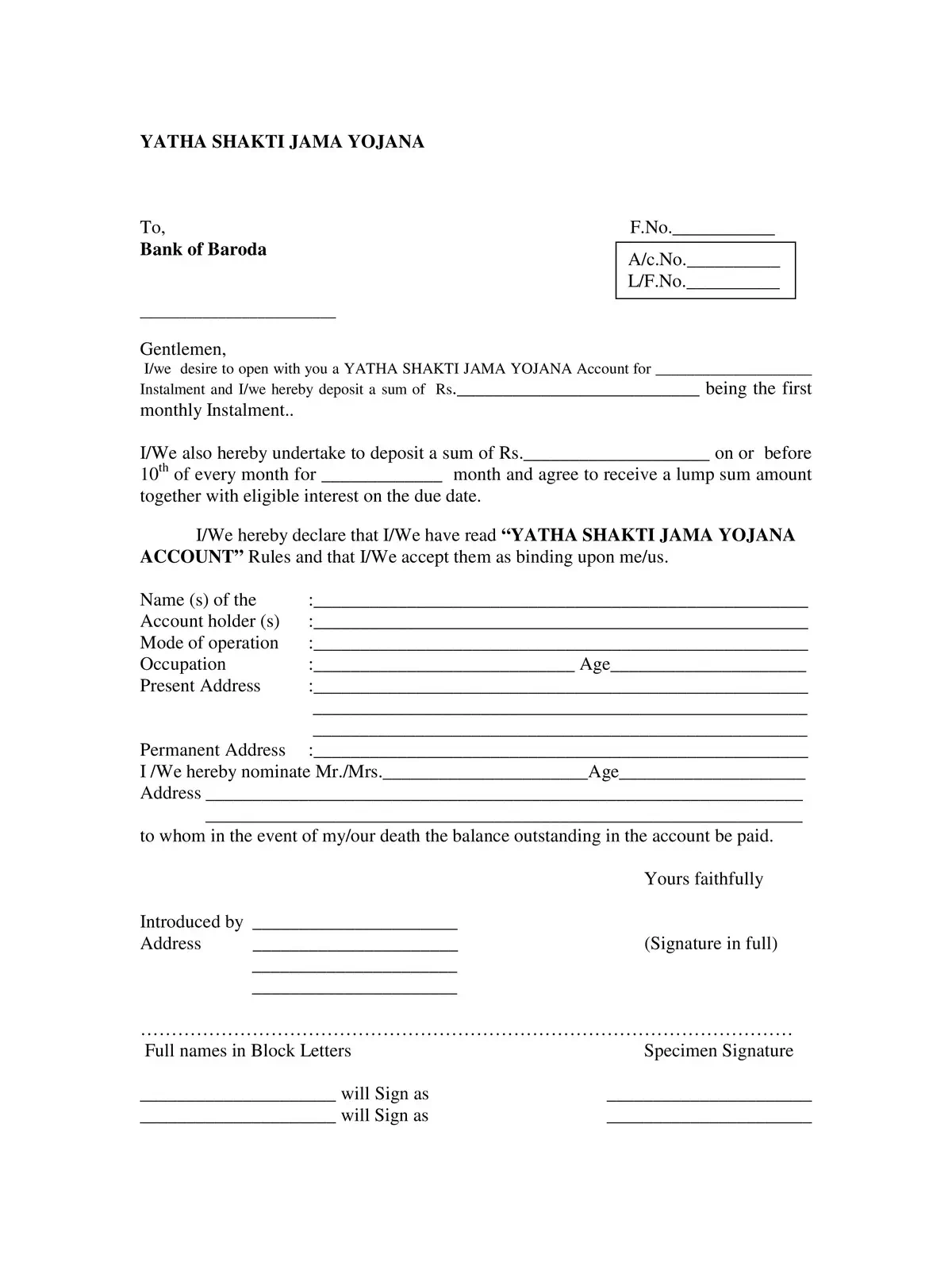

Bank of Baroda Yatha Shakti Account Form - Summary

This is an application form for the Yatha Shakti Account issued by the Bank of Baroda, and it can be easily downloaded in PDF format from the Bank’s official website, www.bankofbaroda.in, or directly from the link provided below.

Bank of Baroda Yatha Shakti Account Eligibility

The Yatha Shakti Account is designed to support various individuals and groups. Here are the eligibility criteria:

- An individual can apply in his/her own name.

- More than one individual can apply together in a joint name.

- A minor aged 10 years and above can apply as per the bank’s terms. Accounts can also be opened for minors with their father or mother as guardians, following the Bank’s guidelines.

- Clubs, associations, educational institutions, partnerships, and joint-stock companies are eligible if they are registered and the bank is satisfied that the account is for genuine savings purposes.

- This product is not available for NRE deposits.

Yatha Shakti Account Interest Rate and Charges

Understanding the benefits associated with this account is key for savers:

- Interest is paid and credited twice a year, in September and March.

- Senior Citizens will receive additional interest benefits according to the guidelines effective at that time (as applicable on Recurring Deposit accounts).

- Bank staff members (including ex-staff) are also eligible for additional interest as per the applicable guidelines. Retired Staff Members who are Senior Citizens can enjoy both Staff rate and Senior Citizen interest rate benefits.

Deposit Amount Details

Here’s what you need to know regarding the deposit amounts:

- Minimum: The minimum core installment to open an account is Rs.100, and further deposits must be in multiples of Rs.100, allowing flexible changes in installment amounts.

- Maximum: The monthly deposit amount can go up to three times the core installment, with a cap of Rs.10,000 per month.

- Tenure of Deposit: Minimum of 12 months to a maximum of 120 months.

- Premature Closure: Interest for premature withdrawals will incur a penalty of 1% from the applicable or contracted rate, whichever is lower.

- Loan/Overdraft Availability: You can avail a loan or overdraft up to 95% of the outstanding balance, at an interest rate as per the bank’s guidelines.

- Maturity of Deposit: The maturity will be one month after the last installment is paid or on the due date, whichever is later.

- Penalty on Delayed Payment: There is no penalty for late payments of installments.

Additional Interest for Senior Citizens: An additional interest rate of 0.50% is applicable for deposits below Rs.1 crore.

Payment of Installments: Installments must be paid by the last working day of each month. For any delayed payment, a penalty of Rs.1.00 + GST for every Rs.100 per month will be charged. Any fraction of Rs.100 will be considered as a full month for calculating the penalty.

Any installment paid during the month it is due will be treated as a timely payment.

Download the Bank of Baroda Yatha Shakti Account Form in PDF format using the link below for further details.