Finance Bill 2022 - Summary

Finance Ministers Present its fourth Union Budget 2022 in Parliament on 1st Feb 2022. The Union Budget 2022-23, while continuing with the declared policy of stable and predictable tax regime, intends to bring more reforms that will take ahead the vision to establish a trustworthy tax regime. Smt Nirmala Sitharaman said that proposals relating to taxes and duties will further simplify the tax system, promote voluntary compliance by taxpayers, and reduce litigation.

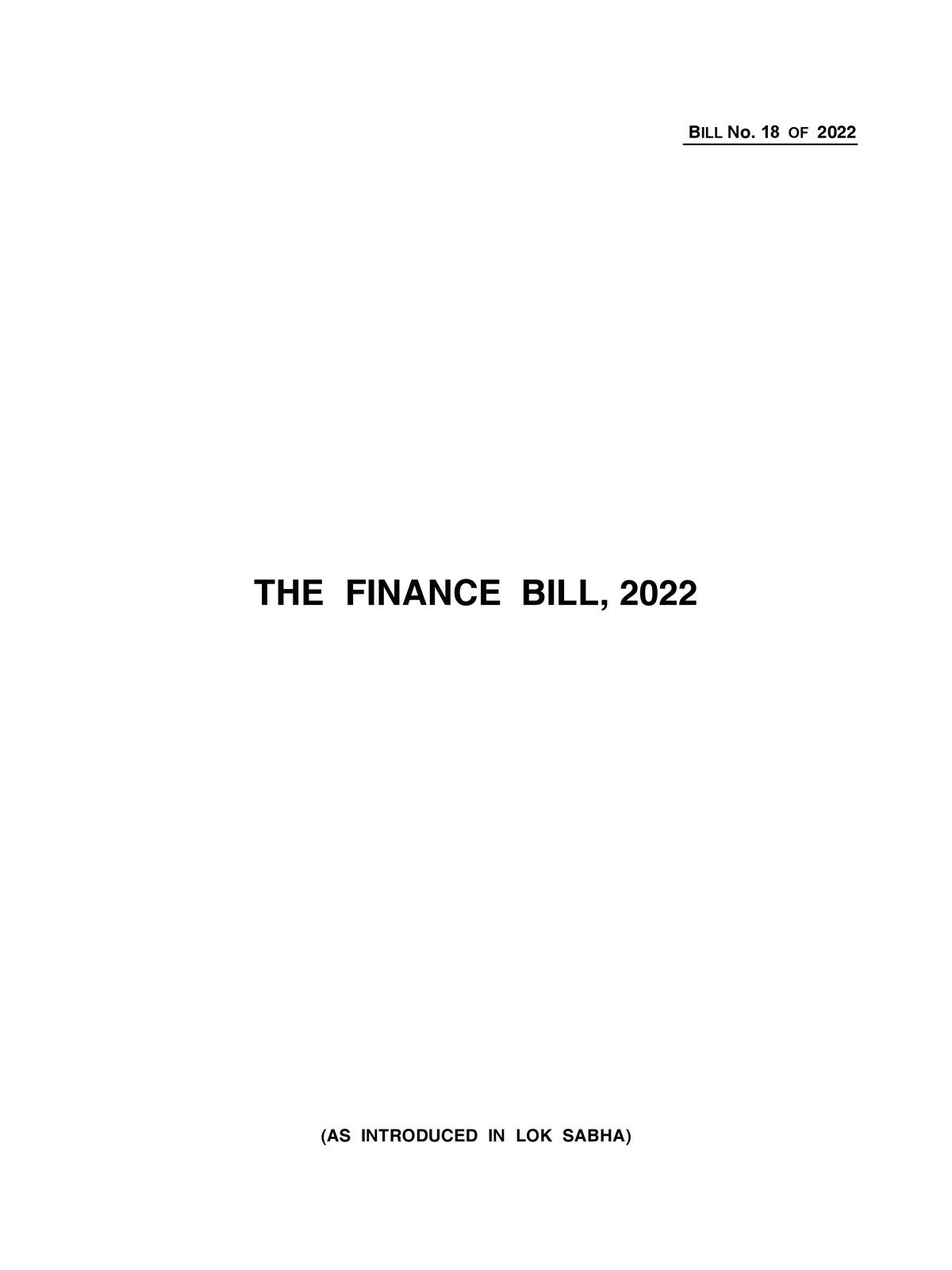

On the Direct Tax side, the budget allows taxpayers to file updated income tax return within 2 years for correcting errors. It also provides tax relief to persons with disability. The budget also reduces Alternate minimum tax rate and surcharge for cooperatives. As an incentive for startups, period of incorporation of eligible startups has been extended by one more year. The budget proposes to increase tax deduction limit on employer’s contribution to NPS account of state government employees to bring parity with central government employees. Newly incorporated manufacturing entities will be incentivized under concessional tax regime. Income from transfer of virtual assets will be taxed at 30%. The budget proposes better litigation management to avoid repetitive appeals.

Finance Bill 2022 – Introduces Change Details

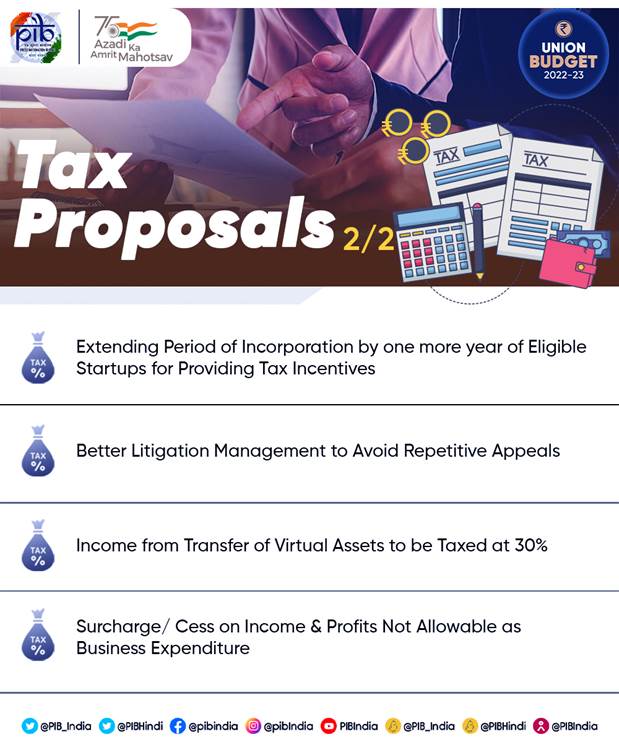

On the Indirect tax side,

- The Union budget says that Customs administration in Special Economic Zones will be fully IT driven. It provides for phasing out of concessional rates in capital goods and project imports gradually and apply a moderate tariff of 7.5%.

- The budget underlines review of customs exemptions and tariff simplification, with more than 350 exemptions proposed to be gradually phased out.

