CAMS FATCA Form - Summary

FATCA (Foreign Account Tax Compliance Act) is a U.S. tax law designed to stop tax evasion by U.S. persons with foreign accounts. It is essential for investors to understand the significance of the CAMS FATCA Form, which helps in meeting FATCA requirements. By filling out this form, you ensure compliance and contribute to the integrity of global tax laws. Don’t forget to download the CAMS FATCA Form PDF for easy reference!

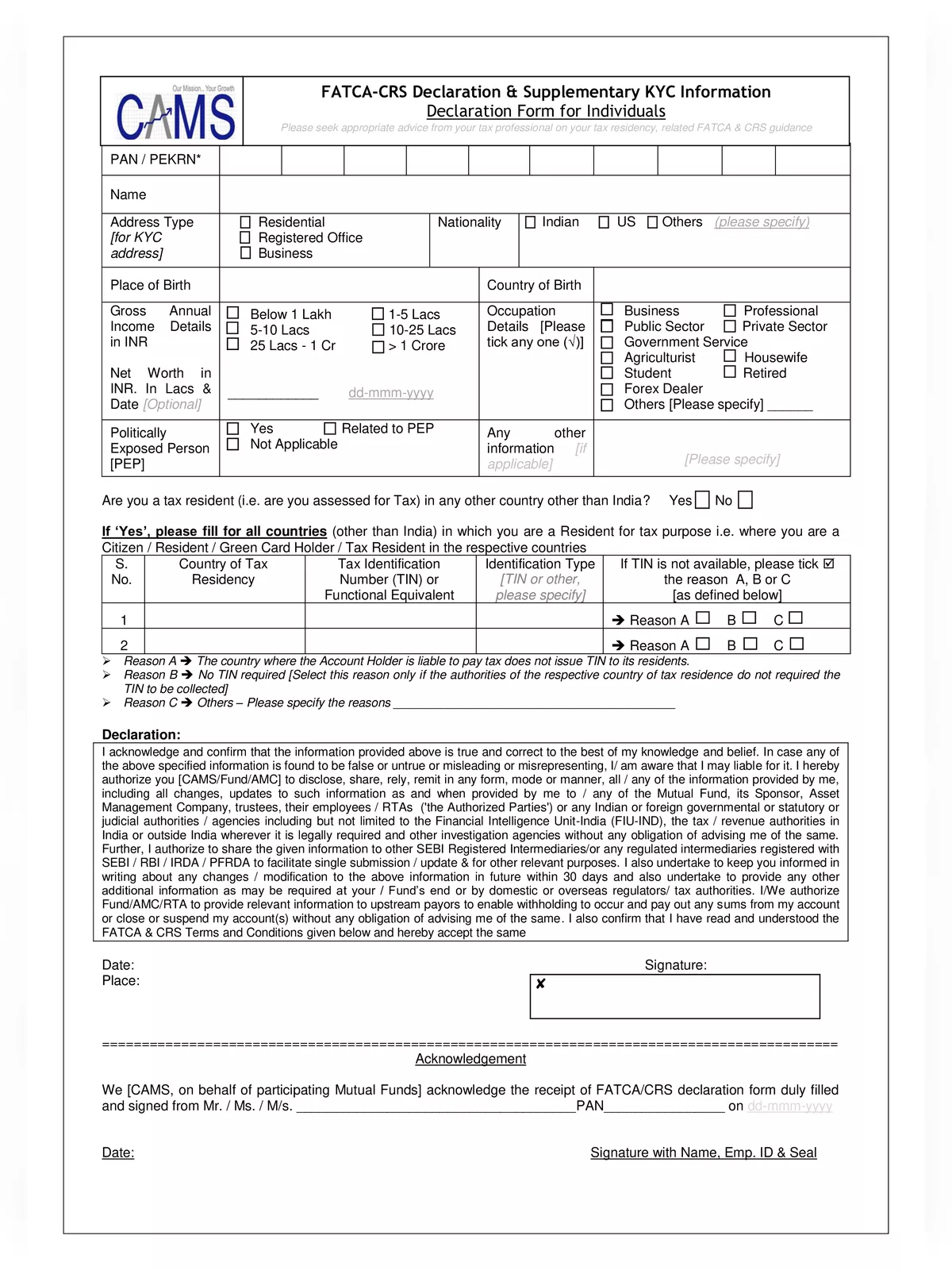

Steps to Fill and Submit the CAMS FATCA Form

- Obtain the Form: You can download the CAMS FATCA form PDF from the CAMS website or collect a physical copy from a CAMS service center.

- Fill in Personal Details: Make sure to enter all your personal information correctly.

- Provide FATCA/CRS Details: Declare where you are a tax resident and share your Tax Identification Numbers (TINs) for each country where you pay taxes.

- Attach Required Documents: Collect and attach copies of the necessary documents listed below.

- Sign the Form: Don’t forget to sign where it’s required.

- Submit the Form: Finally, submit the completed form and accompanying documents to a CAMS service center or mail them to the CAMS office address.

Required Documents

- Proof of Identity (Choose any one from below):

- PAN Card

- Passport

- Aadhaar Card

- Voter ID Card

- Proof of Address (Choose any one from below):

- Passport

- Aadhaar Card

- Utility Bill (electricity, telephone, etc.)

- Bank Statement

- Tax Identification Number (TIN) Proof (if applicable):

- Documents showing TIN for all countries of tax residency outside India.

- Additional Documents for U.S. Persons:

- W-9 form (Request for Taxpayer Identification Number and Certification) for U.S. persons.

For more details and assistance, ensure to download the CAMS FATCA form PDF from our website!