Income Tax Sections List - Summary

Income Tax Sections List in

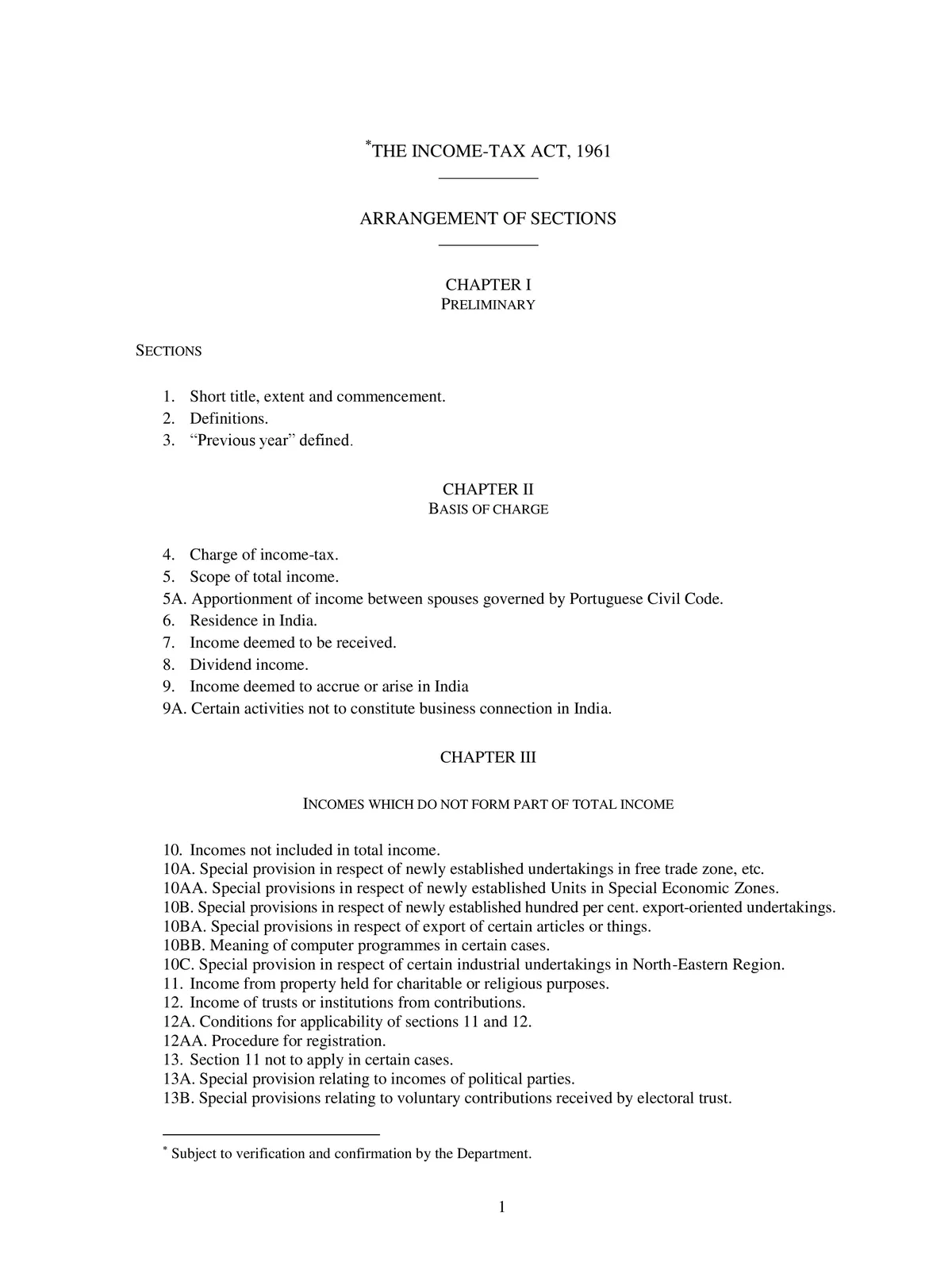

- This Act may be called the Income-tax Act, 1961.

- It extends to the whole of India.

- Save as otherwise provided in this Act, it shall come into force on the 1st day of April, 1962

It was enacted in 1961. The Income Tax Act contains a total of 23 chapters and 298 sections according to the official website of the Income Tax Department of India[1]. These different sections deal with various aspects of taxation in India.

Chapter-I (Sections 1-3): Preliminary

Section – 1: Short title, extent, and commencement

Section – 2: Definitions

Section – 3: “Previous year” defined

Chapter-II (Sections 4-9A): Basis of charge

Section – 4: Charge of income-tax

Section – 5: Scope of total income

Section – 5A: Apportionment of income between spouses governed by Portuguese Civil Code

Section – 6: Residence in India

Section – 7: Income deemed to be received

Section – 8: Dividend income

Section – 9: Income deemed to accrue or arise in India

Section – 9A: Certain activities not to constitute business connection in India

Chapter III (Sections 10-13B): Incomes which do not form part of total income

Section – 10: Incomes not included in total income

Section – 10A: Special provision in respect of newly established undertakings in free trade zone, etc.

Section – 10AA: Special provisions in respect of newly established Units in Special Economic Zones

Section – 10B: Special provisions in respect of newly established hundred per cent export-oriented undertakings

Section – 10BA: Special provisions in respect of export of certain articles or things

Section – 10BB: Meaning of computer programmes in certain cases

Section – 10C: Special provision in respect of certain industrial undertakings in North- Eastern Region

Section – 11: Income from property held for charitable or religious purposes.

Section – 12: Income of trusts or institutions from contributions

Section – 12A: Conditions for applicability of sections 11 and 12

Section – 12AB: Procedure for fresh registration

Section – 12AA: Procedure for registration

Section – 13: Section 11 not to apply in certain cases

Section – 13A: Special provision relating to incomes of political parties

Section – 13B: Special provisions relating to voluntary contributions received by electoral trust

Chapter IV (Sections 14-59): Computation of total income

Section – 14: Heads of income

Section – 14A: Expenditure incurred in relation to income not includible in total income

Section – 15: Salaries

Section – 16: Deductions from salaries

Section – 17: “Salary”, “perquisite” and “profits in lieu of salary” defined

Section – 18: [Omitted by the Finance Act, 1988, w.e.f. 1-4-1989]

Section – 22: Income from house property

Section – 23: Annual value how determined

Section – 24: Deductions from income from house property

Section – 25: Amounts not deductible from income from house property

Section – 25A: Special provision for arrears of rent and unrealised rent received subsequently

Section – 26: Property owned by co-owners

Section – 27: “Owner of house property”, “annual charge”, etc., defined

Section – 28: Profits and gains of business or profession

Section – 29: Income from profits and gains of business or profession, how computed

Section – 30: Rent, rates, taxes, repairs and insurance for buildings

Section – 31: Repairs and insurance of machinery, plant and furniture

Section – 32: Depreciation

Section – 32A: Investment allowance

Section – 32AB: Investment deposit account

Section – 32AC: Investment in new plant or machinery

Section – 32AD: Investment in new plant or machinery in notified backward areas in certain States

Section – 33: Development rebate

Section – 33A: Development allowance

Section – 33AB: Tea development account 57,coffee development account and rubber development account

Section – 33ABA: Site Restoration Fund

Section – 33AC: Reserves for shipping business

Section – 33B: Rehabilitation allowance

Section – 34: Conditions for depreciation allowance and development rebate

Section – 34A: Restriction on unabsorbed depreciation and unabsorbed investment allowance for limited period in case of certain domestic companies

