pension Yojana, you need to provide the following documents:

- Details of the bank and branch where your savings account is held.

- APY registration form, filled out completely.

- Your Aadhaar number and mobile number.

- Balance details of your savings account, ensuring enough funds for monthly contributions.

Monthly Contributions

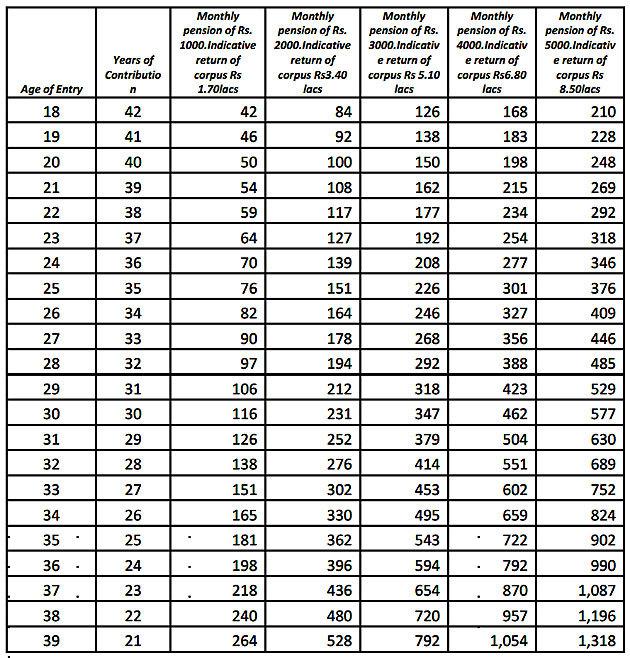

The monthly contribution you need to make is based on the pension amount you wish to receive upon retirement and your starting age for contributions. The following table helps you understand how much you should contribute every year, depending on your age and chosen pension plan.

APY Contribution Chart

APY Monthly contribution[/caption>

APY Monthly contribution[/caption>

Feel free to download the Atal Pension Yojana Form in PDF format using the link below.