Revised 26AS Form - Summary

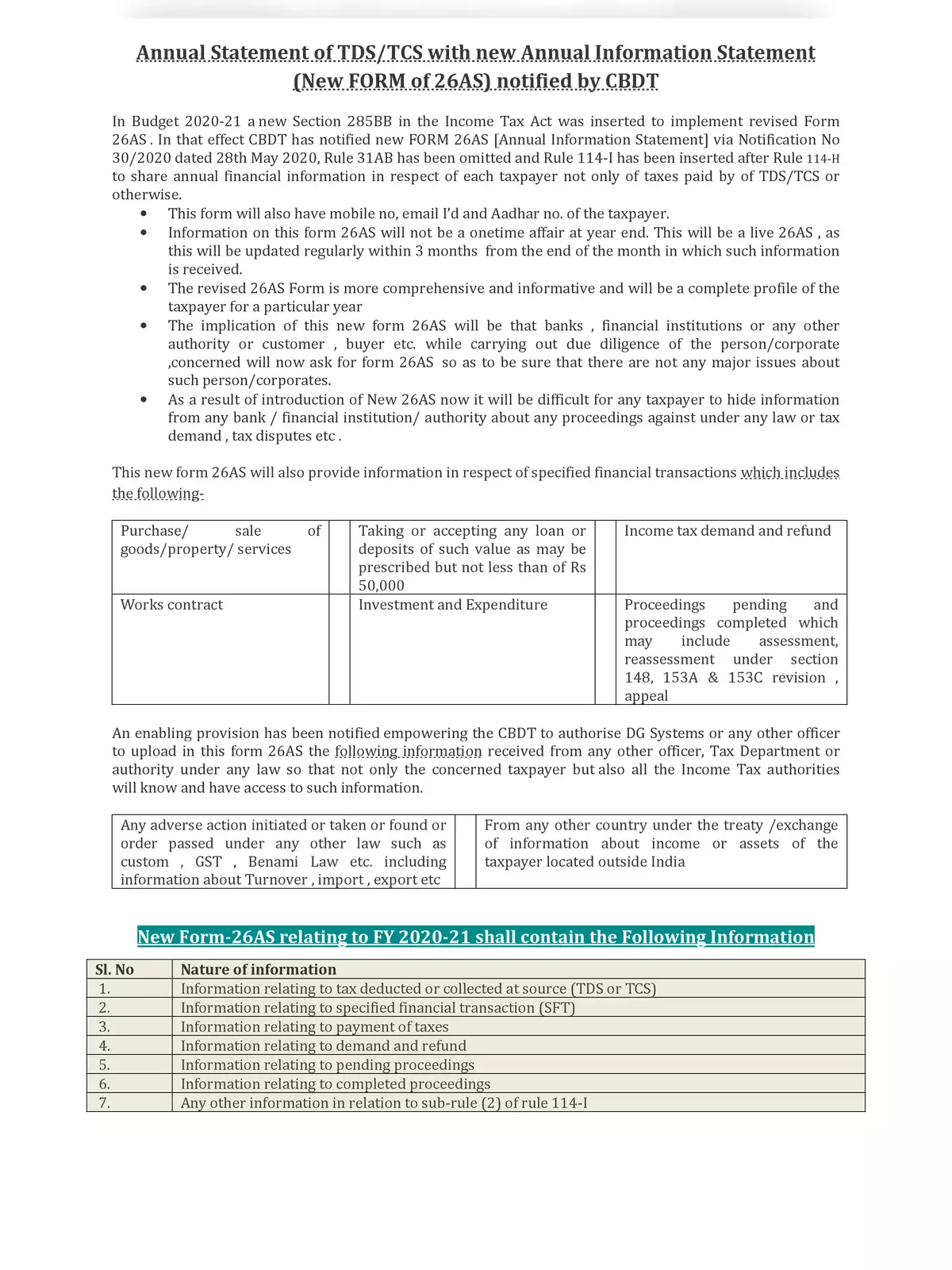

In the Budget 2020-21, a new Section 285BB in the Income Tax Act was introduced to implement the revised Form 26AS. This update means that the CBDT has released the new FORM 26AS [Annual Information Statement] through Notification No 30/2020, dated 28th May 2020. Additionally, Rule 31AB has been removed, and Rule 114-I has been added after Rule 114-H to share annual financial information about each taxpayer, extending beyond just taxes paid by TDS/TCS.

Understanding the Revised Form 26AS

The updated Form 26AS is not just a tax-related document; it also contains important information about taxpayers.

Form 26AS Download

- This form now includes the mobile number, email ID, and Aadhar number of the taxpayer.

- Information on this Form 26AS will be available throughout the year. It will be regularly updated within three months from the end of each month when the data is received, making it a live 26AS.

- The revised 26AS Form is more detailed and informative, providing a comprehensive view of the taxpayer’s profile for a specific year.

- With the new Form 26AS, banks, financial institutions, and other authorities will request it during their due diligence process, helping to avoid major issues related to the taxpayer or corporate entities.

- The introduction of this updated 26AS makes it harder for any taxpayer to hide information from banks, financial institutions, or authorities about any legal actions, tax demands, or disputes.

You can easily download the Revised 26AS in PDF format using the link provided below or through the alternative link. 📥