Common Covid-19 Emergency Credit Line Application Form - Summary

Common Covid-19 Emergency Credit Line (CCECL) is a new loan scheme launched by the Narendra Modi government to provide relief to Agri borrowers / Agri entrepreneurs / SHG Members to tide over the COVID 19 pandemic outbreak.

The scheme is an effort to extend an additional credit facility to the eligible existing borrowers by way of ad-hoc facilities viz Common Covid 19 Emergency Credit Line for sustaining Agri income generation activity.

Who are eligible for finance under CCECL?

All existing KCC / ACC/ ABAL / SHG ACC borrowers.

All standard accounts including SMA 0 and SMA 1 accounts (Risk Grade 0, 1 and 2) as on date of sanction irrespective of internal rating (SMA 2 are not eligible).

What are the documents required for availing CCECL?

For loan limit up to Rs. 1.60 lakh

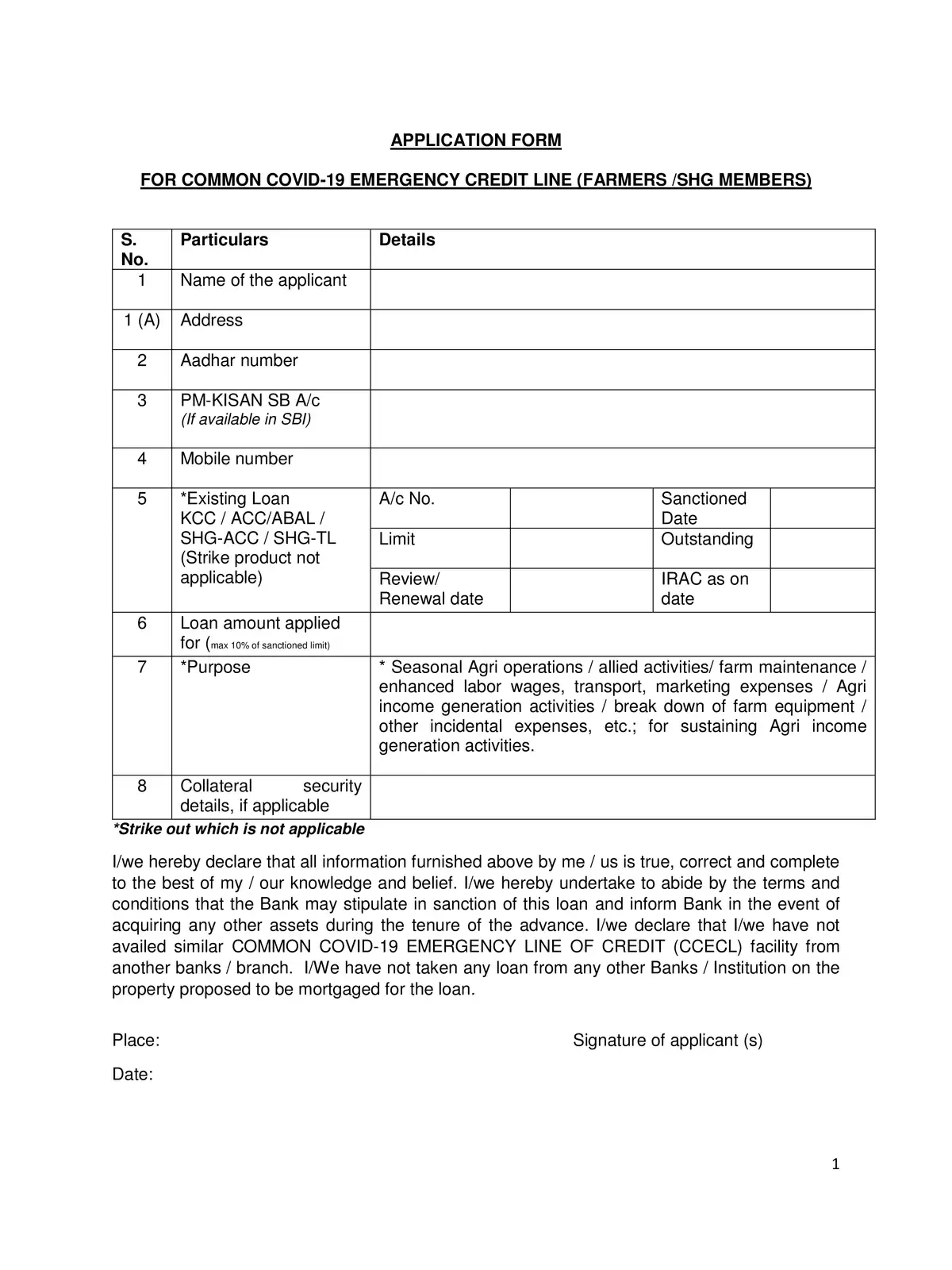

Application form cum appraisal.

Two latest Passport Size Photos,

ID Proof such as Aadhar Card / Voter Identity Card etc.

Address Proof such as Driving License, Aadhar Card, etc.

DP Note and DP Note Take Delivery Letter

Arrangement letter.

Hypothecation Supplementary Agreement (AB1-A)

For loan limit above Rs. 1.60 lakh

Application form cum appraisal.

Two latest Passport Size Photos.

ID Proof such as Aadhar Card / Voter Identity Card etc.

Address Proof such as Driving License, Aadhar Card, etc.

DP Note and DP Note Take Delivery Letter

Arrangement letter.

Hypothecation Supplementary Agreement (AB1-A)

Deed of Extension of mortgage (AB3-A) , if applicable

Extension of equitable mortgage, if applicable.

For SHG-CC

Application for loan assistance by SHG

Resolution for availing “CCECL”

Inter -se Agreement.to be executed by all members of SHG

Articles of Agreement for financing SHGs-executed by Authorized Representatives

Arrangement Letter

Validity period of the scheme CCECL

The scheme (CCECL) will be in force up to 30.06.2020 (draw down will be permitted up to 31.07.2020 either in single tranche or maximum of three tranches).

Minimum and maximum loan under CCECL

Maximum loan: Ten (10%) of the existing limit.

The maximum cap is Rs. 2.00 lakh.

For SHG, Rs,5,000/-per member is the minimum

Detailed FAQs for farmers SHG members

Detailed FAQ’s for CCECL-SHG

Contact Details (SBI) of Support Teams