- It proposes that customs duty rates will be calibrated to provide a graded structure to facilitate domestic electronics manufacturing. Rationalization of exemptions on implements and tools for agri sector manufactured in India will be undertaken.

- Customs duty exemption to steel scrap will be extended. Unblended fuel will attract additional differential excise duty.

The budget proposes a new provision permitting taxpayers to file an Updated Return on payment of additional tax. This updated return can be filed within two years from the end of the relevant assessment year. Smt. Sitharaman said that with this proposal, there will be a trust reposed in the taxpayers that will enable the assessee herself to declare the income that she may have missed out earlier while filing her return. It is an affirmative step in the direction of voluntary tax compliance.

To provide a level playing field between co-operative societies and companies, the budget proposes to reduce Alternate Minimum Tax for the cooperative societies also to fifteen per cent. The Finance Minister also proposed to reduce the surcharge on co-operative societies from present 12 to 7 per cent for those having total income of more than Rs 1 crore and up to Rs 10 crores.

The Central Government contributes 14 per cent of the salary of its employee to the National Pension System (NPS) Tier-I. This is allowed as a deduction in computing the income of the employee. However, such deduction is allowed only to the extent of 10 per cent of the salary in case of employees of the State government. To provide equal treatment, the budget proposes to increase the tax deduction limit from 10 per cent to 14 per cent on employer’s contribution to the NPS account of State Government employees as well.

