LIC IPO Form - Summary

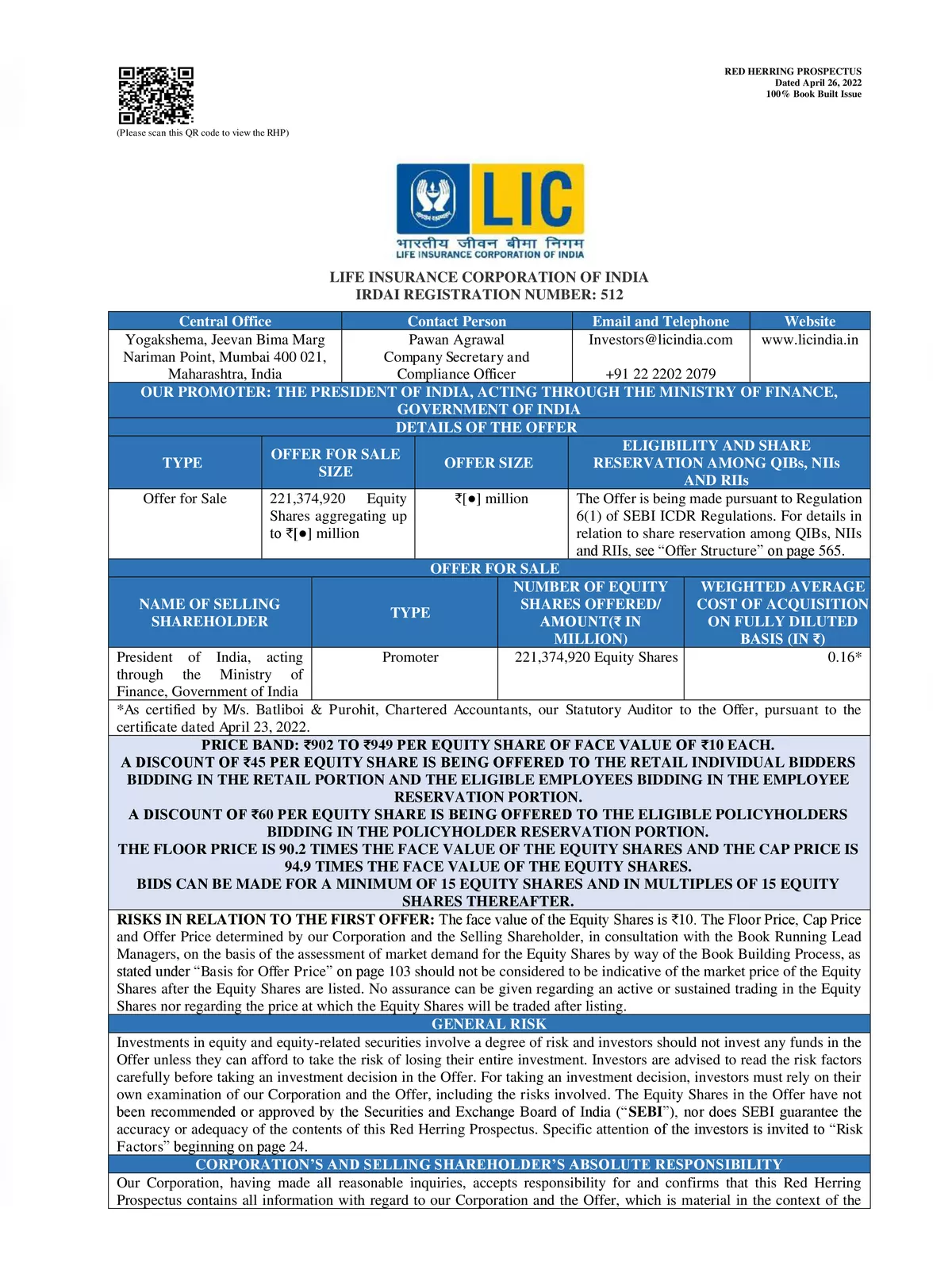

Life Insurance Corporation (LIC) has announced the IPO and set its price band for the initial public offer (IPO) in the Rs 902-949 range. set its price band for the initial public offer (IPO) in the Rs 902-949 range. LIC is valued at Rs 6 trillion, which is just 1.1 times its original embedded value of Rs 5.39 trillion, according to the government’s revised estimates.

LIC policyholders who have one or more LIC policies would be eligible to apply in the IPO under the Policyholder Reservation Portion. Policyholders must ensure that their Permanent Account Number (PAN) details are updated in the policy records of the Corporation at the earliest. Eligible policyholders will be able to apply for the “Policyholder Reservation Portion” at the cut-off price.

LIC IPO Download

LIC has fixed a price band of ₹902 apiece at the lower end and ₹949 apiece at the upper end. The floor price is 90.2 times the face value of the equity shares, on the other hand, the cap price is 94.9 times the face value of the equity shares.

