RTI ACT 2005 Form - Summary

RTI ACT 2005 Form

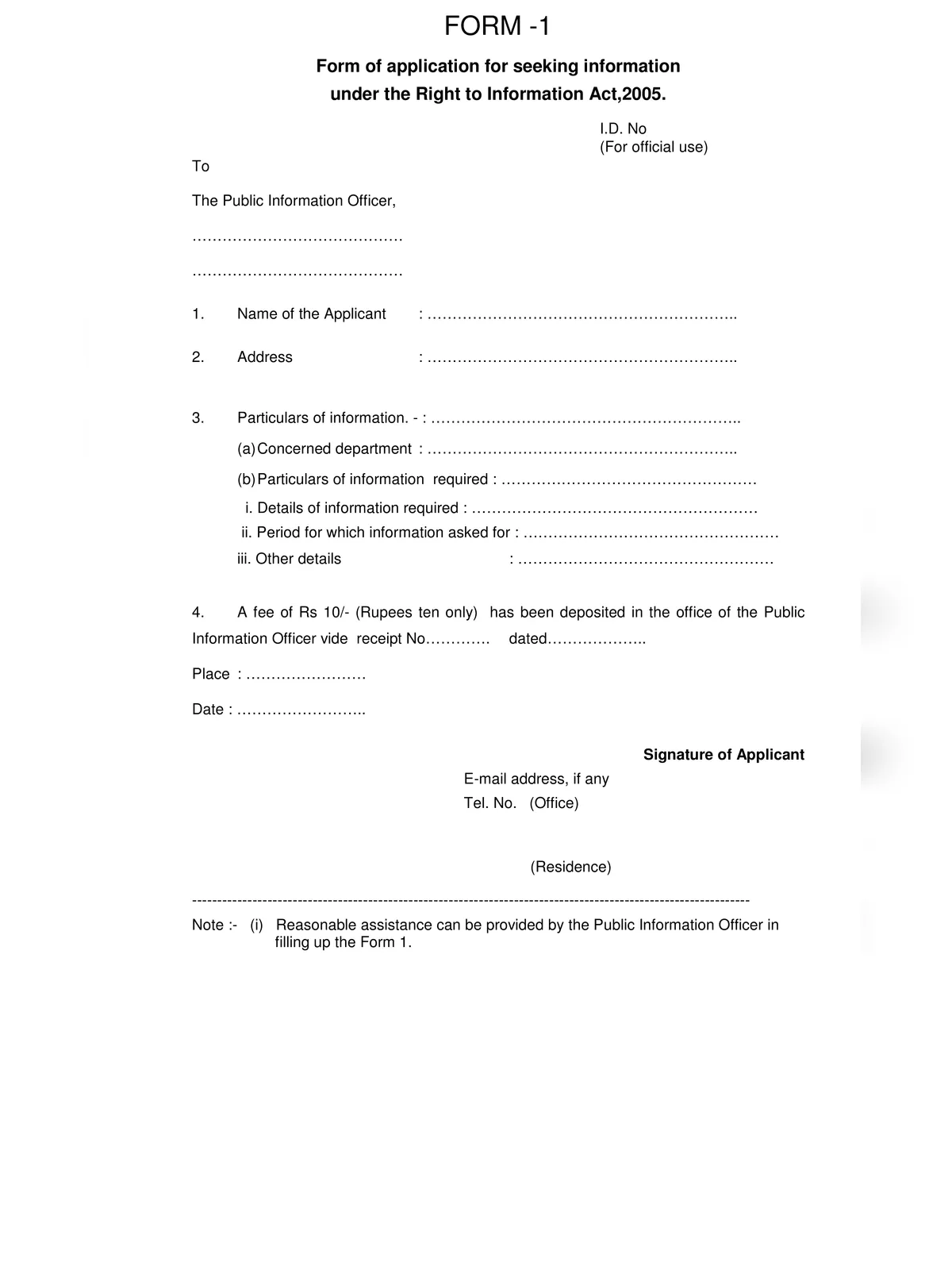

If you’re looking to learn more about the RTI Act 2005, you’ve come to the right place! The Right to Information Act (RTI) is a powerful tool that helps you seek and obtain important information from the Public Information Officer (PIO) of a public authority. Remember, RTI is not meant for addressing grievances; it is specifically for requesting material information held by the public authority. So, it’s important for you to be clear about the specific information you want when you file an RTI application.

How to Submit an RTI Application

The application must be submitted following the RTI Rules that apply to the particular public authority. Each state, along with the Lok Sabha, Rajya Sabha, Supreme Court, High Courts, and Legislative Assemblies, has its own set of RTI Rules.

Format and Word Limit

Many of these RTI Rules require a specific Application Format and impose word or subject limits. For example, in Karnataka and Maharashtra, the RTI application should not exceed 150 words and should focus on only one subject matter. If your application goes beyond this word limit, you will need to file two separate applications.

Application Fee

The Application Fee for a Central Government Public Authority is just Rs.10/-. Make sure to check the RTI Rules that apply to your specific public authority for details on Application Fee, Document Charges, and Inspection Charges.

Document charges: According to the Central RTI Rules, document charges are Rs.2/- for each A4 size page, Rs.50/- for each CD, and the actual cost for printed publications. For an extract copy, it’s Rs.2/- per A4 size page.

Inspection Charges: There’s no inspection charge for the first hour. After that, it’s Rs.5/- for each subsequent hour or part of an hour.

Mode of Payment of Fee: You can pay the Application Fee and any additional fees via Indian Postal Order, Demand Draft, or Bankers’ Cheque made out to the “Accounts Officer” of the Public Authority. You may also pay in cash directly to the public authority with a proper receipt. In many states, you can use adhesive Court Fee Stamps on the application as payment. There are also provisions in State RTI Rules for remitting fees to the treasury using a challan.

To make it easier for you, we have made the RTI ACT 2005 Form available as a PDF. You can download it using the link provided below. This will help ensure that you have the right format to fill out your application correctly.

Download the RTI ACT 2005 Form PDF