Form 13 – Non-Deduction / Lower Deduction of TDS - Summary

Understanding Form 13 for Non-Deduction or Lower Deduction of TDS

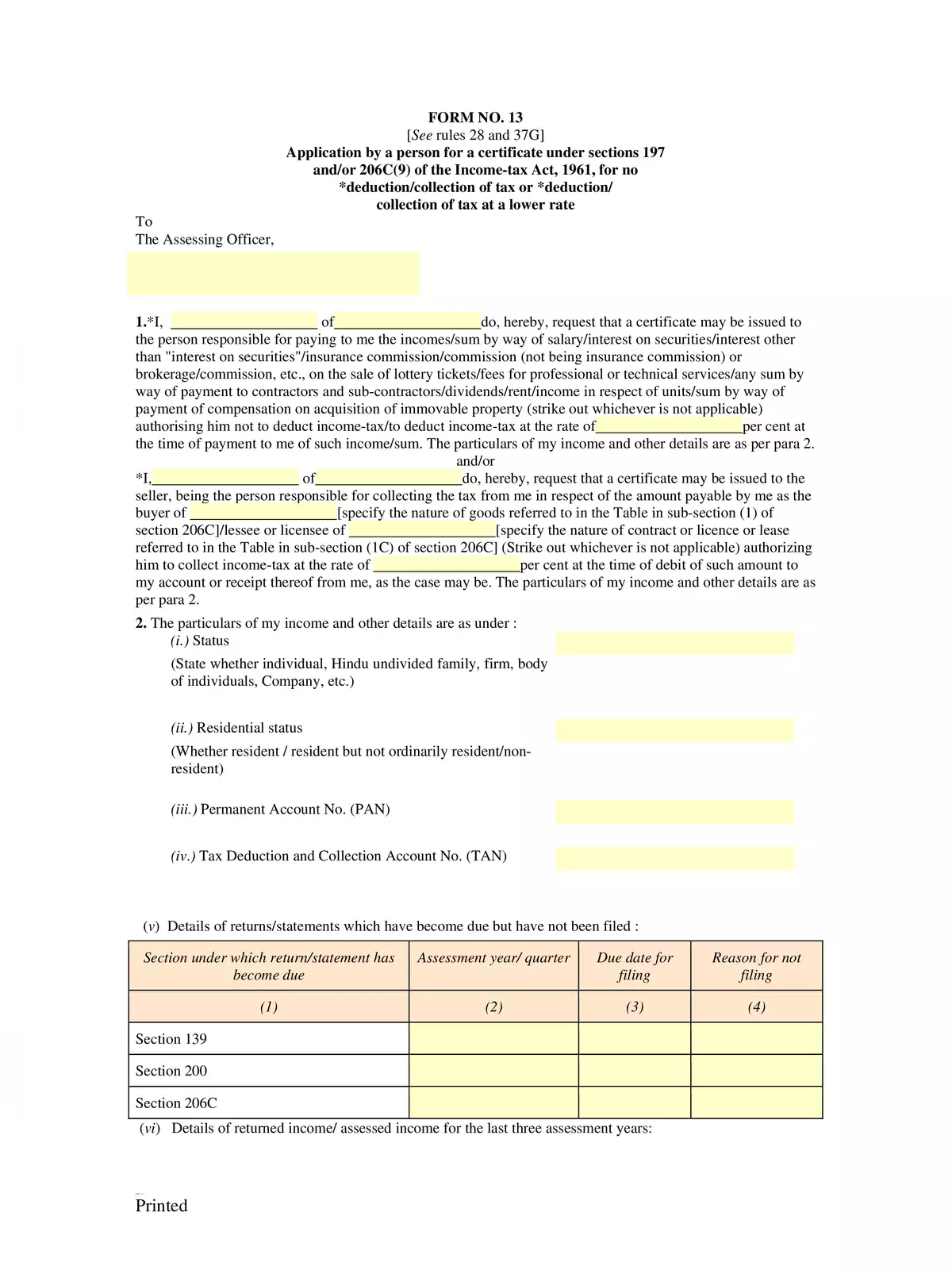

Form 13 is an important document for individuals and businesses seeking non-deduction or lower deduction of TDS. Considering the tendency of taxpayers to adopt tax evasion measures, the Income Tax Act has made provisions for the deduction of tax at source, also known as TDS. This system helps ensure that taxes are collected at the origin of income, which is beneficial for both the government and the taxpayer.

What Does TDS Deduction Involve?

The tax rates for TDS deduction are specified under various sections including Section 192, which deals with salaries, Section 194 for various payments, and Section 195 for payments to non-residents.

Every person or entity responsible for making a payment has the duty to deduct tax at the stipulated rates. This deduction takes place either at the time of crediting the income to the recipient’s account or at the time of making the actual payment, whichever occurs first. After deducting the tax, only the remaining amount is paid to the recipient.

It is essential for taxpayers to understand their responsibilities regarding TDS. By submitting Form 13, they can request the Assessing Officer to allow lower or no TDS deduction based on their estimated income. This can be particularly useful for individuals and businesses facing financial challenges.

Remember, accurately completing Form 13 and understanding its implications can lead to better financial management and compliance with tax regulations. Always consult with a tax professional if you have questions about your specific situation.

For more information about tax and its implications, feel free to check our detailed PDF guide available for download below.