Liquor Retail Shop License Form Telangana

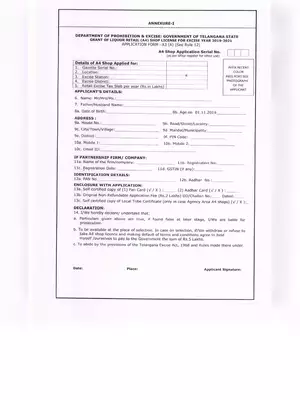

This is an application form for the grant of Liquor Retails (A4) Shop License form for Excise 2023-24 issued by the Department of Prohibition & Excise Telangana. The entire process of applications, allotment, and running of shops will be governed by Telangana Excise (Grant of selling by Shop and Conditions of license) Rules, 2012, and Retail Liquor (A4) Shop license period 2023-24.

Details to be Mentioned in Liquor Retail Shop License Form

- Applicants Details

- Address

- Partnership Firm/Company

- Identification Details

- Any other information

The total of Retail Liquor (A4) Shops for the license period 2023-24 will remain (2216) as in the previous Retail Liquor (A4) Shop license period of 2017-19.

Document Required

The interested applicant(s) may participate in the selection process by submitting an application along with the following documents to the licensing authority.

- Application in prescribed Format in Form – A3 (A)

- Challan/Demand Draft of Nationalized Bank for Rs.2 lakh (rupees two lakhs) towards NonRefundable Fee per shop.

- Three (3) colour passport size photographs to be affixed.

- Aadhar card self-certified copy.

- PAN Card – self-certified copy.

- Local Scheduled Tribe area certificate self-certified copy (only in case of Agency area A4 Shops)

Eligibility

- Who is below the age of 21 years.

- Who has been convicted under the Excise Act, 1968 and

- Who is a defaulter of excise revenue; or Who is adjudged as an insolvent by a competent Court.

Intending applicant(s) can submit an application in person to the authorized officer on or before the last date and time as notified in the respective District Prohibition & Excise Officers. In addition to the applicant(s) can submit in all division DC offices and Commissioner of Prohibition & Excise office, Hyderabad.

Also, Check

Guidelines for Liquor Retail Shop License

Download the Liquor Retail Shop License Form Telangana in PDF format using the link given below or alternative link.