Section – 35: Expenditure on scientific research

Section – 35A: Expenditure on acquisition of patent rights or copyrights

Section – 35AB: Expenditure on know-how

Section – 35ABA: Expenditure for obtaining right to use spectrum for telecommunication services

Section – 35ABB: Expenditure for obtaining licence to operate telecommunication services

Section – 35AC: Expenditure on eligible projects or schemes

Section – 35AD: Deduction in respect of expenditure on specified business

Section – 35B: Export markets development allowance

Section – 35C: Agricultural development allowance

Section – 35CC: Rural development allowance

Section – 35CCA: Expenditure by way of payment to associations and institutions for carrying out rural development programmes

Section – 35CCB: Expenditure by way of payment to associations and institutions for carrying out programmes of conservation of natural resources

Section – 35CCC: Expenditure on agricultural extension project

Section – 35CCD: Expenditure on skill development project

Section – 35D: Amortisation of certain preliminary expenses

Section – 35DD: Amortisation of expenditure in case of amalgamation or demerger

Section – 35DDA: Amortisation of expenditure incurred under voluntary retirement scheme

Section – 35E: Deduction for expenditure on prospecting, etc., for certain minerals

Section – 36: Other deductions

Section – 37: General

Section – 38: Building, etc., partly used for business, etc., or not exclusively so used

Section – 39: Managing agency commission

Section – 40: Amounts not deductible

Section – 40A: Expenses or payments not deductible in certain circumstances

Section – 41: Profits chargeable to tax

Section – 42: Special provision for deductions in the case of business for prospecting, etc., for mineral oil

Section – 43: Definitions of certain terms relevant to income from profits and gains of business or profession

Section – 43A: Special provisions consequential to changes in rate of exchange of currency

Section – 43B: Certain deductions to be only on actual payment

Section – 43C: Special provision for computation of cost of acquisition of certain assets

Section – 43CA: Special provision for full value of consideration for transfer of assets other than capital assets in certain cases

Section – 43D: Special provision in case of income of public financial institutions, public companies, etc.

Section – 44: Interest payable by assessee

Section – 44A: Special provision for deduction in the case of trade, professional or similar association

Section – 44AA: Maintenance of accounts by certain persons carrying on profession or business

Section – 44AB: Audit of accounts of certain persons carrying on business or profession

Section – 44AC: Special provision for computing profits and gains from the business of trading in certain goods

Section – 44AD: Special provision for computing profits and gains of business on presumptive basis

Section – 44ADA: Special provision for computing profits and gains of profession on presumptive basis

Section – 44AE : Special provision for computing profits and gains of business of plying, hiring or leasing goods carriages

Section – 44AF : Special provisions for computing profits and gains of retail business

Section – 44B : Special provision for computing profits and gains of shipping business in the case of non-residents

Section – 44BB : Special provision for computing profits and gains in connection with the business of exploration, etc., of mineral oils

Section – 44BBA : Special provision for computing profits and gains of the business of operation of aircraft in the case of non-residents

Section – 44BBB : Special provision for computing profits and gains of foreign companies engaged in the business of civil construction, etc., in certain turnkey power projects

Section – 44C : Deduction of head office expenditure in the case of non-residents

Section – 44D : Special provisions for computing income by way of royalties, etc., in the case of foreign companies

Section – 44DA : Special provision for computing income by way of royalties, etc., in case of non-residents

Section – 44DB : Special provision for computing deductions in the case of business reorganization of co-operative banks

Section – 45 : Capital gains

Section – 46 : Capital gains on distribution of assets by companies in liquidation

Section – 46A : Capital gains on purchase by company of its own shares or other specified securities

Section – 47 : Transactions not regarded as transfer

Section – 47A : Withdrawal of exemption in certain cases

Section – 48 : Mode of computation

Section – 49 : Cost with reference to certain modes of acquisition

Section – 50 : Special provision for computation of capital gains in case of depreciable assets

Section – 50A : Special provision for cost of acquisition in case of depreciable asset

Section – 50B : Special provision for computation of capital gains in case of slump sale

Section – 50C : Special provision for full value of consideration in certain cases

Section – 50CA : Special provision for full value of consideration for transfer of share other than quoted share

Section – 50D : Fair market value deemed to be full value of consideration in certain cases

Section – 51 : Advance money received

Section – 52 : Consideration for transfer in cases of understatement

Section – 53 : Exemption of capital gains from a residential house

Section – 54 : Profit on sale of property used for residence

Section – 54A : Relief of tax on capital gains in certain cases

Section – 54C : Capital gain on transfer of jewellery held for personal use not to be charged in certain cases

Section – 54D : Capital gain on compulsory acquisition of lands and buildings not to be charged in certain cases

Section – 54E : Capital gain on transfer of capital assets not to be charged in certain cases

Section – 54EA : Capital gain on transfer of long-term capital assets not to be charged in the case of investment in 34[specified securities

Section – 54EB : Capital gain on transfer of long-term capital assets not to be charged in certain cases

Section – 54EC : Capital gain not to be charged on investment in certain bonds

Section – 54ED : Capital gain on transfer of certain listed securities or unit not to be charged in certain cases

Section – 54EE : Capital gain not to be charged on investment in units of a specified fund

Section – 54F : Capital gain on transfer of certain capital assets not to be charged in case of investment in residential house

Section – 54G : Exemption of capital gains on transfer of assets in cases of shifting of industrial undertaking from urban area

Section – 54GB : Capital gain on transfer of residential property not to be charged in certain cases

Section – 54H : Extension of time for acquiring new asset or depositing or investing amount of capital gain

Section – 55 : Meaning of “adjusted”, “cost of improvement” and “cost of acquisition”

Section – 55A : Reference to Valuation Officer

Section – 56 : Income from other sources

Section – 57 : Deductions

Section – 58 : Amounts not deductible

Section – 59 : Profits chargeable to tax

Chapter V (Sections 60-65): Income of other persons included in assessee’s total income

Section – 60 : Transfer of income where there is no transfer of assets

Section – 61 : Revocable transfer of assets

Section – 62 : Transfer irrevocable for a specified period

Section – 63 : “Transfer” and “revocable transfer” defined

Section – 64 : Income of individual to include income of spouse, minor child, etc.

Section – 65 : Liability of person in respect of income included in the income of another person

Chapter VI (Sections 66-80): Aggregation of income and set off or carry forward of loss

Section – 66 : Total income

Section – 67 : Method of computing a partner’s share in the income of the firm

Section – 67A : Method of computing a member’s share in income of association of persons or body of individuals

Section – 68 : Cash credits

Section – 69 : Unexplained investments

Section – 69A : Unexplained money, etc.

Section – 69B : Amount of investments, etc., not fully disclosed in books of account

Section – 69C : Unexplained expenditure, etc.

Section – 69D : Amount borrowed or repaid on hundi

Section – 70 : Set off of loss from one source against income from another source under the same head of income

Section – 71 : Set off of loss from one head against income from another

Section – 71A : Transitional provisions for set off of loss under the head “Income from house property”

Section – 71B : Carry forward and set off of loss from house property

Section – 72 : Carry forward and set off of business losses

Section – 72A : Provisions relating to carry forward and set off of accumulated loss and unabsorbed depreciation allowance in amalgamation or demerger, etc.

