Motilal Oswal Value Migration - Summary

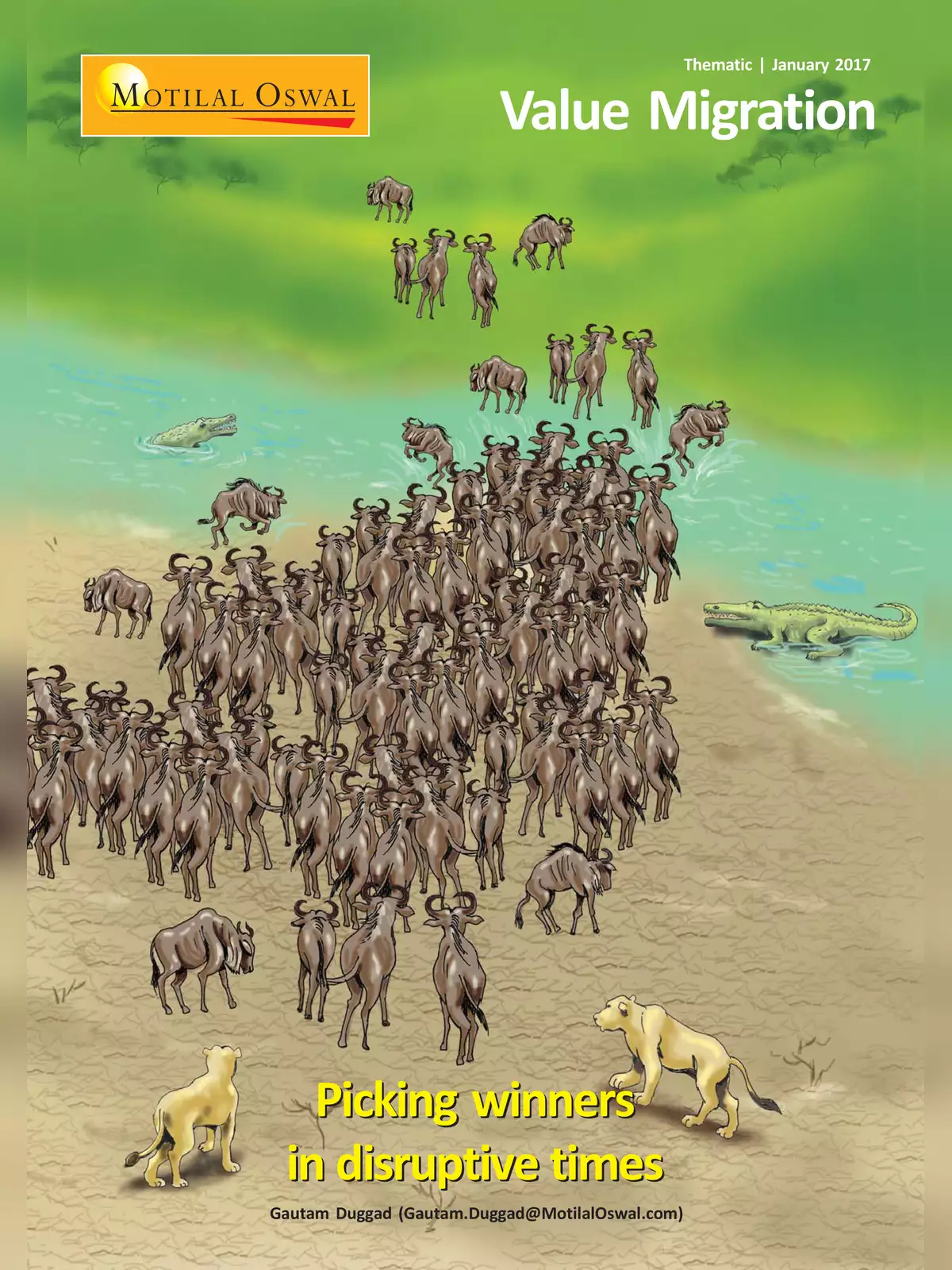

The concept of value migration, popularized by Adrian Slywotzky, focuses on the shift of economic and shareholder value from outdated business models to innovative and effective designs. These new models are better equipped to meet the most significant needs of customers.

The Importance of Understanding Value Migration

In our Theme Report on Value Migration released in January 2017, we emphasized the necessity of adapting to and embracing successful business models, especially during times of extreme disruption. Over the last three years, India has experienced considerable disruption, marked by major reforms such as GST, RERA, IBC (Insolvency and Bankruptcy Code), and Demonetization. These transformational changes are reshaping how businesses operate and create value for all stakeholders.

Why Stay Ahead in Value Migration?

Staying ahead in value migration is crucial for businesses aiming to thrive. By identifying and adopting winning strategies early on, companies can ensure they do not fall behind in this rapidly changing landscape.

You can easily download the Motilal Oswal Value Migration in PDF format using the link given below.