Form No 26Q – Quarterly Statement of Deduction of Tax - Summary

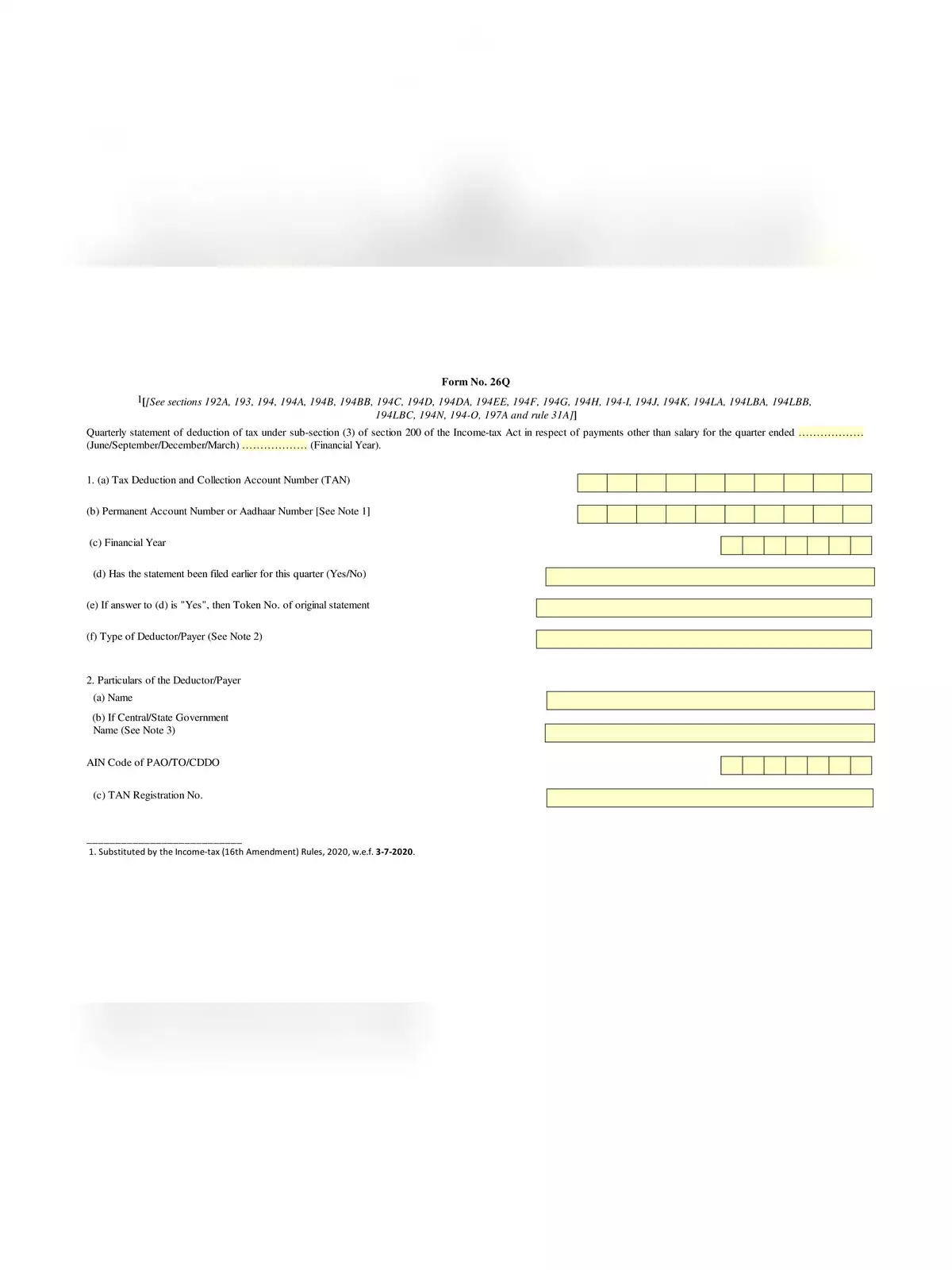

This article provides important information about Form 26Q, which is essential for filing a TDS return for payments other than salary. Form 26Q must be submitted quarterly, and it includes details about the total amount paid during the quarter and the TDS amount deducted from those payments.

Understanding Form 26Q

Submitting Form 26Q is a crucial responsibility for any payer who makes non-salaried payments. By filing this form, you help ensure that the appropriate taxes are reported and deducted.

How to Download Form 26Q

You can easily download the Form No-26Q in PDF format online from the link provided below. Make sure to have this form ready for your quarterly tax filing.