Section – 72AA : Provisions relating to carry forward and set-off of accumulated loss and unabsorbed depreciation allowance in scheme of amalgamation of banking company in certain cases

Section – 72AB : Provisions relating to carry forward and set-off of accumulated loss and unabsorbed depreciation allowance in business reorganisation of co-operative banks

Section – 73 : Losses in speculation business

Section – 73A : Carry forward and set off of losses by specified business

Section – 74 : Losses under the head “Capital gains”

Section – 74A : Losses from certain specified sources falling under the head “Income from other sources”

Section – 75 : Losses of firms

Section – 76 : Omitted by the Finance Act, 1992, w.e.f. 1-4-1993

Section – 78 : Carry forward and set off of losses in case of change in constitution of firm or on succession

Section – 79 : Carry forward and set off of losses in case of certain companies

Section – 80 : Submission of return for losses

Chapter VIA (Sections 80A-80VV): Deductions to be made in computing total income

Section – 80A : Deductions to be made in computing total income

Section – 80AA : Computation of deduction under section 80M

Section – 80AB : Deductions to be made with reference to the income included in the gross total income

Section – 80AC : Deduction not to be allowed unless return furnished

Section – 80B : Definitions

Section – 80C : Deduction in respect of life insurance premia, deferred annuity, contributions to provident fund, subscription to certain equity shares or debentures, etc

Section – 80CC : Deduction in respect of investment in certain new shares

Section – 80CCA : Deduction in respect of deposits under National Savings Scheme or payment to a deferred annuity plan

Section – 80CCB : Deduction in respect of investment made under Equity Linked Savings Scheme

Section – 80CCC : Deduction in respect of contribution to certain pension funds

Section – 80CCD : Deduction in respect of contribution to pension scheme of Central Government

Section – 80CCE : Limit on deductions under sections 80C , 80CCC and 80CCD

Section – 80CCF : Deduction in respect of subscription to long-term infrastructure bonds

Section – 80CCG : Deduction in respect of investment made under an equity savings scheme

Section – 80D : Deduction in respect of health insurance premia

Section – 80DD : Deduction in respect of maintenance including medical treatment of a dependant who is a person with disability

Section – 80DDB : Deduction in respect of medical treatment, etc.

Section – 80E : Deduction in respect of interest on loan taken for higher education

Section – 80EE : Deduction in respect of interest on loan taken for residential house property

Section – 80EEA : Deduction in respect of interest on loan taken for certain house property

Section – 80EEB : Deduction in respect of purchase of electric vehicle

Section – 80F : Deduction in respect of educational expenses in certain cases

Section – 80FF : Deduction in respect of expenses on higher education in certain cases

Section – 80G : Deduction in respect of donations to certain funds, charitable institutions, etc.

Section – 80GG : Deductions in respect of rents paid

Section – 80GGA : Deduction in respect of certain donations for scientific research or rural development

Section – 80GGB : Deduction in respect of contributions given by companies to political parties

Section – 80GGC : Deduction in respect of contributions given by any person to political parties

Section – 80H : Deduction in case of new industrial undertakings employing displaced persons, etc.

Section – 80HH : Deduction in respect of profits and gains from newly established industrial undertakings or hotel business in backward areas

Section – 80HHA : Deduction in respect of profits and gains from newly established small-scale industrial undertakings in certain areas

Section – 80HHB : Deduction in respect of profits and gains from projects outside India

Section – 80HHBA : Deduction in respect of profits and gains from housing projects in certain cases

Section – 80HHC : Deduction in respect of profits retained for export business

Section – 80HHD : Deduction in respect of earnings in convertible foreign exchange

Section – 80HHE : Deduction in respect of profits from export of computer software, etc.

Section – 80HHF : Deduction in respect of profits and gains from export or transfer of film software, etc.

Section – 80-I : Deduction in respect of profits and gains from industrial undertakings after a certain date, etc.

Section – 80-IA : Deductions in respect of profits and gains from industrial undertakings or enterprises engaged in infrastructure development, etc

Section – 80-IAB : Deductions in respect of profits and gains by an undertaking or enterprise engaged in development of Special Economic Zone

Section – 80-IAC : Special provision in respect of specified business

Section – 80-IB : Deduction in respect of profits and gains from certain industrial undertakings other than infrastructure development undertakings

Section – 80-IBA : Deductions in respect of profits and gains from housing projects

Section – 80-IC : Special provisions in respect of certain undertakings or enterprises in certain special category States

Section – 80-ID : Deduction in respect of profits and gains from business of hotels and convention centres in specified area

Section – 80-IE : Special provisions in respect of certain undertakings in North-Eastern States

Section – 80J : Deduction in respect of profits and gains from newly established industrial undertakings or ships or hotel business in certain cases

Section – 80JJ : Deduction in respect of profits and gains from business of poultry farming

Section – 80JJA : Deduction in respect of profits and gains from business of collecting and processing of bio-degradable waste

Section – 80JJAA : Deduction in respect of employment of new employees

Section – 80K : Deduction in respect of dividends attributable to profits and gains from new industrial undertakings or ships or hotel business

Section – 80L : Deductions in respect of interest on certain securities, dividends, etc

Section – 80LA : Deductions in respect of certain incomes of Offshore Banking Units and International Financial Services Centre

Section – 80M : Deduction in respect of certain inter-corporate dividends

Section – 80MM : Deduction in the case of an Indian company in respect of royalties, etc., received from any concern in India

Section – 80N : Deduction in respect of dividends received from certain foreign companies

Section – 80-O : Deduction in respect of royalties, etc., from certain foreign enterprises

Section – 80P : Deduction in respect of income of co-operative societies

Section – 80PA : Deduction in respect of certain income of Producer Companies

Section – 80Q : Deduction in respect of profits and gains from the business of publication of books

Section – 80QQ : Deduction in respect of profits and gains from the business of publication of books

Section – 80QQA : Deduction in respect of professional income of authors of text books in Indian languages

Section – 80QQB : Deduction in respect of royalty income, etc., of authors of certain books other than text-books

Section – 80R : Deduction in respect of remuneration from certain foreign sources in the case of professors, teachers, etc

Section – 80RR : Deduction in respect of professional income from foreign sources in certain cases

Section – 80RRA : Deduction in respect of remuneration received for services rendered outside India

Section – 80RRB : Deduction in respect of royalty on patents

Section – 80S : Deduction in respect of compensation for termination of managing agency, etc., in the case of assessees other than companies

Section – 80T : Deduction in respect of long-term capital gains in the case of assessees other than companies

Section – 80TT : Deduction in respect of winnings from lottery

Section – 80TTA : Deduction in respect of interest on deposits in savings account

Section – 80TTB : Deduction in respect of interest on deposits in case of senior citizens

Section – 80U : Deduction in case of a person with disability

Section – 80V : Deduction from gross total income of the parent in certain cases

Section – 80VV : Deduction in respect of expenses incurred in connection with certain proceedings under the Act

Chapter VII (Sections 81-86A): Incomes forming part of total income on which no income-tax is payable

Section – 81 to 85C : Omitted

Section – 86 : Share of member of an association of persons or body of individuals in the income of the association or body

Section – 86A : Deduction from tax on certain securities

Chapter VIII (Sections 87-89A): Rebates and reliefs

Section – 87 : Rebate to be allowed in computing income-tax

Section – 87A : Rebate of income-tax in case of certain individuals

Section – 88 : Rebate on life insurance premia, contribution to provident fund, etc

Section – 88A : Rebate in respect of investment in certain new shares or units

Section – 88B : Rebate of income-tax in case of individuals of sixty-five years or above