Eligible start-ups established before 31.3.2022 had been provided a tax incentive for three consecutive years out of ten years from incorporation. In view of the Covid pandemic, the budget provides for extending the period of incorporation of the eligible start-up by one more year, that is, up to 31.03.2023 for providing such tax incentive.

In an effort to establish a globally competitive business environment for certain domestic companies, a concessional tax regime of 15 per cent tax was introduced by the government for newly incorporated domestic manufacturing companies. The Union Budget proposes to extend the last date for commencement of manufacturing or production under section 115BAB by one year i.e. to 31st March, 2024.

For the taxation of virtual digital assets, the budget provides that any income from transfer of any virtual digital asset shall be taxed at the rate of 30 per cent. No deduction in respect of any expenditure or allowance shall be allowed while computing such income except cost of acquisition. Further, loss from transfer of virtual digital asset cannot be set off against any other income. In order to capture the transaction details, a provision has been made for TDS on payment made in relation to transfer of virtual digital asset at the rate of 1 per cent of such consideration above a monetary threshold. Gift of virtual digital asset is also proposed to be taxed in the hands of the recipient.

Taking forward the policy of sound litigation management, the budget provides that, if a question of law in the case of an assessee is identical to a question of law which is pending in appeal before the jurisdictional High Court or the Supreme Court in any case, the filing of further appeal in the case of this assessee by the department shall be deferred till such question of law is decided by the jurisdictional High Court or the Supreme Court.

The budget says that reforms in Customs Administration of Special Economic Zones will be undertaken, and it shall henceforth be fully IT driven and function on the Customs National Portal with a focus on higher facilitation and with only risk-based checks. This reform shall be implemented by 30th September 2022.

The budget proposes to phase out the concessional rates in capital goods and project imports gradually and apply a moderate tariff of 7.5 per cent. Certain exemptions for advanced machineries that are not manufactured within the country shall continue. A few exemptions have been introduced on inputs, like specialised castings, ball screw and linear motion guide, to encourage domestic manufacturing of capital goods.

More than 350 exemption entries will be gradually phased out. These include exemption on certain agricultural produce, chemicals, fabrics, medical devices and drugs and medicines for which sufficient domestic capacity exists. Further, several concessional rates are being incorporated in the Customs Tariff Schedule itself instead of prescribing them through various notifications.

In the field of electronics, Customs duty rates are being calibrated to provide a graded rate structure to facilitate domestic manufacturing of wearable devices, hearable devices and electronic smart meters. Duty concessions are also being given to parts of transformer of mobile phone chargers and camera lens of mobile camera module and certain other items.

To give a boost to the Gems and Jewellery sector, Customs duty on cut and polished diamonds and gemstones is being reduced to 5 per cent. To facilitate export of jewellery through e-commerce, a simplified regulatory framework shall be implemented by June this year. To disincentivise import of undervalued imitation jewellery, the customs duty on imitation jewellery is being prescribed in a manner that a duty of at least Rs 400 per Kg is paid on its import.

Customs duty on certain critical chemicals namely methanol, acetic acid and heavy feed stocks for petroleum refining are being reduced, while duty is being raised on sodium cyanide for which adequate domestic capacity exists.

Duty on umbrellas is being raised to 20 per cent. Exemption to parts of umbrellas is being withdrawn. Exemption is also being rationalised on implements and tools for agri-sector which are manufactured in India. Customs duty exemption given to steel scrap last year is being extended for another year. Certain Anti- dumping and CVD on stainless steel and coated steel flat products, bars of alloy steel and high-speed steel are being revoked.

To incentivise exports, exemptions are being provided on items such as embellishment, trimming, fasteners, buttons, zipper, lining material, specified leather, furniture fittings and packaging boxes that may be needed by bonafide exporters of handicrafts, textiles and leather garments, leather footwear and other goods. Duty is being reduced on certain inputs required for shrimp aquaculture so as to promote its exports.

Blending of fuel is a priority of this Government. To encourage the efforts for blending of fuel, unblended fuel shall attract an additional differential excise duty of Rs 2/ litre from the 1st day of October 2022.

Finance Bill 2022

You can download the Finance Bill 2022 PDF using the link given below.