Income Tax Computation Format - Summary

Income tax is calculated based on the applicable tax slab. Understanding how to compute your income tax involves knowing your taxable income, which is determined after applying relevant deductions and accounting for any taxes you’ve already paid, such as Advance Tax and TDS. Your final taxable income is then taxed at the slab rate that matches your income level.

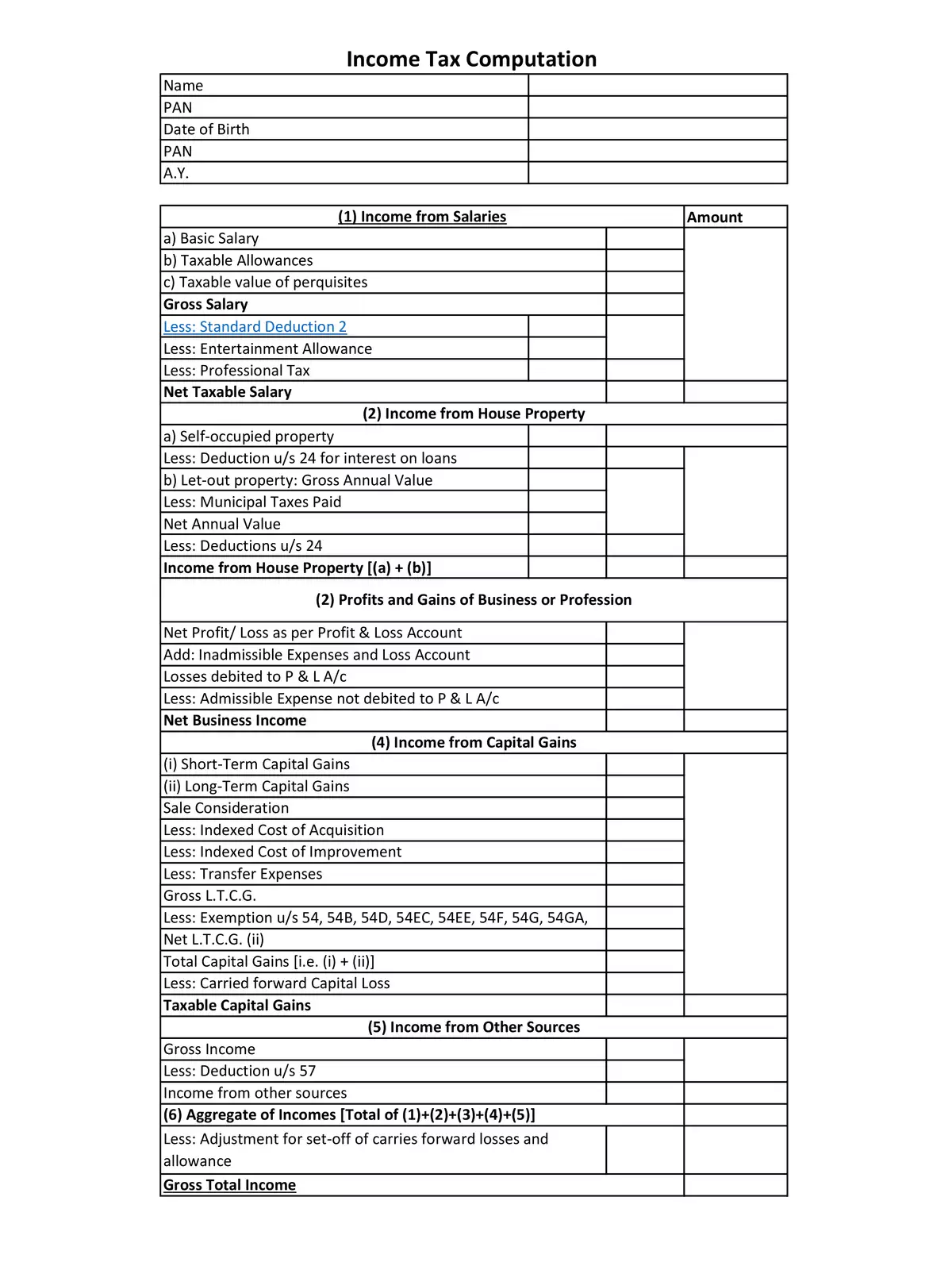

To effectively compute your income tax, you need to consider a few key factors. These factors include your taxable income, the current tax rates, available deductions, and any exemptions you may qualify for. Below, you will find a general overview of the **Income Tax Computation Format** for AY 2023-24. You can easily download the PDF from the provided link to assist you.

Income Tax Computation Format for AY 2023-24

- Name

- PAN

- Date of Birth

- Mobile Number

- A.Y.

- Basic Salary

- Taxable Allowances

- Taxable value of perquisites

- Gross Salary

- Less: Standard Deduction

- Less: Entertainment Allowance

- Less: Professional Tax

- Net Taxable Salary

Make sure to download the **Income Tax Computation Format** for AY 2023-24 in PDF format below to make your tax calculations easier! 📄