Section – 88C : Rebate of income-tax in case of women below sixty-five years

Section – 88D : Rebate of income-tax in case of certain individuals

Section – 88E : Rebate in respect of securities transaction tax

Section – 89 : Relief when salary, etc., is paid in arrears or in advance

Section – 89A : Tax relief in relation to export turnover

Chapter IX (Sections 90-91): Double Taxation Relief

Section – 90 : Agreement with foreign countries or specified territories

Section – 90A : Adoption by Central Government of agreement between specified associations for double taxation relief

Section – 91 : Countries with which no agreement exists

Chapter X (Sections 92 – 94B): Special provisions relating to avoidance of tax

Section – 92 : Computation of income from international transaction having regard to arm’s length price

Section – 92A : Meaning of associated enterprise

Section – 92B : Meaning of international transaction

Section – 92BA : Meaning of specified domestic transaction

Section – 92C : Computation of arm’s length price

Section – 92CA : Reference to Transfer Pricing Officer

Section – 92CB : Power of Board to make safe harbour rules

Section – 92CC : Advance pricing agreement

Section – 92CD : Effect to advance pricing agreement

Section – 92CE : Secondary adjustment in certain cases

Section – 92D : Maintenance and keeping of information and document by persons entering into an international transaction

Section – 92E : Report from an accountant to be furnished by persons entering into international transaction

Section – 92F : Definitions of certain terms relevant to computation of arm’s length price, etc

Section – 93 : Avoidance of income-tax by transactions resulting in transfer of income to non-residents

Section – 94 : Avoidance of tax by certain transactions in securities

Section – 94A : Special measures in respect of transactions with persons located in notified jurisdictional area

Section – 94B : Limitation on interest deduction in certain cases

CHAPTER XA (Section 95 – 102): GENERAL ANTI-AVOIDANCE RULE

Section – 95 : Applicability of General Anti-Avoidance Rule

Section – 96 : Impermissible avoidance arrangement.

Section – 97 : Arrangement to lack commercial substance

Section – 98 : Consequences of impermissible avoidance arrangement

Section – 99 : Treatment of connected person and accommodating party

Section – 100 : Application of this Chapter

Section – 101 : Framing of guidelines

Section – 102 : Definitions

CHAPTER XI (Sections 104 – 109): Additional income-tax on undistributed profits

Section – 104 : Income-tax on undistributed income of certain companies

Section – 105 : Special provisions for certain companies

Section – 106 : Period of limitation for making orders under section 104

Section – 107 : Approval of Inspecting Assistant Commissioner for orders under section 104

Section – 107A : Reduction of minimum distribution in certain cases

Section – 108 : Savings for company in which public are substantially interested

Section – 109 : “Distributable income”, “investment company” and “statutory percentage” defined

CHAPTER XII (Sections 110 – 115BBG): Additional income-tax on undistributed profits

Section – 110 : Determination of tax where total income includes income on which no tax is payable

Section – 111 : Tax on accumulated balance of recognised provident fund

Section – 111A : Tax on short-term capital gains in certain cases

Section – 112 : Tax on long-term capital gains

Section – 112A : Tax on long-term capital gains in certain cases

Section – 113 : Tax in the case of block assessment of search cases

Section – 114 : Tax on capital gains in cases of assessees other than companies

Section – 115 : Tax on capital gains in case of companies

Section – 115A : Tax on dividends, royalty and technical service fees in the case of foreign companies

Section – 115AB : Tax on income from units purchased in foreign currency or capital gains arising from their transfer

Section – 115AC : Tax on income from bonds or Global Depository Receipts purchased in foreign currency or capital gains arising from their transfer

Section – 115ACA : Tax on income from Global Depository Receipts purchased in foreign currency or capital gains arising from their transfer

Section – 115AD : Tax on income of Foreign Institutional Investors from securities or capital gains arising from their transfer

Section – 115B : Tax on profits and gains of life insurance business

Section – 115BA : Tax on income of certain manufacturing domestic companies

Section – 115BAA : Tax on income of certain domestic companies

Section – 115BAB : Tax on income of new manufacturing domestic companies

Section – 115BB : Tax on winnings from lotteries, crossword puzzles, races including horse races, card games and other games of any sort or gambling or betting of any form or nature whatsoever

Section – 115BBA : Tax on non-resident sportsmen or sports associations

Section – 115BBB : Tax on income from units of an open-ended equity oriented fund of the Unit Trust of India or of Mutual Funds

Section – 115BBC : Anonymous donations to be taxed in certain cases

Section – 115BBD : Tax on certain dividends received from foreign companies

Section – 115BBDA : Tax on certain dividends received from domestic companies

Section – 115BBE : Tax on income referred to in section 68 or section 69 or section 69A or section 69B or section 69C or section 69D

Section – 115BBF : Tax on income from patent

Section – 115BBG : Tax on income from transfer of carbon credits

CHAPTER XIIA (Sections 115C – 115I): Special provisions relating to certain incomes of non-residents

Section – 115C : Definitions

Section – 115D : Special provision for computation of total income of non-residents

Section – 115E : Tax on investment income

Section – 115F : Capital gains on transfer of foreign exchange assets not to be charged in certain cases

Section – 115G : Return of income not to be filed in certain cases

Section – 115H : Benefit under Chapter to be available in certain cases even after the assessee becomes resident

Section – 115-I : Chapter not to apply if the assessee so chooses

CHAPTER XIIB (Sections 115J – 115JB): Special provisions relating to certain companies

Section – 115J : Special provisions relating to certain companies

Section – 115JA : Deemed income relating to certain companies

Section – 115JAA : Tax credit in respect of tax paid on deemed income relating to certain companies

Section – 115JB : Special provision for payment of tax by certain companies

CHAPTER XIIBA (Sections 115JC – 115JF): Special provisions relating to certain limited liability partnerships

Section – 115JC : Special provisions for payment of tax by certain persons other than a company

Section – 115JD : Tax credit for alternate minimum tax

Section – 115JE : Application of other provisions of this Act

Section – 115JEE : Application of this Chapter to certain persons

Section – 115JF : Interpretation in this Chapter

CHAPTER XIIBB – Special provisions relating to conversion of Indian branch of a foreign bank into a subsidiary company

Section – 115JG : Conversion of an Indian branch of foreign company into subsidiary Indian company

CHAPTER XIIBC – SPECIAL PROVISIONS RELATING TO FOREIGN COMPANY SAID TO BE RESIDENT IN INDIA

Section – 115JH : Foreign company said to be resident in India

CHAPTER XIIC (Sections 115K – 115N): Special provisions relating to retail trade etc.

