Student Credit Card Scheme Guidelines West Bengal - Summary

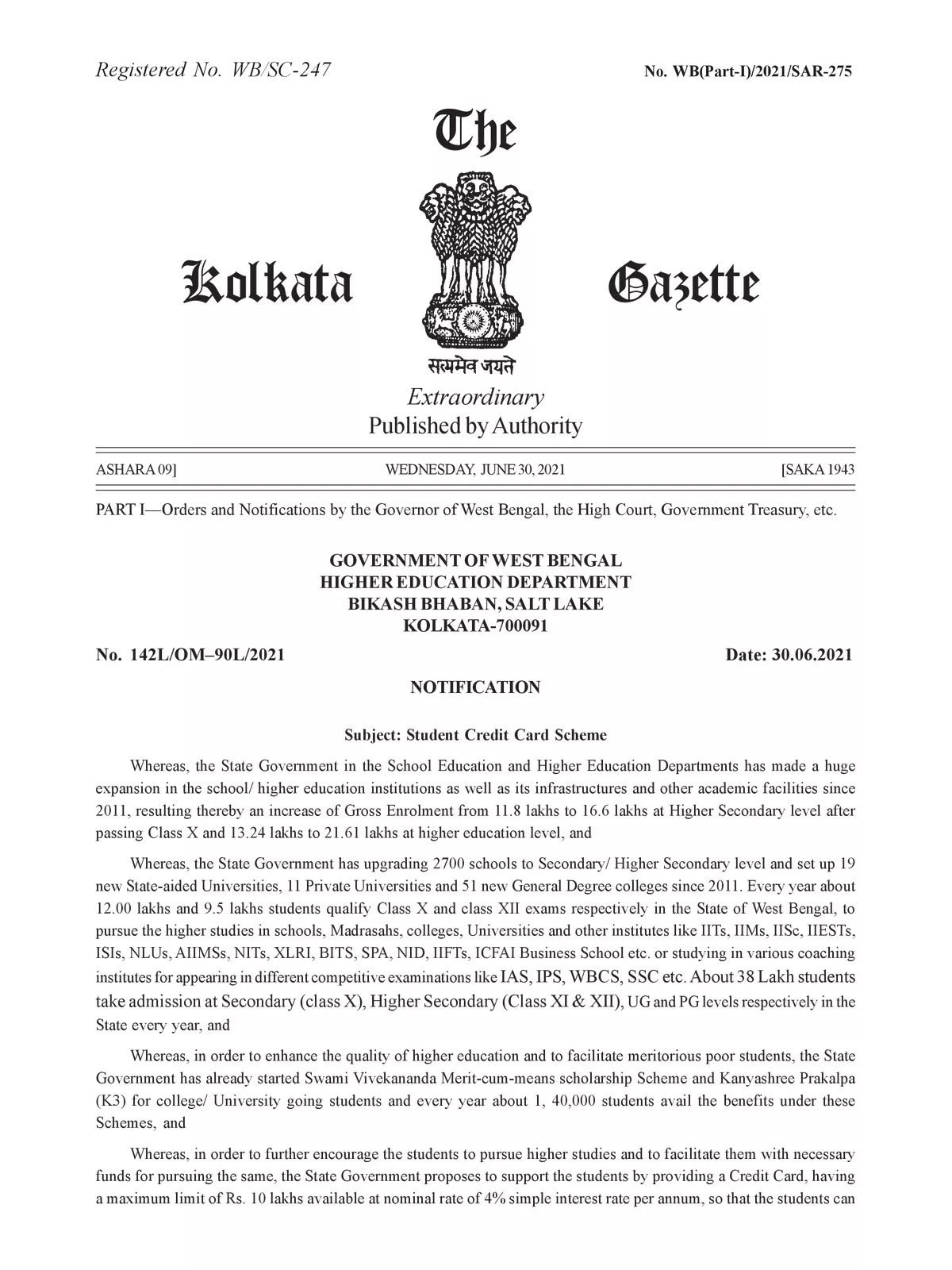

The West Bengal government launched Student Credit Card Scheme, under this scheme a student can get a soft loan of up to ₹10 lakh to pursue higher studies.

This scheme was one of the poll promises made by the current Chief Minister, Mamata Banerjee during the assembly elections. Even though the Department of Higher Education has not released an official order yet, sources have confirmed various online meetings being held with colleges in order to explain the new scheme.

Student Credit Card Scheme West Bengal – Eligibilities Criteria

- Students studying in class 10 and above will be eligible for this card.

- The upper age limit to apply for this scheme is 40 years

- Students who have been living in the state for 10 years or more will also be eligible for this card.

