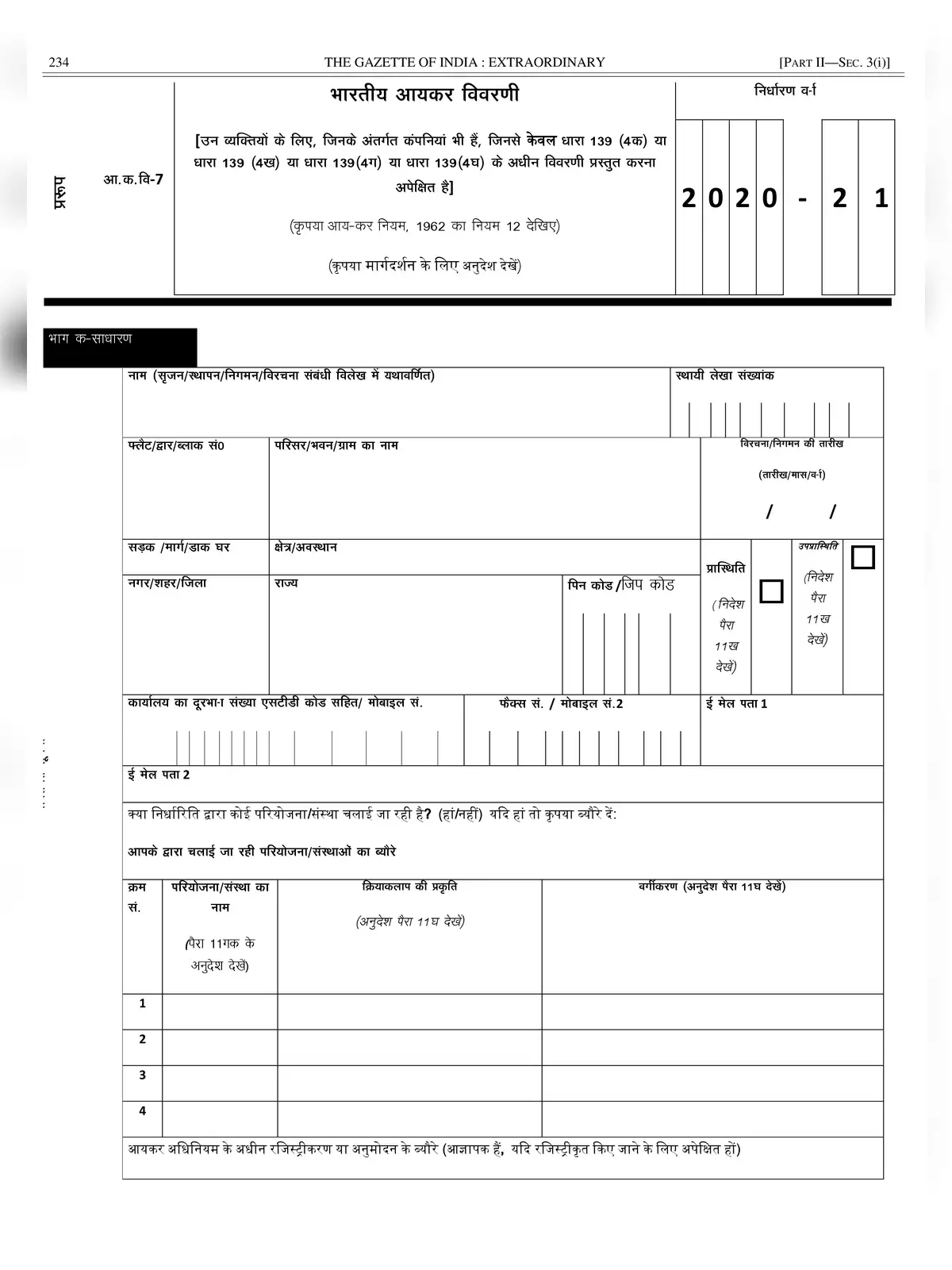

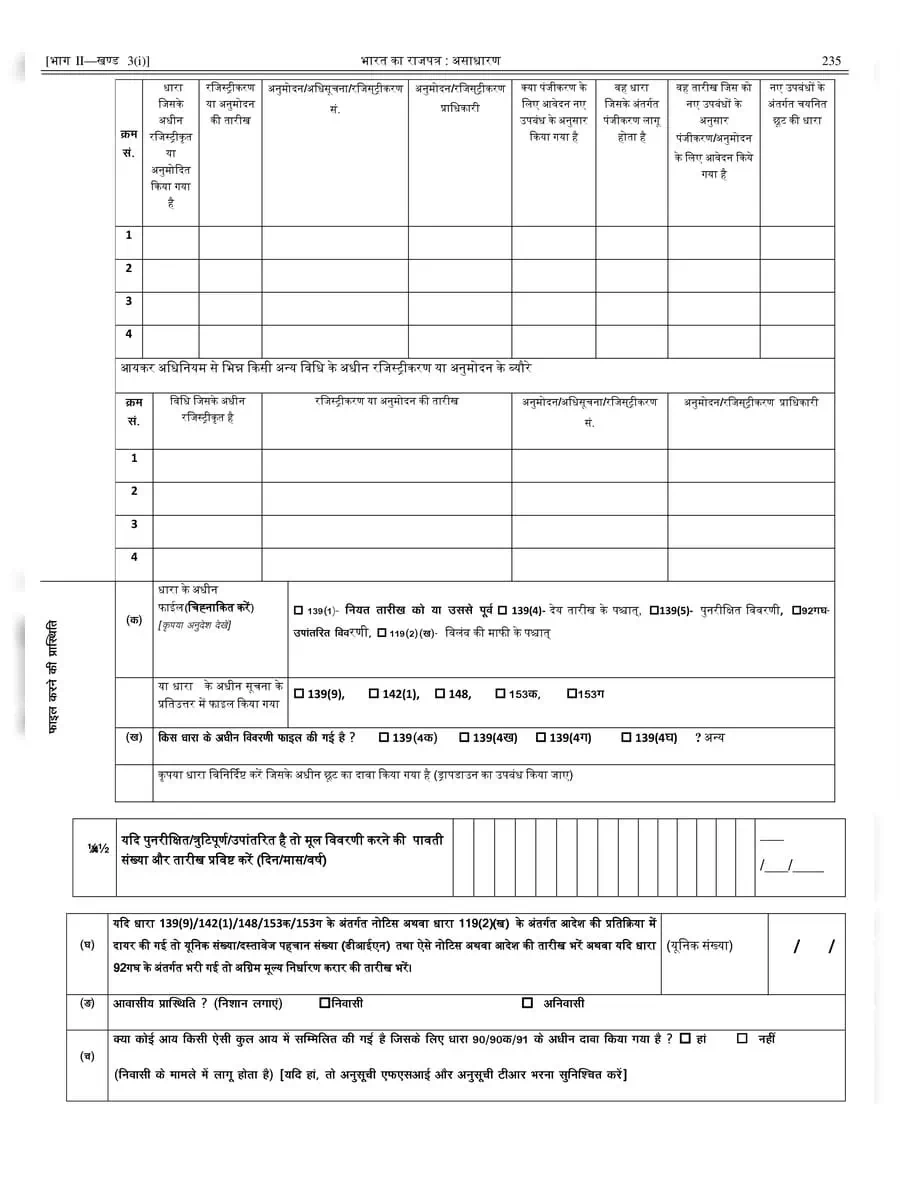

ITR 7 Form 2020-21 in Hindi

ITR-7 is filed when persons including companies fall under section 139(4A) or section 139 (4B) or section 139 (4C) or section 139 4(D). No document (including TDS certificate) should be attached to this return form while filing ITR-7. Taxpayers are advised to match the taxes deducted/collected/paid by or on behalf of them with their Tax Credit Statement Form 26AS.

If the assessee is liable for Audit u/s 44AB and the accounts have been audited by an accountant, the details of such audit report along with the date of furnishing it to the department has to be filled under the head “Audit Information.”

Eligible Person to file the ITR-7 Form

- Return under section 139(4A) is required to be filed by every person in receipt of income derived from property held under trust or other legal obligation wholly for charitable or religious purposes or in part only for such purposes.

- Return under section 139(4B) is required to be filed by a political party if the total income without giving effect to the provisions of section 139A exceeds the maximum amount which is not chargeable to income-tax.

- Return under section 139(4C) is required to be filed by every

- scientific research association ;

- news agency ;

- association or institution referred to in section 10(23A);

- institution referred to in section 10(23B);

- fund or institution or university or other educational institution or any hospital or other medical institution.