Section – 115K : Special provision for computation of income in certain cases

Section – 115L : Return of income not to be filed in certain cases

Section – 115M : Special provision for disallowance of deductions and rebate of income-tax

Section – 115N : Bar of proceedings in certain cases

CHAPTER XIID (Sections 115O – 115Q): Special provisions relating to tax on distributed profits of domestic companies

Section – 115-O : Tax on distributed profits of domestic companies

Section – 115P : Interest payable for non-payment of tax by domestic companies

Section – 115Q : When company is deemed to be in default

CHAPTER XIIDA (Sections 115QA – 115QC): SPECIAL PROVISIONS RELATING TO TAX ON DISTRIBUTED INCOME OF DOMESTIC COMPANY FOR BUY-BACK OF SHARES

Section – 115QA : Tax on distributed income to shareholders

Section – 115QB : Interest payable for non-payment of tax by company

Section – 115QC : When company is deemed to be assessee in default

CHAPTER XIIE (Sections 115R – 115T): Special provisions relating to tax on distributed income

Section – 115R : Tax on distributed income to unit holders

Section – 115S : Interest payable for non-payment of tax

Section – 115T : Unit Trust of India or Mutual Fund to be an assessee in default

CHAPTER XIIEA (Sections 115TA – 115TCA): SPECIAL PROVISIONS RELATING TO TAX ON DISTRIBUTED INCOME BY SECURITISATION TRUSTS

Section – 115TA : Tax on distributed income to investors

Section – 115TB : Interest payable for non-payment of tax

Section – 115TC : Securitisation trust to be assessee in default

Section – 115TCA : Tax on income from securitisation trusts

CHAPTER XIIEB – SPECIAL PROVISIONS RELATING TO TAX ON ACCRETED INCOMEOF CERTAIN TRUSTS AND INSTITUTIONS

Section – 115TD : Tax on accreted income

Section – 115TE : Interest payable for non-payment of tax by trust or institution

Section – 115TF : When trust or institution is deemed to be assessee in default

Section – 115U : Tax on income in certain cases

Section – 115UA : Tax on income of unit holder and business trust

Section – 115UB : Tax on income of investment fund and its unit holders

Section – 115V : Definitions

Section – 115VA : Computation of profits and gains from the business of operating qualifying ships

Section – 115VB : Operating ships

Section – 115VC : Qualifying company

Section – 115VD : Qualifying ship

Section – 115VE : Manner of computation of income under tonnage tax scheme

Section – 115VF : Tonnage income

Section – 115VG : Computation of tonnage income

Section – 115VH : Calculation in case of joint operation, etc

Section – 115V-I :

Section – 115VJ : Treatment of common costs

Section – 115VK : Depreciation

Section – 115VL : General exclusion of deduction and set off, etc

Section – 115VM : Exclusion of loss

Section – 115VN : Chargeable gains from transfer of tonnage tax assets

Section – 115V-O : Exclusion from provisions of section 115JB

Section – 115VP : Method and time of opting for tonnage tax scheme

Section – 115VQ : Period for which tonnage tax option to remain in force

Section – 115VR : Renewal of tonnage tax scheme

Section – 115VS : Prohibition to opt for tonnage tax scheme in certain cases

Section – 115VT : Transfer of profits to Tonnage Tax Reserve Account

Section – 115VU : Minimum training requirement for tonnage tax company

Section – 115VV : Limit for charter in of tonnage

Section – 115VW : Maintenance and audit of accounts

Section – 115VX : Determination of tonnage

Section – 115VY : Amalgamation

Section – 115VZ : Demerger

Section – 115VZA : Effect of temporarily ceasing to operate qualifying ships

Section – 115VZB : Avoidance of tax

Section – 115VZC : Exclusion from tonnage tax scheme

Section – 115W : Definitions

Section – 115WA : Charge of fringe benefit tax

Section – 115WB : Fringe benefits

Section – 115WC : Value of fringe benefits

Section – 115WD : Return of fringe benefits

Section – 115WE : Assessment

Section – 115WF : Best judgment assessment

Section – 115WG : Fringe benefits escaping assessment

Section – 115WH : Issue of notice where fringe benefits have escaped assessment

Section – 115WI : Payment of fringe benefit tax

Section – 115WJ : Advance tax in respect of fringe benefits

Section – 115WK : Interest for default in furnishing return of fringe benefits

Section – 115WKA : Recovery of fringe benefit tax by the employer from the employee

Section – 115WKB : Deemed payment of tax by employee.

Section – 115WL : Application of other provisions of this Act

Section – 115WM : Chapter XII-H not to apply after a certain date

Section – 116 : Income-tax authorities

Section – 117 : Appointment of income-tax authorities

Section – 118 : Control of income-tax authorities

Section – 119 : Instructions to subordinate authorities

Section – 120 : Jurisdiction of income-tax authorities

Section – 121 : Jurisdiction of Commissioners

Section – 121A : Jurisdiction of Commissioners (Appeals)

Section – 122 : Jurisdiction of Appellate Assistant Commissioners

Section – 123 : Jurisdiction of Inspecting Assistant Commissioners

Section – 124 : Jurisdiction of Assessing Officers

Section – 125 : Powers of Commissioner respecting specified areas, cases, persons, etc

Section – 125A : Concurrent jurisdiction of Inspecting Assistant Commissioner and Income-tax Officer

Section – 126 : Powers of Board respecting specified area, classes of persons or incomes

Section – 127 : Power to transfer cases

Section – 128 : Functions of Inspectors of Income-tax

Section – 129 : Change of incumbent of an office

Section – 130 : Commissioner competent to perform any function or functions

Section – 130A : Income-tax Officer competent to perform any function or functions

Section – 131 : Power regarding discovery, production of evidence, etc

Section – 132 : Search and seizure

Section – 132A : Powers to requisition books of account, etc

Section – 132B : Application of seized or requisitioned assets

Section – 133 : Power to call for information

Section – 133A : Power of survey

Section – 133B : Power to collect certain information

Section – 133C : Power to call for information by prescribed income-tax authority

Section – 134 : Power to inspect registers of companies

Section – 135 : Power of61[62[Principal Director General or] Director General or 62[Principal Director or] Director],63[64[Principal Chief Commissioner or] Chief Commissioner or 64[Principal Commissioner or] Commissioner] and 65[Joint Commissioner]

Section – 136 : Proceedings before income-tax authorities to be judicial proceedings

Section – 137 : Disclosure of information prohibited

Section – 138 : Disclosure of information respecting assessees

CHAPTER XIV (Sections 139 – 145B): Procedure for assessment

Section – 139 : Return of income

Section – 139A : Permanent account number

Section – 139AA : Quoting of Aadhaar number

Section – 139B : Scheme for submission of returns through Tax Return Preparers

Section – 139C : Power of Board to dispense with furnishing documents, etc., with return

Section – 139D : Filing of return in electronic form

Section – 140 : Return by whom to be 14[verified

Section – 140A : Self-assessment

Section – 141 : Provisional assessment

Section – 141A : Provisional assessment for refund

Section – 142 : Inquiry before assessment

Section – 142A : Estimation of value of assets by Valuation Officer

Section – 143 : Assessment

Section – 144 : Best judgment assessment

Section – 144A : Power of37[Joint Commissioner] to issue directions in certain cases.

Section – 144B : Reference to Deputy Commissioner in certain cases

Section – 144BA : Reference to 46[Principal Commissioner or] Commissioner in certain cases.

Section – 144C : Reference to dispute resolution panel

Section – 145 : Method of accounting

Section – 145A : Method of accounting in certain cases

Section – 146 : Reopening of assessment at the instance of the assessee

Section – 147 : Income escaping assessment

Section – 148 : Issue of notice where income has escaped assessment

Section – 149 : Time limit for notice

Section – 150 : Provision for cases where assessment is in pursuance of an order on appeal, etc

Section – 151 : Sanction for issue of notice

Section – 152 : Other provisions

Section – 153 : Time limit for completion of assessment, reassessment and recomputation

Section – 153A : Assessment in case of search or requisition

Section – 153B : Time limit for completion of assessment under section 153A

Section – 153C : Assessment of income of any other person

Section – 153D : Prior approval necessary for assessment in cases of search or requisition

Section – 154 : Rectification of mistake

Section – 155 : Other amendments

Section – 156 : Notice of demand

Section – 157 : Intimation of loss

Section – 158 : Intimation of assessment of firm

Section – 145B : Taxability of certain income

CHAPTER XIVA – Special provision for avoiding repetitive appeals

Section – 158A : Procedure when assessee claims identical question of law is pending before High Court or Supreme Court

