Mudra Loan Kishore Application Form - Summary

Mudra loan is a credit facility regulated by the Government of India, to facilitate the funding requirements of small scale business units. The loan can be taken from banks or NBFCs, to fund business requirements such as the purchase of commercial vehicles, to fund day to day expenses, or to purchase plants and machinery. However, availing Mudra loan requires one to follow a certain procedure that begins with filling the Pradhan Mantri Mudra Yojana application form. One can get the mudra loan application form from the authorized public, private, regional rural banks, cooperative banks, microfinance institutions or NBFCs. The Mudra loan form is common for Kishor and Tarun mudra loan type; but different for Sishu scheme.

The Pradhan Mantri MUDRA Yojana (PMMY) launched on 8th April 2015, provides loans to small business owners up to the amount of Rs.10 Lakh.

The following are the individuals who need to know how to apply for MUDRA loan under this scheme:

- Small manufacturing business owners

- Fruit and vegetable sellers

- Artisans

- Shopkeepers

- Those associated with various agriculture activities like livestock, dairy, pisciculture, poultry, fishery, etc.

MUDRA Loan Application Form

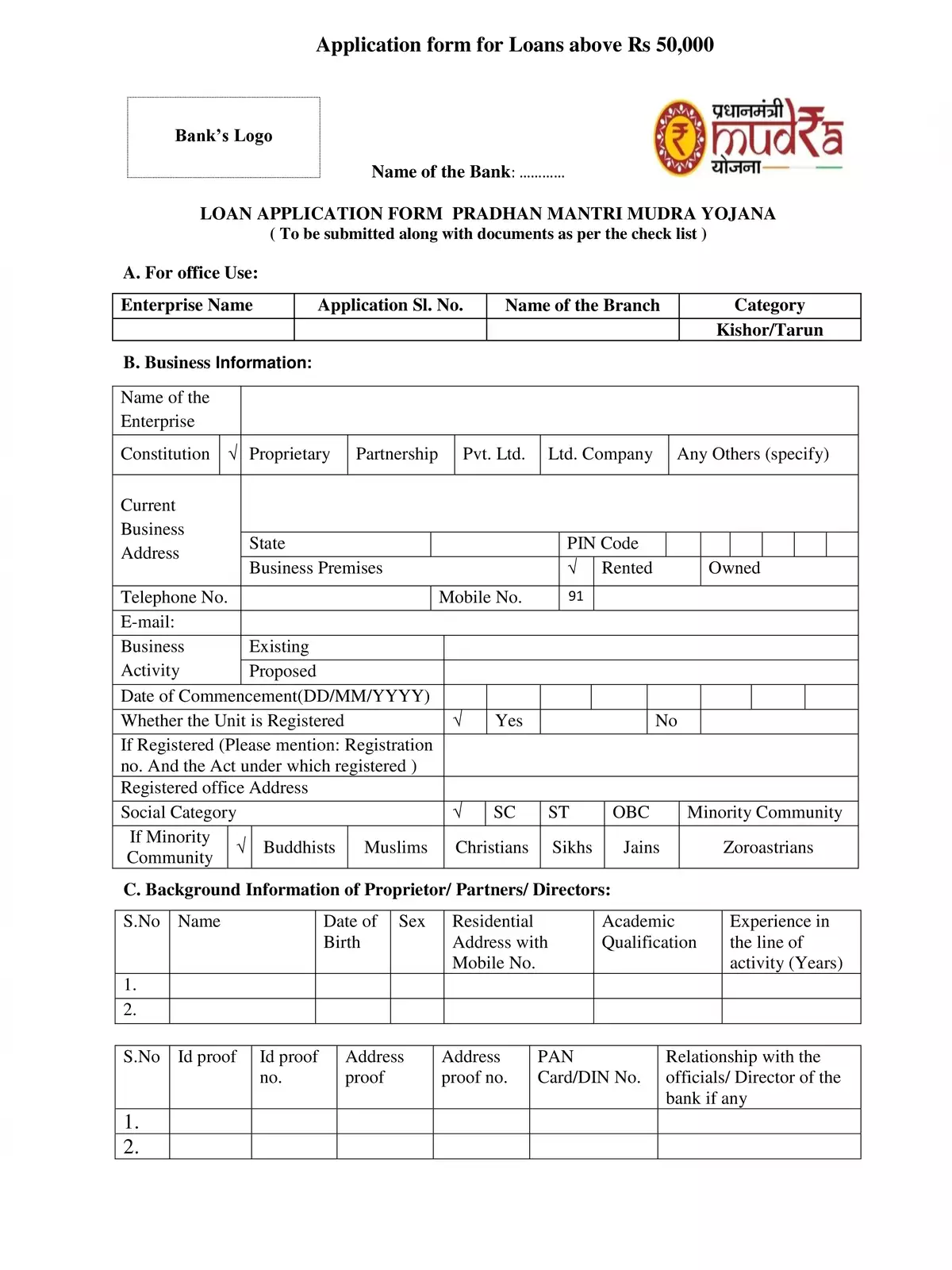

The mudra loan application form for Kishor and Tarun mudra scheme is common across all banks and NBFCs that offer the loan. The mudra application form is detailed and requires one to mention various information, as listed below:

- Bank details: This section requires the loan applicant to mention the details of the bank such as the bank name and branch details wherein, one wishes to avail the Mudra loan.

- Details of the Loan applicant/applicants: The form requires one to fill certain personal information of the loan applicant or applicant in case of joint or multiple applicants. This includes mentioning the name of the applicant/applicants, Father’s or Husband’s name of the applicant/ applicants. The form also requires one to mention whether the constitution of the applicant is either individual, joint applicants, sole proprietors, partnership firm or any other. Apart from that, the applicant is also required to mention his/her date of birth, sex, and age.

- Address details: The applicant needs to mention their residential address and details about it, whether it is rented or self-owned. In addition to the residential address, similar information is required for a business address as well.

- Educational details: The applicants are also required to mention the educational details. In case an applicant is illiterate, he or she can specify the same. Educational degrees such as 10th grade, graduation or professional degrees can also be submitted.