- Return under section 139(4D) is required to be filed by every university, college, or other institution, which is not required to furnish return of income or loss under any other provision of this section.

- Return under section 139(4E) must be filed by every business trust which is not required to furnish return of income or loss under any other provisions of this section.

- Return under section 139(4F) must be filed by any investment fund referred to in section 115UB. It is not required to furnish the return of income or loss under any other provisions of this section.

Procedure to file ITR 7 Form

This return form has to be mandatorily filed online with the Income Tax Department in the following ways:

- By furnishing the return electronically under digital signature

- By transmitting the data in the return electronically and thereafter submitting the verification of the return in Return Form ITR-V

After the filing of the return, the assessee should print out two copies of the ITR-V Form. One copy of ITR-V, duly signed by the assessee, has to be sent by ordinary post to Post Bag No. 1, Electronic City Office, Bengaluru–560100 (Karnataka). The other copy may be retained by the assessee for his record.

Download the ITR 7 Form 2020-21 in PDF format form the link given below or alternative link.

Also, Check

- Advance Tax Income Tax Challan Form 280

- TDS/TCS Tax Challan Form 281

- ITR-4 Form 2020-21

- ITR-1 Sahaj Form 2020-21

- ITR 6 Form 2020-21 Hindi

- ITR 5 Form 2020-21 Hindi

- ITR 4 Form 2020-21 Hindi

- ITR 3 Form 2020-21 Hindi