PM Pik Vima Yojana Non Loanee Farmers Application Form - Summary

The PM Pik Vima Yojana Non Loanee Farmers Application Form is an important resource for farmers seeking crop insurance benefits under the Pradhan Mantri Fasal Bima Yojana (PMFBY). Launched in 2016, PMFBY replaces all existing yield insurance schemes in India and focuses on boosting the crop sector. This scheme offers coverage for localized risks and post-harvest losses, while promoting technology for yield estimation. The aim is to raise awareness among farmers and offer lower premium rates to enhance crop insurance uptake in India. 📄

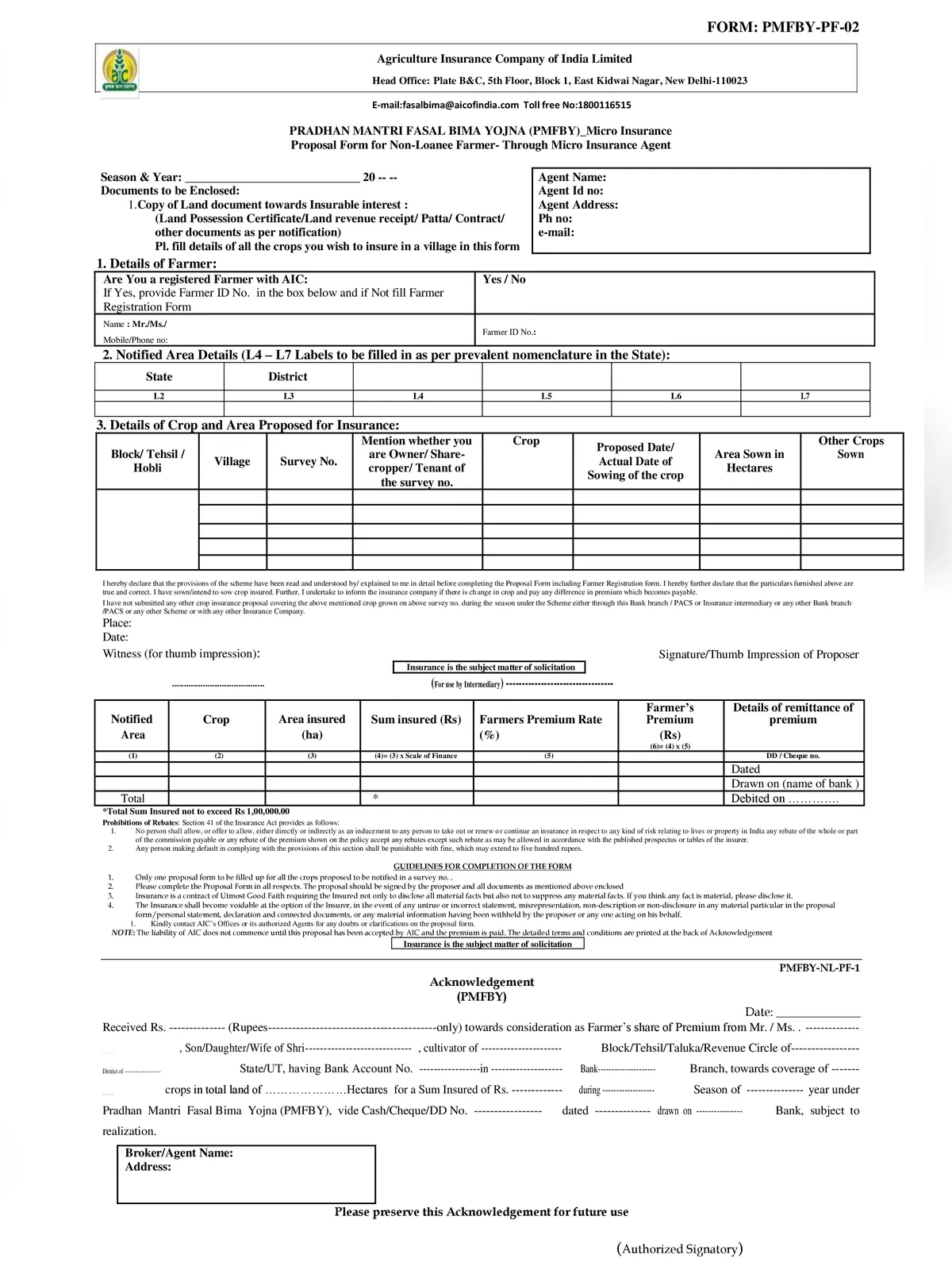

Guidelines for the PM Pik Vima Yojana Non-Loanee Farmers Application Form

PM Pik Vima Yojana Non-Loanee Farmers Application Form Guidelines

- Only one proposal form should be filled for all crops proposed in a survey number.

- Make sure to complete the Proposal Form fully. The proposer must sign and attach all required documents.

- Insurance relies on Utmost Good Faith, which means the insured must disclose all important facts and not hide any material details. If you think something is important, please mention it.

- The insurance may be voidable at the option of the insurer if any statements are untrue or misleading in the proposal form, personal statement, declaration, or any connected documents.

Eligibility Criteria

- Compulsory Component: All farmers availing Seasonal Agricultural Operations (SAO) loans from Financial Institutions (i.e. loanee farmers) must be covered compulsorily.

- Voluntary Component: The scheme is optional for non-loanee farmers.

Coverage of Risks and Exclusions:

The scheme covers the following stages of crops and associated risks leading to crop loss:

- Prevented Sowing/ Planting Risk: Coverage for areas where sowing/ planting is prevented due to lack of rainfall or unfavorable seasonal conditions.

- Standing Crop (Sowing to Harvesting): Comprehensive risk insurance covers yield losses due to non-preventable risks such as drought, floods, pest attacks, and natural disasters like storms and cyclones.

- Post-Harvest Losses: Coverage is available for a maximum of two weeks after harvest for crops that are left to dry in the field due to cyclonic rains and unseasonal rains.

- Localized Calamities: Loss or damage from specific localized risks like hailstorms, landslides, and flooding that impact isolated farms in the notified area.

Objective: The Pradhan Mantri Fasal Bima Yojana (PMFBY) aims to support sustainable agricultural production by:

- Providing financial assistance to farmers facing crop loss or damage due to unexpected events.

- Stabilizing farmer income to encourage continued farming efforts.

- Encouraging the adoption of innovative and modern agricultural practices.

- Ensuring the inflow of credit to agriculture, contributing to food security, crop diversification, and enhancing growth in the agriculture sector while protecting farmers from production risks.

Download the PM Pik Vima Yojana Non Loanee Farmers Application Form in PDF format using the link given below.