PMVVY Form – LIC Plan 856 - Summary

Pradhan Mantri Vaya Vandana Yojana (PMVVY) Pension plan provides an immediate pension for senior citizens of 60 years and above. LIC Plan 856 can be purchased by paying a lumpsum amount. People can now buy LIC PM Vaya Vandana Yojana plan online at licindia.in.

There are no specific eligibility criteria as such for PMVVY scheme except that the subscriber must be a senior citizen (above the age of 60 years). The applicant must be an Indian citizen. There is no maximum entry age for PMVVY scheme. Also, the applicant must be ready to avail the policy term of ten years. The minimum purchase price is Rs 1.5 lakh, and it offers a monthly pension of Rs 1,000. The maximum purchase price is Rs 15 lakh, and it offers a monthly pension of Rs 10,000.

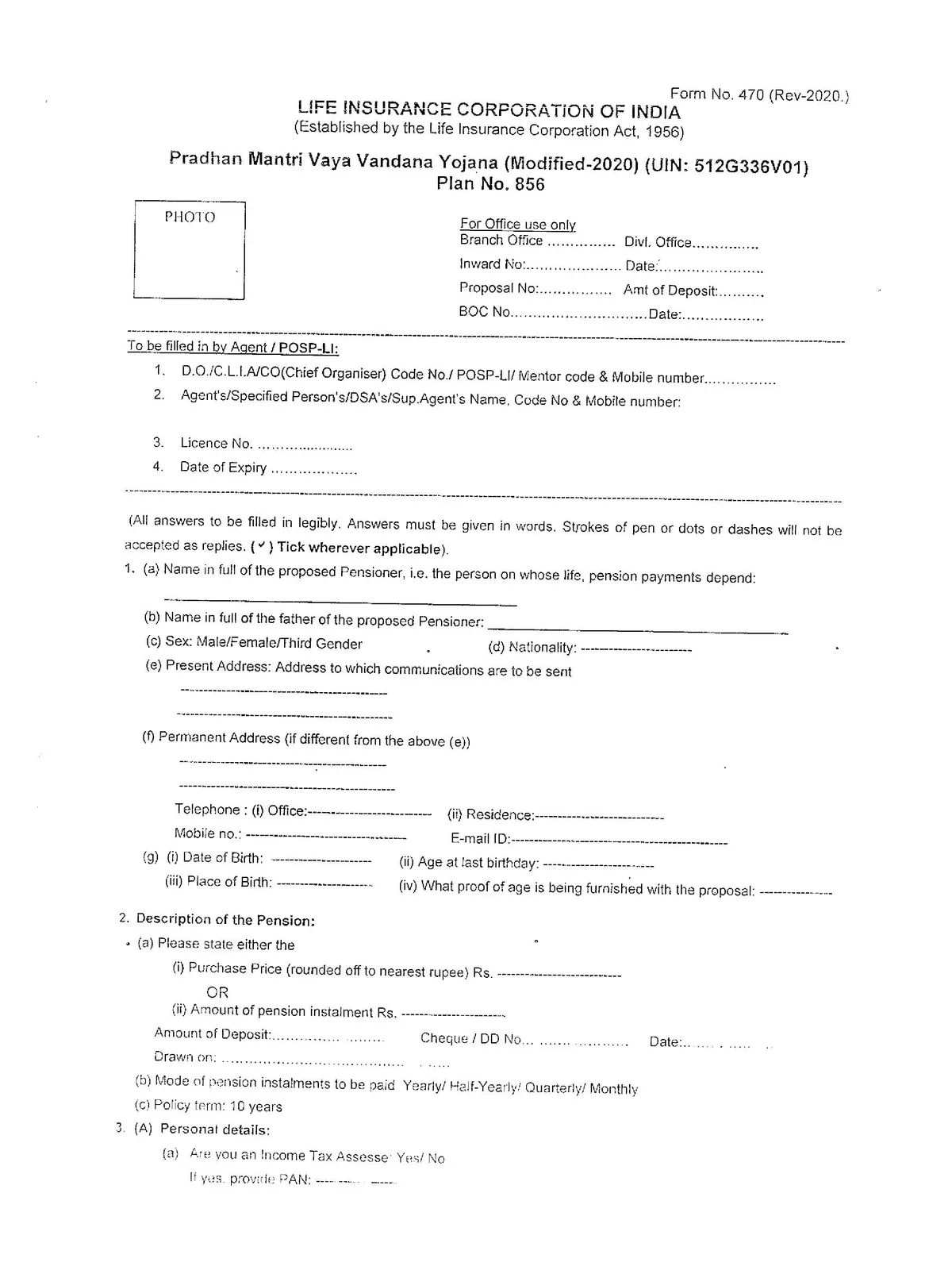

Pradhan Mantri Vaya Vandana Yojana Form (Documents Required)

- Aadhaar card

- Proof of age

- Proof of address

- Passport size photo of the applicant

- Documents indicating that the applicant has retired from employment

Application Procedure

One can subscribe to the PMVVY scheme in the following ways:

i) Online procedure:

- Log onto the official website of LIC

- Select ‘pension plans’ under products and proceed

- Fill the relevant application form

- Submit the online application and upload the documents as requested

ii) Offline Procedure

- Collect the application form at any of the LIC branches

- Duly fill the application form

- Submit the duly filled application form by attaching all relevant documents

Pension Policy

As mentioned earlier, the minimum purchase price is Rs 1,50,000 for a monthly pension of Rs 1,000. The amount of pension that a subscriber receives would depend on their purchase price:

| Pension mode | Minimum amount of pension | Minimum amount of investment | Maximum amount of pension | Maximum amount of investment |

| Monthly | Rs 1,000 | Rs 1,50,000 | Rs 10,000 | Rs 15,00,000 |

| Quarterly | Rs 3,000 | Rs 1,49,068 | Rs 30,000 | Rs 14,90,684 |

| Bi-annually | Rs 6,000 | Rs 1,47,601 | Rs 60,000 | Rs 14,76,014 |

| Annually | Rs 12,00 | Rs 1,44,578 | Rs 1,20,000 | Rs 14,45,784 |

PMVVY is a great investment option for senior citizens. This scheme can be considered by those senior citizens that are looking for a regular pension. However, to invest in this scheme, one should have a considerable amount in hand.

LIC Plan 856 (PMVVY) application form PDF download available on the official website.