Section – 158AA : Procedure when in an appeal by revenue an identical question of law is pending before Supreme Court

CHAPTER XIVB – Special procedure for assessment of search cases

Section – 158B : Definitions

Section – 158BA : Assessment of undisclosed income as a result of search

Section – 158BB : Computation of undisclosed income of the block period

Section – 158BC : Procedure for block assessment

Section – 158BD : Undisclosed income of any other person

Section – 158BE : Time limit for completion of block assessment

Section – 158BF : Certain interests and penalties not to be levied or imposed

Section – 158BFA : Levy of interest and penalty in certain cases

Section – 158BG : Authority competent to make the block assessment

Section – 158BH : Application of other provisions of this Act

Section – 158BI : Chapter not to apply after certain date

CHAPTER XV – Liability in special cases

Section – 159 : Legal representatives

Section – 160 : Representative assessee

Section – 161 : Liability of representative assessee

Section – 162 : Right of representative assessee to recover tax paid

Section – 163 : Who may be regarded as agent

Section – 164 : Charge 31 of tax where share of beneficiaries unknown

Section – 164A : Charge of tax in case of oral trust

Section – 165 : Case where part of trust income is chargeable

Section – 166 : Direct assessment or recovery not barred

Section – 167 : Remedies against property in cases of representative assessees

Section – 167A : Charge of tax in the case of a firm

Section – 167B : Charge of tax where shares of members in association of persons or body of individuals unknown, etc

Section – 167C : Liability of partners of limited liability partnership in liquidation

Section – 168 : Executors

Section – 169 : Right of executor to recover tax paid

Section – 170 : Succession to business otherwise than on death

Section – 171 : Assessment after partition of a Hindu undivided family

Section – 172 : Shipping business of non-residents

Section – 173 : Recovery of tax in respect of non-resident from his assets

Section – 174 : Assessment of persons leaving India

Section – 174A : Assessment of association of persons or body of individuals or artificial juridical person formed for a particular event or purpose

Section – 175 : Assessment of persons likely to transfer property to avoid tax

Section – 176 : Discontinued business

Section – 177 : Association dissolved or business discontinued

Section – 178 : Company in liquidation

Section – 179 : Liability of directors of private company in liquidation

Section – 180 : Royalties or copyright fees for literary or artistic work

Section – 180A : Consideration for know-how

Section – 181 : Omitted by the Finance Act, 1988, w.e.f. 1-4-1989

CHAPTER XVI – Special provisions applicable to firms

Section – 182 : Assessment of registered firms

Section – 183 : Assessment of unregistered firms

Section – 184 : Assessment as a firm

Section – 185 : Assessment when section 184 not complied with

Section – 187 : Change in constitution of a firm

Section – 188 : Succession of one firm by another firm

Section – 188A : Joint and several liability of partners for tax payable by firm

Section – 189 : Firm dissolved or business discontinued

Section – 189A : Provisions applicable to past assessments of firms

CHAPTER XVII (Sections 190 – 234F): Collection and recovery of tax

Section – 190 : Deduction at source and advance payment

Section – 191 : Direct payment

Section – 192 : Salary

Section – 192A : Payment of accumulated balance due to an employee

Section – 193 : Interest on securities

Section – 194 : Dividends

Section – 194A : Interest other than “Interest on securities”

Section – 194B : Winnings from lottery or crossword puzzle

Section – 194BB : Winnings from horse race

Section – 194C : Payments to contractors

Section – 194D : Insurance commission

Section – 194DA : Payment in respect of life insurance policy

Section – 194E : Payments to non-resident sportsmen or sports associations

Section – 194EE : Payments in respect of deposits under National Savings Scheme, etc

Section – 194F : Payments on account of repurchase of units by Mutual Fund or Unit Trust of India

Section – 194G : Commission, etc., on the sale of lottery tickets

Section – 194H : Commission or brokerage

Section – 194-I : Rent

Section – 194IA : Payment on transfer of certain immovable property other than agricultural land

Section – 194IB : Payment of rent by certain individuals or Hindu undivided family

Section – 194IC : [Payment under specified agreement

Section – 194J : Fees for professional or technical services

Section – 194K : Income in respect of units

Section – 194L : Payment of compensation on acquisition of capital asset

Section – 194LA : Payment of compensation on acquisition of certain immovable property

Section – 194LB : Income by way of interest from infrastructure debt fund

Section – 194LBA : Certain income from units of a business trust

Section – 194LBB : Income in respect of units of investment fund

Section – 194LBC : Income in respect of investment in securitization trust

Section – 194LC : Income by way of interest from Indian company

Section – 194LD : Income by way of interest on certain bonds and Government securities

Section – 195 : Other sums

Section – 195A : Income payable “net of tax”

Section – 196 : Interest or dividend or other sums payable to Government, Reserve Bank or certain corporations

Section – 196A : Income in respect of units of non-residents

Section – 196B : Income from units

Section – 196C : Income from foreign currency bonds or shares

Section – 196D : Income of Foreign Institutional Investors from securities

Section – 197 : Certificate for deduction at lower rate

Section – 197A : No deduction to be made in certain cases

Section – 198 : Tax deducted is income received

Section – 199 : Credit for tax deducted

Section – 200 : Duty of person deducting tax

Section – 200A : Processing of statements of tax deducted at source

Section – 201 : Consequences of failure to deduct or pay

Section – 202 : Deduction only one mode of recovery

Section – 203 : Certificate for tax deducted

Section – 203A : Tax deduction and collection account number

Section – 203AA : Furnishing of statement of tax deducted

Section – 204 : Meaning of “person responsible for paying”

Section – 205 : Bar against direct demand on assessee

Section – 206 : Persons deducting tax to furnish prescribed returns

Section – 206A : Furnishing of quarterly* return in respect of payment of interest to residents without deduction of tax

Section – 206AA : Requirement to furnish Permanent Account Number

Section – 206B : Person paying dividend to certain residents without deduction of tax to furnish prescribed return

Section – 206C : Profits and gains from the business of trading in alcoholic liquor, forest produce, scrap, etc

Section – 206CA : Tax collection account number

Section – 206CB : Processing of statements of tax collected at source

Section – 206CC : [Requirement to furnish Permanent Account number by collectee

Section – 207 : Liability for payment of advance tax

Section – 208 : Conditions of liability to pay advance tax

Section – 209 : Computation of advance tax

Section – 209A : Computation and payment of advance tax by assessee

Section – 210 : Payment of advance tax by the assessee of his own accord or in pursuance of order of Assessing Officer

Section – 211 : Instalments of advance tax and due dates

Section – 212 : Estimate by assessee

Section – 213 : Commission receipts

Section – 214 : Interest payable by Government

Section – 215 : Interest payable by assessee

Section – 216 : Interest payable by assessee in case of under-estimate, etc

Section – 217 : Interest payable by assessee when no estimate made

Section – 218 : When assessee deemed to be in default

Section – 219 : Credit for advance tax

Section – 220 : When tax payable and when assessee deemed in default

Section – 221 : Penalty payable when tax in default

Section – 222 : Certificate to Tax Recovery Officer

Section – 223 : Tax Recovery Officer by whom recovery is to be effected

Section – 224 : Validity of certificate and cancellation or amendment thereof

Section – 225 : Stay of proceedings in pursuance of certificate and amendment or cancellation thereof

Section – 226 : Other modes of recovery

Section – 227 : Recovery through State Government

Section – 228 : Recovery of Indian tax in Pakistan and Pakistan tax in India

Section – 228A : Recovery of tax in pursuance of agreements with foreign countries

