GST State Code List and Jurisdiction - Summary

GST stands for Goods and Services Tax. It is a tax we pay on things we buy or services we use. Every business that has a GST number (GSTIN) is linked to a state using a special code. This GST state code helps in identifying which state the business belongs to.

Each Indian state and union territory has a unique two-digit GST state code. These codes are used while filing GST returns, making invoices, and during other GST-related work. Knowing the correct state code is important for doing GST work correctly and avoiding mistakes.

Also Read – New GST Rate List 2025 PDF

What is GST State Codes?

Under GST law, every state and Union Territory is assigned a unique numeric code referred to as the GST state code. For example, ‘02’ is the GST state code for Himachal Pradesh and ‘07’ is the GST state code for Delhi. The GST state code will also form the first two digits of a taxpayer’s GST number i.e. GSTIN. Hence, if a taxpayer’s GSTIN is 07AAXXX1234A1Z5, then one can identify that the taxpayer has taken their GST registration in Delhi.

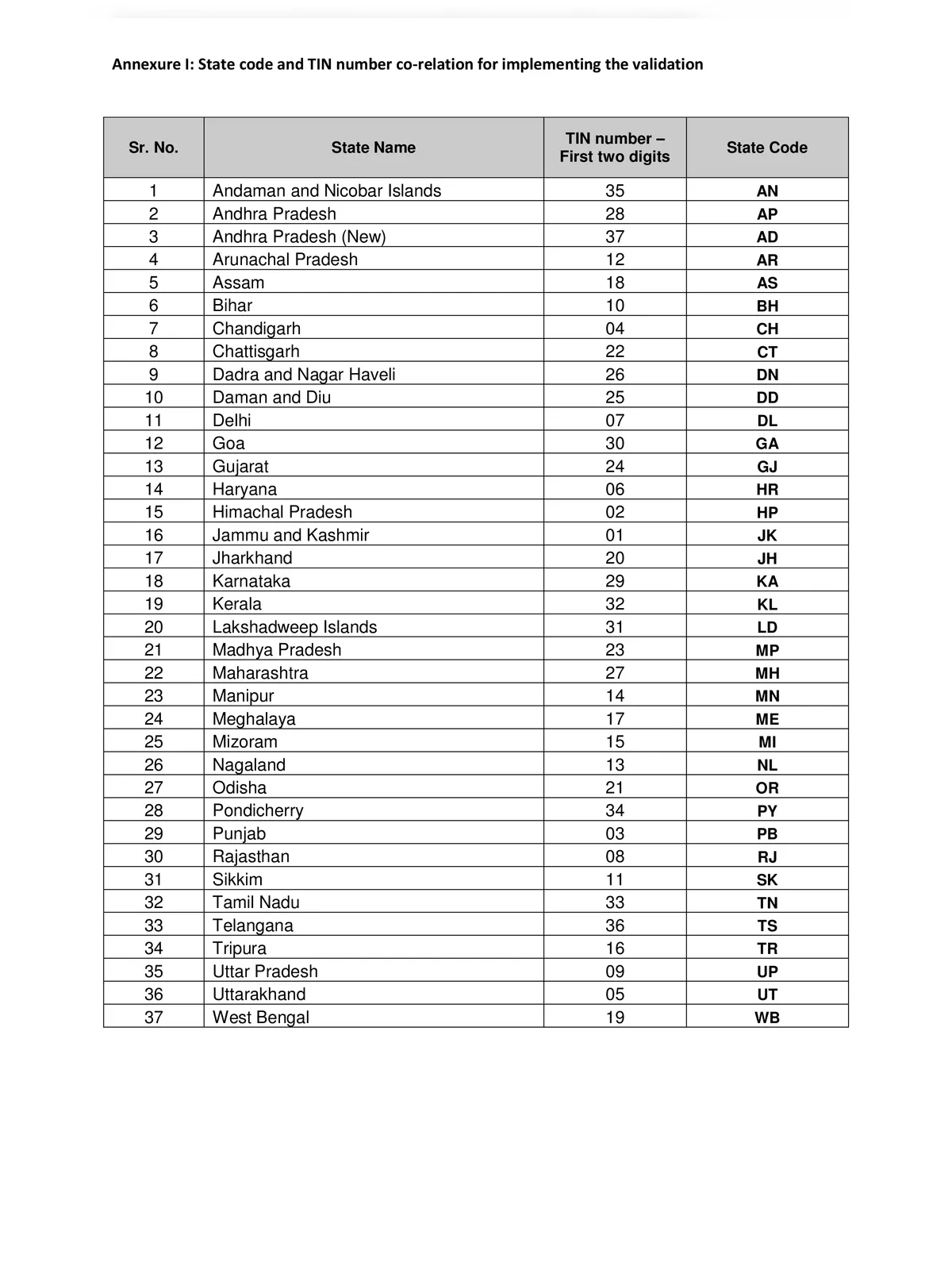

GST State Codes List 2026

| State Name | State Code | Alphabetical Code |

|---|---|---|

| Jammu and Kashmir | 01 | JK |

| Himachal Pradesh | 02 | HP |

| Punjab | 03 | PB |

| Chandigarh | 04 | CH |

| Uttarakhand | 05 | UT |

| Haryana | 06 | HR |

| Delhi | 07 | DL |

| Rajasthan | 08 | RJ |

| Uttar Pradesh | 09 | UP |

| Bihar | 10 | BH |

| Sikkim | 11 | SK |

| Arunachal Pradesh | 12 | AR |

| Nagaland | 13 | NL |

| Manipur | 14 | MN |

| Mizoram | 15 | MI |

| Tripura | 16 | TR |

| Meghalaya | 17 | ME |

| Assam | 18 | AS |

| West Bengal | 19 | WB |

| Jharkhand | 20 | JH |

| Odisha | 21 | OR |

| Chattisgarh | 22 | CT |

| Madhya Pradesh | 23 | MP |

| Gujarat | 24 | GJ |

| Daman and Diu | 25 | DD |

| Dadra and Nagar Haveli | 26 | DN |

| Maharashtra | 27 | MH |

| Andhra Pradesh | 28 | AP |

| Karnataka | 29 | KA |

| Goa | 30 | GA |

| Lakshadweep Islands | 31 | LD |

| Kerala | 32 | KL |

| Tamil Nadu | 33 | TN |

| Pondicherry | 34 | PY |

| Andaman and Nicobar Islands | 35 | AN |

| Telangana | 36 | TS |

| Andhra Pradesh (New) | 37 | AD |

| Ladakh (New) | 38 | LA |

Importance of GST State Code:

- GST Registration: The correct state code is essential during registration as it forms part of the GSTIN and determines the jurisdiction.

- GST Invoice & e-Invoicing: State codes in GSTINs help determine the place of supply and correct tax type (IGST or CGST+SGST). Incorrect codes can lead to wrong tax charges or cancellation of IRNs.

- GSTR-1 & GSTR-3B Return Filing: Accurate GSTINs (with correct state codes) are required in return filings. Errors may result in incorrect tax credit being passed to the wrong taxpayer.

GSTIN Format Explained

The GSTIN is a special number made up of 15 digits. It is linked to a person’s PAN and is also state-specific. Here’s how GSTIN breaks down:

- First Two Digits: Represent the State Code

- Next Ten Digits: Indicate PAN or TAN

- Thirteenth Digit: Represents the number of registrations under a single PAN

- The Fourteenth Digit: Indicates the nature of the business (kept as ‘Z’ by default for future use)

- Fifteenth Digit: Alphanumeric character that indicates the check code

Don’t forget to download the GST State Code List PDF using the link given below for easy reference! 📥