How to apply for West Bengal Student Credit Card Scheme

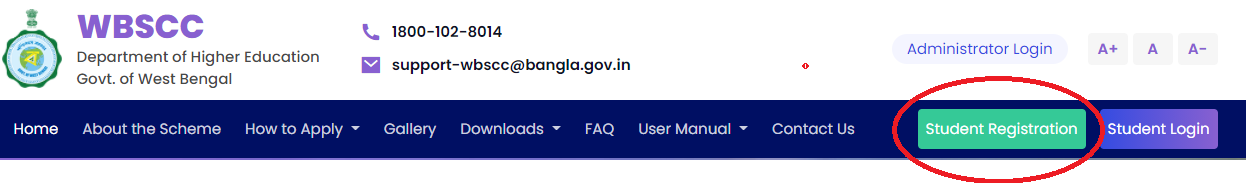

Step1: Visit the West Bengal government’s official website https://wb.gov.in/

Step 2: On the homepage, you will see a Student’s Registration link as the image is shown below.

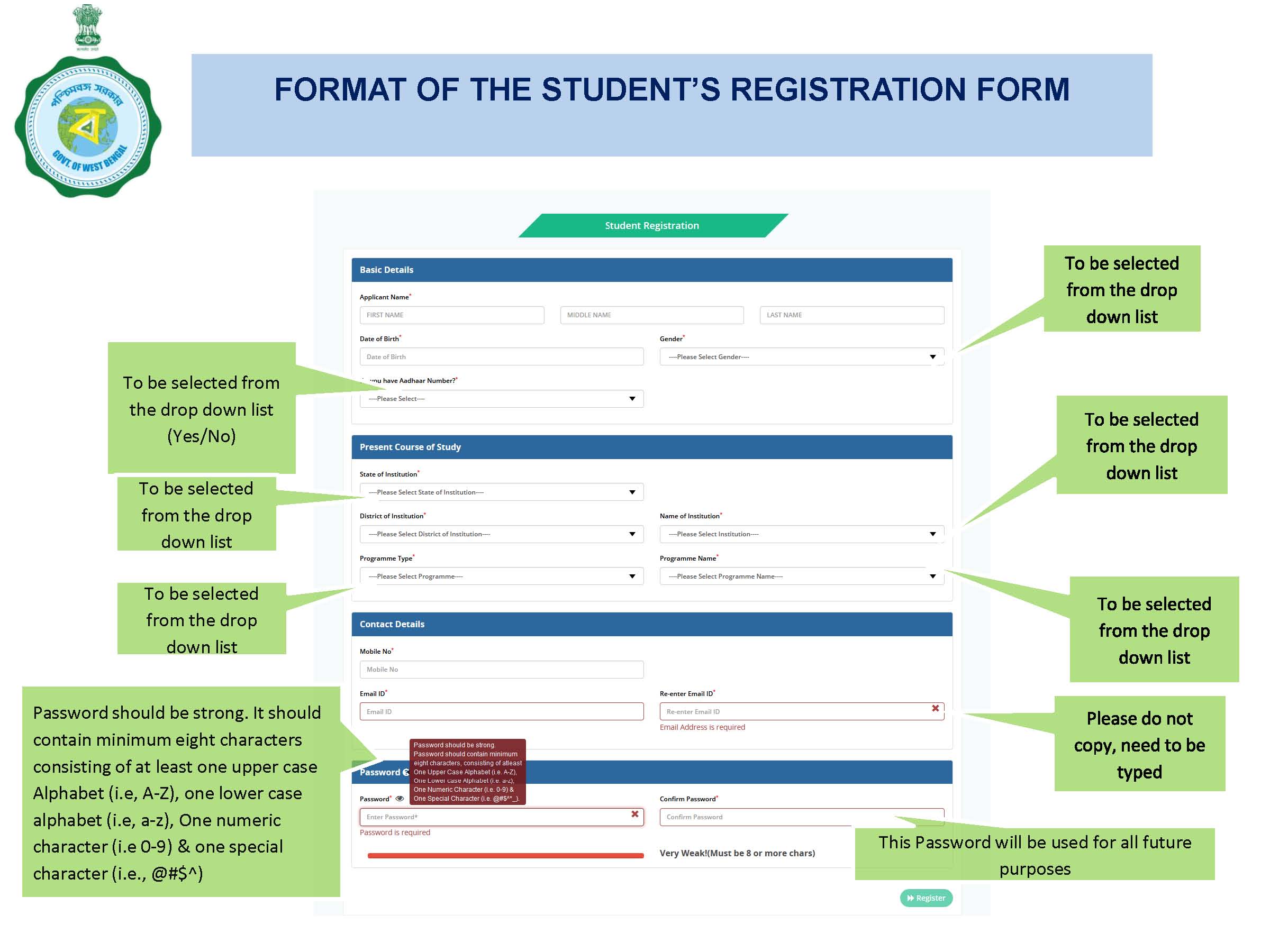

Step 3: Now you have to mention basic details, Present Course of study, contact details of the student, and also mention the password for this site then click on the “Registration” button to register for Student Credit Card Scheme West Bengal as image shown below.