Section – 229 : Recovery of penalties, fine, interest and other sums

Section – 230 : Tax clearance certificate

Section – 230A : Restrictions on registration of transfers of immovable property in certain cases

Section – 231 : Period for commencing recovery proceedings

Section – 232 : Recovery by suit or under other law not affected

Section – 233 : Recovery of tax payable under provisional assessment

Section – 234 : Tax paid by deduction or advance payment

Section – 234A : Interest for defaults in furnishing return of income

Section – 234B : Interest for defaults in payment of advance tax

Section – 234C : Interest for deferment of advance tax

Section – 234D : Interest on excess refund

Section – 234E : Fee for default in furnishing statements

Section – 234F : Fee for default in furnishing return of income

CHAPTER XVIII – Relief respecting tax on dividends in certain cases

Section – 235 : Relief to shareholders in respect of agricultural income-tax attributable to dividends

Section – 236 : Relief to company in respect of dividend paid out of past taxed profits

Section – 236A : Relief to certain charitable institutions or funds in respect of certain dividends

CHAPTER XIX – Refunds

Section – 237 : Refunds

Section – 238 : Person entitled to claim refund in certain special cases

Section – 239 : Form of claim for refund and limitation

Section – 240 : Refund on appeal, etc

Section – 241 : Power to withhold refund in certain cases

Section – 241A : Withholding of refund in certain cases

Section – 242 : Correctness of assessment not to be questioned

Section – 243 : Interest on delayed refunds

Section – 244 : Interest on refund where no claim is needed

Section – 244A : Interest on refunds

Section – 245 : Set off of refunds against tax remaining payable

CHAPTER XIXA – Settlement of cases

Section – 245A : Definitions

Section – 245B : Income-tax Settlement Commission

Section – 245BA : Jurisdiction and powers of Settlement Commission

Section – 245BB : Vice-Chairman to act as Chairman or to discharge his functions in certain circumstances

Section – 245BC : Power of Chairman to transfer cases from one Bench to another

Section – 245BD : Decision to be by majority

Section – 245C : Application for settlement of cases

Section – 245D : Procedure on receipt of an application under section 245C

Section – 245DD : Power of Settlement Commission to order provisional attachment to protect revenue

Section – 245E : Power of Settlement Commission to reopen completed proceedings

Section – 245F : Powers and procedure of Settlement Commission

Section – 245G : Inspection, etc., of reports

Section – 245H : Power of Settlement Commission to grant immunity from prosecution and penalty

Section – 245HA : Abatement of proceeding before Settlement Commission

Section – 245HAA : Credit for tax paid in case of abatement of proceedings

Section – 245I : Order of settlement to be conclusive

Section – 245J : Recovery of sums due under order of settlement

Section – 245K : Bar on subsequent application for settlement

Section – 245L : Proceedings before Settlement Commission to be judicial proceedings

Section – 245M : Certain persons who have filed appeals to the Appellate Tribunal entitled to make applications to the Settlement Commission

CHAPTER XIXB (Sections 245N – 245V): Advance rulings

Section – 245N : Definitions

Section – 245O : Authority for Advance Rulings

Section – 245P : Vacancies, etc., not to invalidate proceedings

Section – 245Q : Application for advance ruling

Section – 245R : Procedure on receipt of application

Section – 245RR : Appellate authority not to proceed in certain cases

Section – 245S : Applicability of advance ruling

Section – 245T : Advance ruling to be void in certain circumstances

Section – 245U : Powers of the Authority

Section – 245V : Procedure of Authority

CHAPTER XX (Sections 246 – 269): Appeals and revision

Section – 246 : Appealable orders

Section – 246A : Appealable orders before Commissioner (Appeals)

Section – 247 : Appeal by partner

Section – 248 : Appeal by a person denying liability to deduct tax in certain cases

Section – 249 : Form of appeal and limitation

Section – 250 : Procedure in appeal

Section – 251 : Powers of the 88[***] 89[Commissioner (Appeals)]

Section – 252 : Appellate Tribunal

Section – 252A : [Qualifications, terms and conditions of service of President, Vice-President and Member

Section – 253 : Appeals to the Appellate Tribunal

Section – 254 : Orders of Appellate Tribunal

Section – 255 : Procedure of Appellate Tribunal

Section – 256 : Statement of case to the High Court

Section – 257 : Statement of case to Supreme Court in certain cases

Section – 258 : Power of High Court or Supreme Court to require statement to be amended

Section – 259 : Case before High Court to be heard by not less than two judges

Section – 260 : Decision of High Court or Supreme Court on the case stated

Section – 260A : Appeal to High Court

Section – 260B : Case before High Court to be heard by not less than two Judges

Section – 261 : Appeal to Supreme Court

Section – 262 : Hearing before Supreme Court

Section – 263 : Revision of orders prejudicial to revenue

Section – 264 : Revision of other orders

Section – 265 : Tax to be paid notwithstanding reference, etc

Section – 266 : Execution for costs awarded by Supreme Court

Section – 267 : Amendment of assessment on appeal

Section – 268 : Exclusion of time taken for copy

Section – 268A : Filing of appeal or application for reference by income-tax authority

Section – 269 : Definition of “High Court”

CHAPTER XXA – Acquisition of immovable properties in certain cases of transfer to counteract evasion of tax

Section – 269A : Definitions

Section – 269AB : Registration of certain transactions

Section – 269B : Competent authority

Section – 269C : Immovable property in respect of which proceedings for acquisition may be taken

Section – 269D : Preliminary notice

Section – 269E : Objections

Section – 269F : Hearing of objections

Section – 269G : Appeal against order for acquisition

Section – 269H : Appeal to High Court

Section – 269I : Vesting of property in Central Government

Section – 269J : Compensation

Section – 269K : Payment or deposit of compensation

Section – 269L : Assistance by Valuation Officers

Section – 269M : Powers of competent authority

Section – 269N : Rectification of mistakes

Section – 269O : Appearance by authorised representative or registered valuer

Section – 269P : Statement to be furnished in respect of transfers of immovable property

Section – 269Q : Chapter not to apply to transfers to relatives

Section – 269R : Properties liable for acquisition under this Chapter not to be acquired under other laws

Section – 269RR : Chapter not to apply where transfer of immovable property made after a certain date

Section – 269S : Chapter not to extend to State of Jammu and Kashmir

Section – 269SS : Mode of taking or accepting certain loans, deposits and specified sum.

