Form No. 49B - Summary

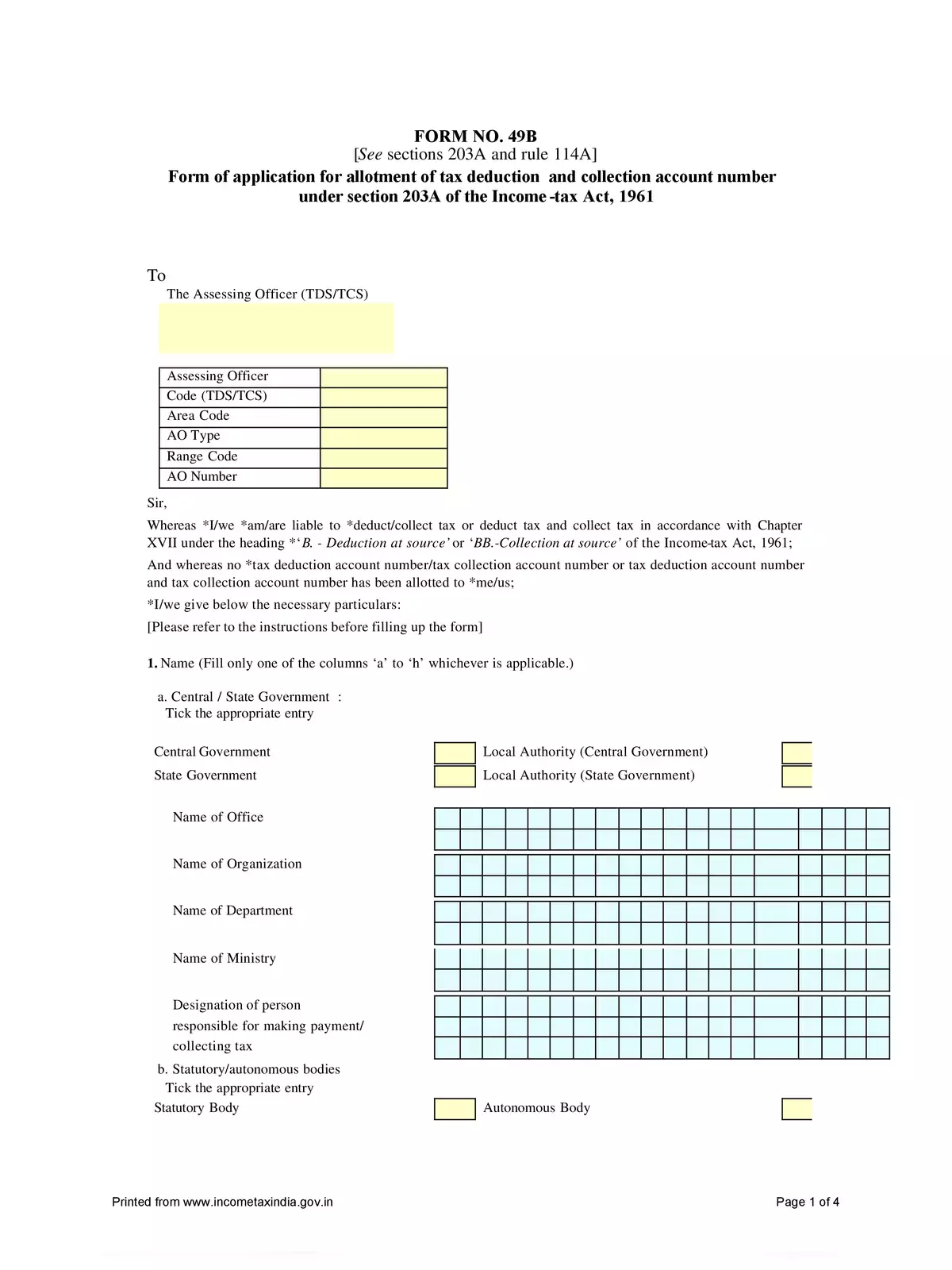

Form 49B is an important document that you need when applying for a TAN number or a collection and deduction account number as per section 203A of the Income Tax Act, 1961. This TAN number is mandatory for anyone who has to deduct TDS on different transactions. (Source- Tax Information Network website).

Form No. 49B is primarily used by companies, firms, trusts, and other organizations to get a PAN for their tax-related needs.

It is very important to fill out the form with accurate and up-to-date information. Once you have completed Form No. 49B, make sure to submit it along with the required supporting documents to the PAN Application Center or via the online portal as directed by the income tax authorities in India.

Key Information for Form No. 49B

Essential Details Required

The form contains various sections that must be filled in correctly. Below is a list of the important details included in Form No. 49B:

- Full name of the applicant

- Full name of the representative (if the applicant is not an individual)

- Address details (city, state, PIN code, and country)

- Contact details (telephone number and email address)

- Status of the applicant (like company, firm, trust, association, etc.)

- Address for communication (if different from the main address)

- Name and designation of the authorized representative

- Address of the authorized representative

- Contact details of the authorized representative

- Date of incorporation or establishment (for companies or firms)

- Date of birth/incorporation (for individuals)

- Gender (for individuals)

- Father’s name (for individuals)

- Address details (including city, state, PIN code, and country)

- Contact details (telephone number and email address)

- List of documents submitted as proof of identity and address (like certificate of incorporation, partnership deed, trust deed, etc.)

- Name and address of the representative assessee(s), if applicable

- Name, designation, and address of the principal officer or authorized signatory

- Contact details of the principal officer or authorized signatory

- Declaration by the applicant or authorized representative regarding the accuracy of the information in the form

- Verification by the applicant or authorized representative

For your convenience, you can easily download the Form No. 49B in PDF format using the link provided below. Make sure to keep it handy as you complete your application! 📄