- Contact details: Mentioning the contact details such as telephone number, mobile number, and email address are important so that the applicant can be updated about the loan process and application updates.

- Business details: Mudra loan application form inquiries information about the business enterprise involved in the loan process. This includes mentioning the line of business activity, business vintage, existing annual sales, proposed annual sales, experience in the running business.

- Social category details: Mentioning the applicant’s social category is an important feature in the PMMY application form. This requires mentioning the category whether General, SC, ST, OBC or minority. The minority category is further subdivided into options like Buddhist, Muslim, Sikh, Jain, Zoroastrians, Christian, or others.

- Loan details: Another important information that needs to be mentioned carefully in the form is the loan details. Applicants are required to specify the required loan amount, and other requirements of overdraft or term loan if applicable. In case a person holds an existing loan account, then he or she is required to mention the loan type, existing loan amount number, borrowed loan amount along with the bank and branch details from where the loan has been availed.

- Declarations: The form contains a declaration about the loan process which needs to be signed with the applicant’s form. The signature needs to be put with the date and place on which the form is signed.

- Acknowledgement slip: On successful filling of the information on the form, the concerned bank may hand over the acknowledgement slip that must be signed and sealed by the bank’s authorized representative.

Documents Required

Apart from filling the application form correctly as per the required information, one is also required to submit certain documents, as listed follows:

- Passport size photographs

- Identity proofs such as Driving license, passport, PAN card or Voter ID card.

- Address proofs such as voter Id card, passport, aadhar card or utility bills such as electricity, water, gas or telephone bill.

- Category or reservation proofs such as ST/ SC/OBC certificates

- Identity and address proofs of the business unit

- Bank account statements for the last six months

- Balance sheet of the last two years and income tax return in case of loan amount above Rs 2 lakhs.

- Partnership deed in case the business unit is a partnership firm

- Memorandum and articles of association for a company

- Certificates of educational qualifications

- Title deed or lease agreement of the business unit

- Small scale industry or MSME registration certificate

- Rent agreement for a rented business premise

You can download the Mudra Loan Kishore Application Form in PDF format using the link given below or an alternative link for more details.

Mudra Loan Kishore Application Form PDF Download