Section – 269ST : Mode of undertaking transactions

Section – 269T : Mode of repayment of certain loans or deposits

Section – 269TT : Mode of repayment of Special Bearer Bonds, 1991

Section – 269U : Commencement of Chapter

Section – 269UA : Definitions

Section – 269UB : Appropriate authority

Section – 269UC : Restrictions on transfer of immovable property

Section – 269UD : Order by appropriate authority for purchase by Central Government of immovable property

Section – 269UE : Vesting of property in Central Government

Section – 269UF : Consideration for purchase of immovable property by Central Government

Section – 269UG : Payment or deposit of consideration

Section – 269UH : Re-vesting of property in the transferor on failure of payment or deposit of consideration

Section – 269UI : Powers of the appropriate authority

Section – 269UJ : Rectification of mistakes

Section – 269UK : Restrictions on revocation or alteration of certain agreements for the transfer of immovable property or on transfer of certain immovable property

Section – 269UL : Restrictions on registration, etc., of documents in respect of transfer of immovable property

Section – 269UM : Immunity to transferor against claims of transferee for transfer

Section – 269UN : Order of appropriate authority to be final and conclusive

Section – 269UO : Chapter not to apply to certain transfers

Section – 269UP : Chapter not to apply where transfer of immovable property effected after certain date

Section – 270 : Failure to furnish information regarding securities, etc

Section – 270A : Penalty for under-reporting and misreporting of income

Section – 270AA : Immunity from imposition of penalty, etc

Section – 271 : Failure to furnish returns, comply with notices, concealment of income, etc

Section – 271A : Failure to keep, maintain or retain books of account, documents, etc

Section – 271AA : Penalty for failure to keep and maintain information and document, etc., in respect of certain transactions

Section – 271AAA : Penalty where search has been initiated

Section – 271AAB : Penalty where search has been initiated

Section – 271B : Failure to get accounts audited

Section – 271BA : Penalty for failure to furnish report under section 92E

Section – 271BB : Failure to subscribe to the eligible issue of capital

Section – 271C : Penalty for failure to deduct tax at source

Section – 271CA : Penalty for failure to collect tax at source

Section – 271D : Penalty for failure to comply with the provisions of section 269SS

Section – 271DA : Penalty for failure to comply with provisions of section 269ST

Section – 271E : Penalty for failure to comply with the provisions of section 269T

Section – 271F : Penalty for failure to furnish return of income

Section – 271FA : Penalty for failure to furnish

Section – 271FAA : Penalty for furnishing inaccurate statement of financial transaction or reportable account

Section – 271FAB : Penalty for failure to furnish statement or information or document by an eligible investment fund

Section – 271FB : Penalty for failure to furnish return of fringe benefits.

Section – 271G : Penalty for failure to furnish information or document under section 92D

Section – 271GA : Penalty for failure to furnish information or document under section 285A

Section – 271GB : Penalty for failure to furnish report or for furnishing inaccurate report under section 286

Section – 271H : Penalty for failure to furnish statements, etc

Section – 271-I : Penalty for failure to furnish information or furnishing inaccurate information under section 195

Section – 272 : Failure to give notice of discontinuance

Section – 272A : Penalty for failure to answer questions, sign statements, furnish information, returns or statements, allow inspections, etc

Section – 272AA : Penalty for failure to comply with the provisions of section 133B

Section – 272B : Penalty for failure to comply with the provisions of section 139A

Section – 272BB : Penalty for failure to comply with the provisions of section 203A

Section – 272BBB : Penalty for failure to comply with the provisions of section 206CA

Section – 273 : False estimate of, or failure to pay, advance tax

Section – 273A : Power to reduce or waive penalty, etc., in certain cases

Section – 273AA : Power of 8[Principal Commissioner or] Commissioner to grant immunity from penalty.

Section – 273B : Penalty not to be imposed in certain cases

Section – 274 : Procedure

Section – 275 : Bar of limitation for imposing penalties

Section – 275A : Contravention of order made under sub-section (3) of section 132

Section – 275B : Failure to comply with the provisions of clause (iib) of sub-section (1) of section 132

Section – 276 : Removal, concealment, transfer or delivery of property to thwart tax recovery

Section – 276A : Failure to comply with the provisions of sub-sections (1) and (3) of section 178

Section – 276AA : Failure to comply with the provisions of section 269AB or section 269-I

Section – 276AB : Failure to comply with the provisions of sections 269UC, 269UE and 269UL

Section – 276B : Failure to pay tax to the credit of Central Government under Chapter XII-D or XVII-B

Section – 276BB : Failure to pay the tax collected at source

Section – 276C : Wilful attempt to evade tax, etc

Section – 276CC : Failure to furnish returns of income

Section – 276CCC : Failure to furnish return of income in search cases

Section – 276D : Failure to produce accounts and documents

Section – 276DD : Failure to comply with the provisions of section 269SS

Section – 276E : Failure to comply with the provisions of section 269T

Section – 277 : False statement in verification, etc

Section – 277A : Falsification of books of account or document, etc

Section – 278 : Abetment of false return, etc

Section – 278A : Punishment for second and subsequent offences

Section – 278AA : Punishment not to be imposed in certain cases

Section – 278AB : Power of

Section – 278B : Offences by companies

Section – 278C : Offences by Hindu undivided families

Section – 278D : Presumption as to assets, books of account, etc., in certain cases

Section – 278E : Presumption as to culpable mental state

Section – 279 : Prosecution to be at instance of

Section – 279A : Certain offences to be non-cognizable

Section – 279B : Proof of entries in records or documents

Section – 280 : Disclosure of particulars by public servants

Section – 280A : Special Courts

Section – 280B : Offences triable by Special Court

Section – 280C : Trial of offences as summons case

Section – 280D : Application of Code of Criminal Procedure, 1973 to proceedings before Special Court

Section – 280Y : Definitions

Section – 280Z : Tax credit certificates to certain equity shareholders

Section – 280ZA : Tax credit certificates for shifting of industrial undertaking from urban area

Section – 280ZB : Tax credit certificate to certain manufacturing companies in certain cases

Section – 280ZC : Tax credit certificate in relation to exports

Section – 280ZD : Tax credit certificates in relation to increased production of certain goods

Section – 280ZE : Tax credit certificate scheme

CHAPTER XXIII – Miscellaneous

Section – 281 : Certain transfers to be void

Section – 281A : Effect of failure to furnish information in respect of properties held benami

Section – 281B : Provisional attachment to protect revenue in certain cases

Section – 282 : Service of notice generally

Section – 282A : Authentication of notices and other documents

Section – 282B : Allotment of Document Identification Number

Section – 283 : Service of notice when family is disrupted or firm, etc., is dissolved

Section – 284 : Service of notice in the case of discontinued business

Section – 285 : Submission of statement by a non-resident having liaison office

Section – 285A : Furnishing of information or documents by an Indian concern in certain cases

Section – 285B : Submission of statements by producers of cinematograph films

Section – 285BA : Obligation to furnish statement of financial transaction or reportable account

Section – 286 : Furnishing of report in respect of international group

Section – 287 : Publication of information respecting assessees in certain cases

Section – 287A : Appearance by registered valuer in certain matters

Section – 288 : Appearance by authorised representative

Section – 288A : Rounding off of income

Section – 288B : Rounding off amount payable and refund due

Section – 289 : Receipt to be given

Section – 290 : Indemnity

Section – 291 : Power to tender immunity from prosecution

Section – 292 : Cognizance of offences

Section – 292A : Section 360 of the Code of Criminal Procedure, 1973, and the Probation of Offenders Act, 1958, not to apply

Section – 292B : Return of income, etc., not to be invalid on certain grounds

Section – 292BB : Notice deemed to be valid in certain circumstances

Section – 292C : Presumption as to assets, books of account, etc

Section – 292CC : Authorisation and assessment in case of search or requisition

Section – 293 : Bar of suits in civil courts

Section – 293A : Power to make exemption, etc., in relation to participation in the business of prospecting for, extraction, etc., of mineral oils

Section – 293B : Power of Central Government or Board to condone delays in obtaining approval

Section – 293C : Power to withdraw approval

Section – 294 : Act to have effect pending legislative provision for charge of tax

Section – 294A : Power to make exemption, etc., in relation to certain Union territories

Section – 295 : Power to make rules

Section – 296 : Rules and certain notifications to be placed before Parliament

Section – 297 : Repeals and savings

Section – 298: Power to remove difficulties

For more Section details in PDF

Download the Income Tax Sections List in PDF format using the link given below.