Step 4: Submit and your registration details will be shown below

Step 5: Next, apply for Student Credit Card Scheme and complete the procedure and download a copy for future reference

Step 6: Students can also check the Students Registration User Manual

West Bengal Student Credit Card Scheme – Features

- A student from West Bengal can obtain a maximum loan of Rs. 10 lakhs @ 4% per annum simple interest from the State Cooperative Bank and its affiliated Central Cooperative Banks and District Central Cooperative Banks and Public/ Private Sector Banks. 1% interest concession will be provided to the borrower if the interest is fully serviced during the study period

- According to the credit card scheme, it will have a credit limit of ₹10 lakh with an interest rate of only 4 percent and easy repayment options, so that students do not have to depend on their parents to pursue higher studies.

- Anyone who has spent 10 years in West Bengal can avail of the benefits of it.

- The loan will be available for undergraduate, postgraduate, doctoral, and post-doctoral study in India or abroad

- The upper age limit for the interested students has been kept as 40(forty) years at the time of applying for a loan. The repayment period shall be fifteen (15) years for any loan availed under this Credit Card including the Moratorium/ repayment holiday.

- Fifteen years will be given to a student to repay the loan after getting a job, the chief minister had said.

- The applications of students will be sent to the banks via their institutions and the Department of Higher Education.

- The loan can be used for both institutional expenses and for non-institutional expenses such as hostel fees/rent, purchase of a laptop, or study tours/projects.

Purpose of Scheme

Under this scheme the Credit Card may be used to avail loan to meet up the following expenses: –

- Course fees payable to the School/ Madrasah/ College/ University / Professional Institutes like IITs,

IIMs, IIESTs, ISIs, NLUs, AIIMSs, NITs, XLRI, IISCs, BITS, SPA, NID, IIFTs, ICFAI Business

School etc. various competitive coaching institutes meant for different competitive examinations like

Engineering/Medical/Law, IAS, IPS, WBCS, SSC etc. - Fees required for accommodation in School/ Madrasah/ College/ University/ Institution hostel or rent/

license fees payable for living outside the hostel or fees required for living as a Paying Guest. - Fees payable for caution deposit/ building fund / refundable deposit/ examination/ library/ laboratory

fees to be supported by Institution’s bills/ receipts. - Cost of purchasing of books/ Computer/ Lap-top/ Tablet/ equipments etc.

- Any other expense required to complete the course such as study tours, project works, thesis, etc.

- The student can incur expenditure up to 30% of the total loan sanctioned for non-institutional expenses

for the whole course of study. - Up to 20% of the total loan sanctioned can be used as living expenses for the duration of the course.

West Bengal Student Credit Card Scheme – Documents Required

- Aadhar card

- Residence certificate

- Age proof

- Ration card

- Income certificate

- Bank account details

- Mobile number

- Passport size photograph

Quantum of Loan and Documentation

- The maximum amount of loan available under the Scheme is Rs. 10.00 lakhs at 4% simple rate of interest per

annum, after interest subvention. - For the entire amount of loan sanctioned up to Rs.10.00 Lakh, rate of interest to be charged at prevalent 3-

year MCLR of State Bank of India Plus 1%. The Rate of Interest so fixed on the date of sanction will

remain fixed and calculated at a simple rate for the entire duration of the loan. - A student can avail loan under this scheme at any time during the course of study.

- The bank concerned shall upload the details of the loan to the Department’s portal immediately after disbursement of the loan and such detail shall be updated by the Bank from time to time.

- The loan application should be submitted by the student and the parent/ legal guardian as co-borrower.

- Students and Parents/ Legal Guardians will enter into an agreement with the bank.

Margin Money Under Student Credit Card Scheme

(a) Up to Rs. 4.00 Lakhs: NIL

(b) Above Rs. 4.00 Lakhs: 5%

(c) Scholarship/ Assistance ship to be included in Margin.

(d) Margin will be brought in on a year-to-year basis as and when disbursements are made on a pro rata basis in

applicable cases.

Security:–

(a) While sanctioning the loan, the Bank should not put any unnecessary restrictions or conditions regarding

collateral security etc.

(b) The Banks will not insist on any security /collateral security in tangible/ intangible form other than no obligation of the parents/ Legal guardians. The State Government will enter into an agreement with the banks

separately in this regard.

Students Credit Card Scheme FAQ’s PDF