LIC offers a discount of ₹60 apiece to eligible policyholders bidding in the reserved category. While a discount of ₹45 apiece is offered to retail individual investors. Bids can be made for a minimum of 15 equity shares and in multiples of 15 equity shares thereof. The IPO is expected to be open from 4 May to 9 May.

LIC IPO Form – how to Apply

Firstly, the policyholder needs to ensure their LIC policy is linked with their updated Permanent Account Number (PAN).

“A policyholder of our Corporation shall ensure that his / her PAN details are updated in the policy records of our Corporation at the earliest. A policyholder who has not updated his / her PAN details with our Corporation before the expiry of two weeks from the date of the filing of this Draft Red Herring Prospectus with SEBI (i.e., by February 28, 2022) shall not be considered as an Eligible Policyholder,” LIC said in its draft.

Secondly, ensure that you have a Demat account and it matches with your PAN card as well.

Here’s how you can link your PAN with your LIC policies.

Step 1: Keep your PAN card handy along with the list of policies. Click here.

Step 2: You will need to click on the ‘Proceed’ option available in the instruction at the bottom.

Step 3: Add details like the date of birth that is mentioned on the PAN card. Further, add Gender, Email ID, PAN, Full name as per PAN, registered Mobile number, and Policy Number. In case, if you hold more than one policy, then you should select ‘Add Policy’ and proceed to feed in the further details.

Step 4: Once the above procedure is done, click on the deceleration checkbox.

Step 5: A unique captcha will be available on the screen. Add it as it is in the box and then click on the Get OTP option.

Step 6: LIC will send you an OTP on your registered mobile number. Add it in the required box and click on ‘Submit’.

Step 7: After submitting the form, a message will be shown on the success of the registration request.

You can also check your policy PAN status.

Once your policy is successfully linked with your PAN. You can apply for the IPO through various means.

One of the easiest way would be through any supported UPI app.

In its draft, LIC stated that “all potential Bidders (except Anchor Investors) are required to mandatorily utilise the Application Supported by Blocked Amount (“ASBA”) process providing details of their respective ASBA Accounts, and UPI ID in case of RIBs, Eligible Employee(s) and Eligible Policyholder(s) Bidding using the UPI Mechanism, if applicable, in which the corresponding Bid Amounts will be blocked by the SCSBs or under the UPI Mechanism, as the case may be, to the extent of respective Bid Amounts.”

Currently, NCPI approved UPI apps live on IPO are – BHIM in partnership with companies like Bank of Baroda, IDBI Bank, UPI, AU Small Finance Bank, Axis Bank, Bandhan Bank, DLB, IndusPay, SBI, Yes Bank, ICICI Bank, HSBC, Yes Bank, HDFC Bank, and DBS among others. Also, Freecharge, Paytm, Google Pay, Phone-Pe, and MobiKwik allow IPO investment using UPI.

Through Net Banking – Another way to apply for an IPO is through internet banking.

Step 1 – Bidder needs to log in to their online net-banking account. They will be directed to their home page subsequently.

Step 2: Go to the investment section and click on the IPO/e-IPO option.

Step 3: Then you will be needed to fill in depository details and bank account details. After doing so, the verification process will be completed.

Step 4: Once the verification process is completed, investors are required to click on the ‘Invest in IPO’ option.

Step 5: Then you should select the IPO you would like to apply for. Click on LIC IPO and then add the number of shares and the “bid price”.

Step 6: Investors need to ensure that they have read the terms and conditions of the bidding in the LIC IPO carefully before placing their bids.

Step 7: Once done, investors can confirm and place their order by selecting the ‘Apply Now’ option.

Step 8: At the bank, the application money will remain blocked up to the finalization on the basis of allotment.

Step 9: Furthermore, the account will be debited post the allotment of the shares.

LIC IPO Form – Overview

| IPO Date: | 4th May – 9th May 2022 |

| Price Band: | Rs. 902 to Rs. 949 |

| Min Quantity: | 15 Shares |

| Maximum amt: Retail/ Employee/ Policyholder- | Rs. 2 Lakhs |

| Retail Discount: | Rs. 45 per share |

| Employee Discount: | Rs. 45 per share |

| Policyholder Discount: | Rs. 60 per share |

LIC IPO Details by Investor Category

| Category | Bidding at | Max Bid Amount | Basis of Allotment | Discount | Final Price |

|---|---|---|---|---|---|

| HNI | At price | Rs 9,067 Cr | Proportionate | No | Rs 949 |

| Retail | Cut-off | Not above Rs 2 lakhs | Draw of Lot | Rs 45 per share | Rs 904 |

| Employee | Cut-off | Not above Rs 2 lakhs | Proportionate | Rs 45 per share | Rs 904 |

| Policy Holders | Cut-off | Not above Rs 2 lakhs | Proportionate | Rs 60 per share | Rs 889 |

You can download the LIC IPO Form PDF using the link given below.