TDS Declaration Form - Summary

Hello, Friends! Today we are sharing the TDS Declaration Form PDF to assist all of you. If you are looking for the TDS Declaration Form 2022-23 or AY 2023-24 in PDF format, you have come to the right place. You can easily download it from the link provided at the bottom of this page. 📥

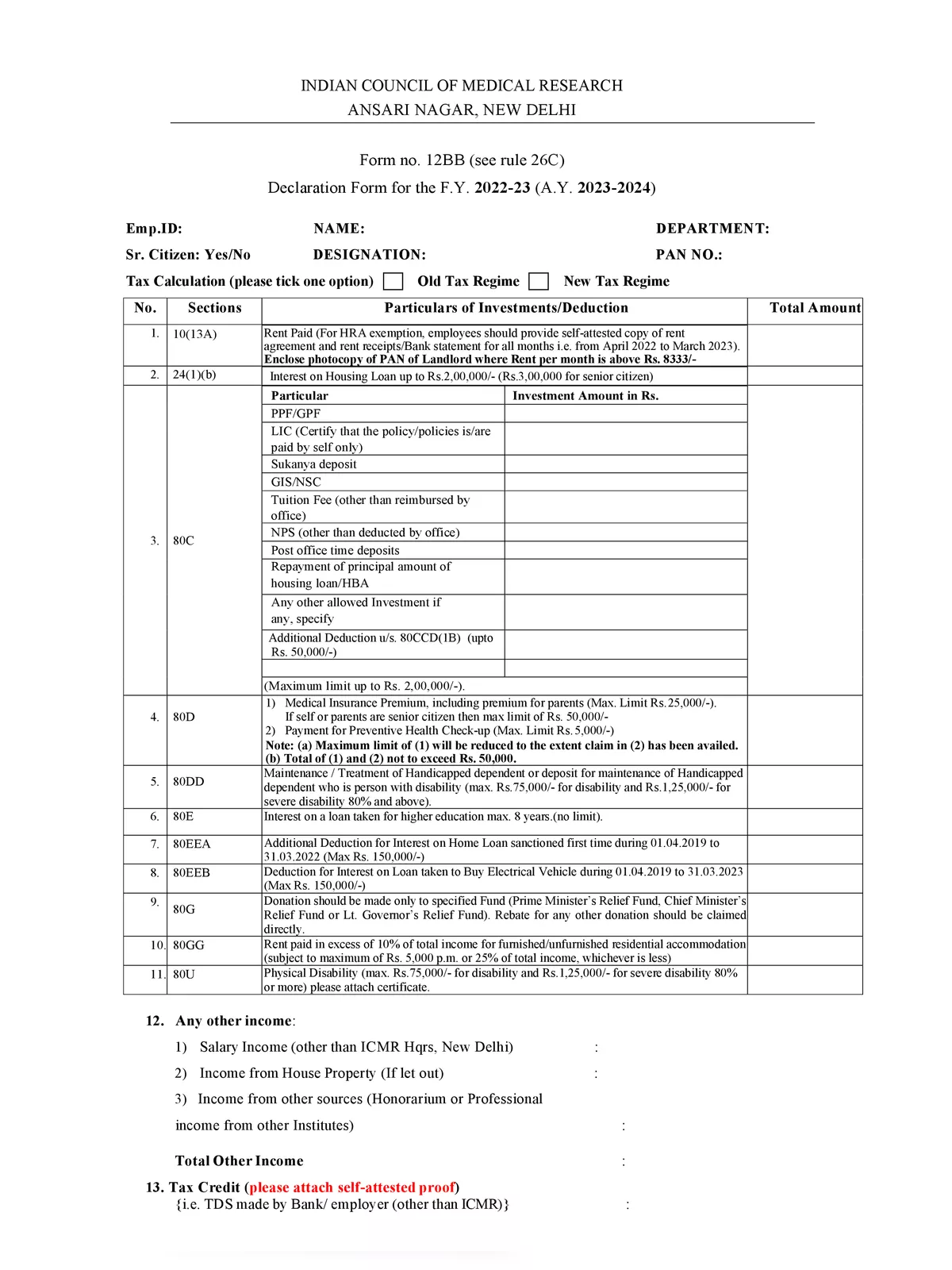

Understanding the TDS Declaration Form

Employees must submit a TDS Declaration Form to declare the deductions and exemptions they wish to claim. Based on these declarations, the employer will deduct TDS from the employee’s salary. Typically, these investment declarations need to be made on the employer’s HR portal. It’s really important to declare your tax-saving investments at the beginning of the financial year. By doing so, your employer can accurately deduct tax from your monthly salary, which can lead to a higher take-home salary for you.

Details Required in the TDS Declaration Form

In the TDS Declaration Form, you will need to mention the following details:

- Employee ID and personal details

- Destination

- Department

- PAN number

- Investment details

- Any other income

- Tax credit, if any

- And any other relevant details

You can download the TDS Declaration Form PDF using the link given below.