PSB Kisan Credit Card Loan (KCC) Form - Summary

The PSB Kisan Credit Card Loan (KCC) Form is essential for farmers seeking short-term loans to support their agricultural needs. With the KCC, loans are available at a low interest rate of just 4 percent when payments are made on time. Moreover, if farmers repay their loans without delay, they can enjoy an interest waiver of up to 3 percent, as highlighted by the government-run State Bank of India.

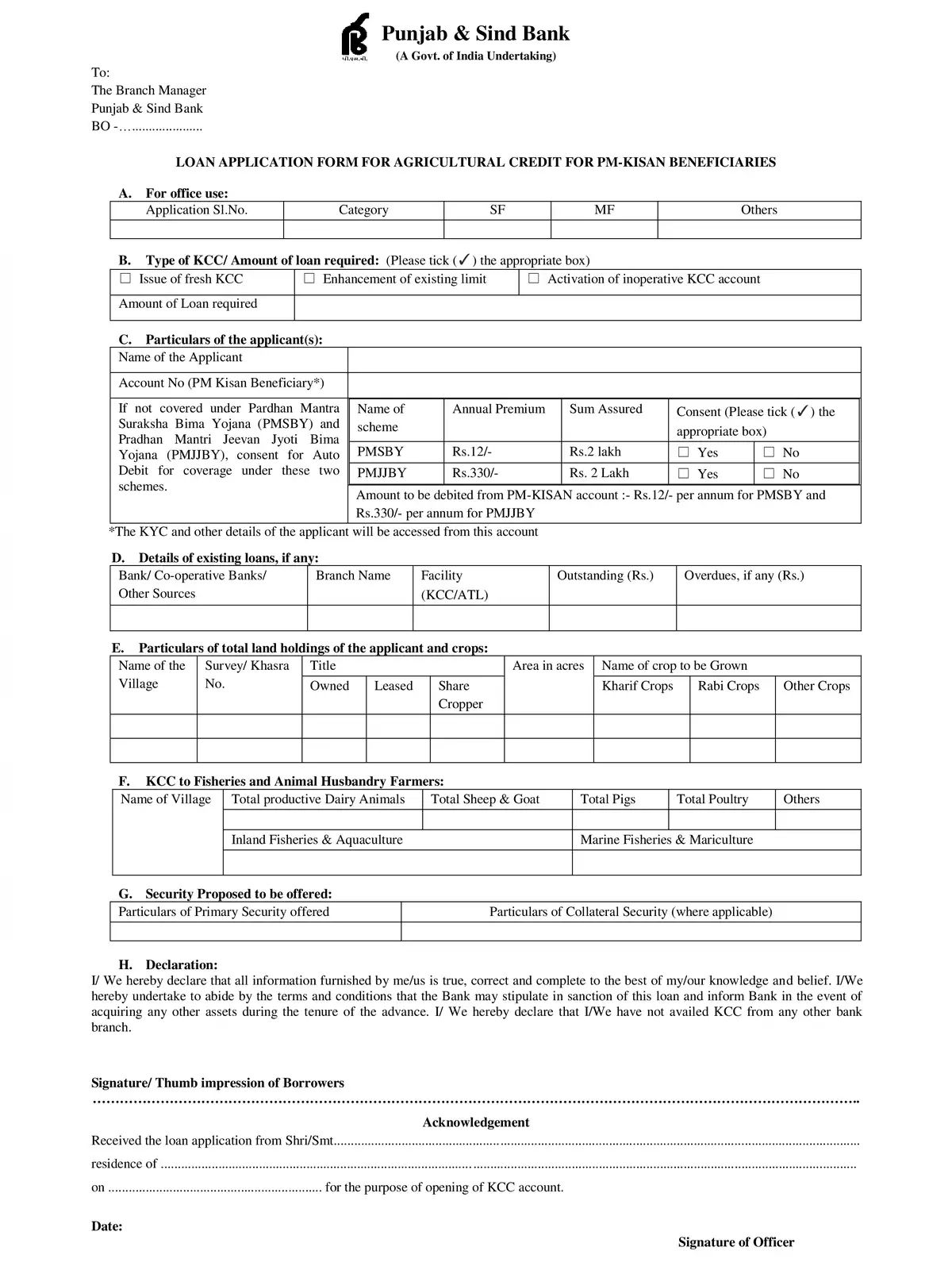

Objectives of KCC

The primary goal of the Kisan Credit Card (KCC) scheme is to provide farmers with easy and hassle-free investment credit for agricultural purposes. This support enables farmers to improve their productivity and enhance their livelihoods.

Eligibility Criteria

Individual farmers or joint borrowers who are already Kisan Credit Card (KCC) holders and have maintained a satisfactory track record for one year can apply for this loan.

Area of Operation

This scheme will be available through all branches of the State Bank of India.

Nature of the Facility

The Kisan Credit Card offers a term loan that should be repaid within 3 to 5 years. This loan can be used for farm mechanization, land development, minor irrigation, allied activities, horticulture, and many other agriculture-related projects.

Quantum of Loan

Farmers can receive a loan of up to Rs 50,000 per acre of owned land, with a maximum limit of Rs 5 Lakhs. The specific amount of the term loan will be determined based on a risk assessment conducted on a case-by-case basis. It’s important to note that this loan amount is in addition to the existing KCC limit for borrowers.

Security Requirements

To secure the loan, borrowers must hypothecate the assets created with the bank loan. Additionally, land that is already mortgaged with the bank as part of the KCC limits can serve as extra security. Borrowers must also provide an undertaking that the security will remain intact until the term loan is fully repaid. A third-party guarantee is required as well.

Margin Requirement

A margin ranging from 15% to 25% of the project cost is necessary for securing this loan.

To access the KCC loan application form, click on the download link below to download the PDF version for easy reference and submission! 📄