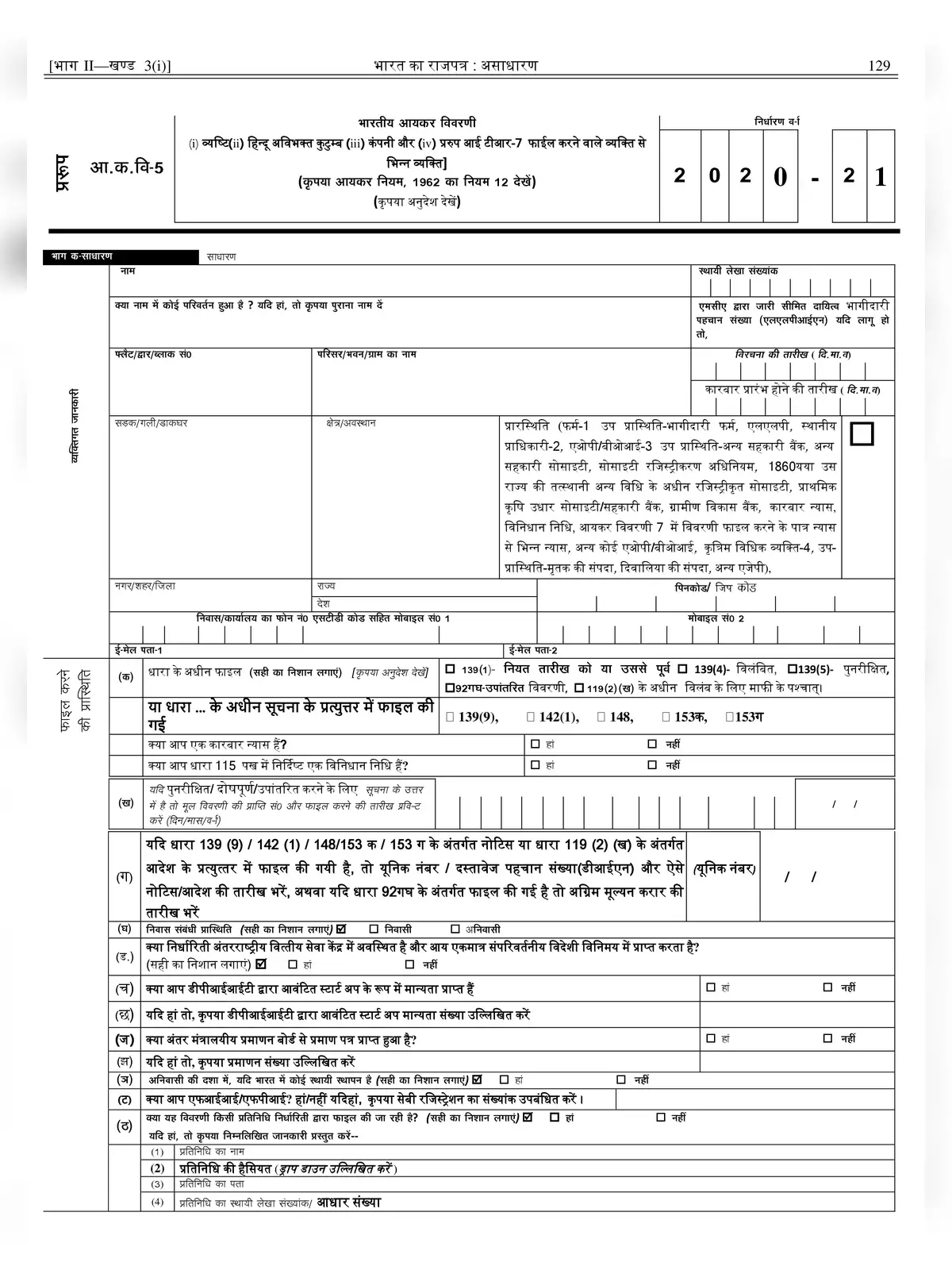

ITR 5 Form 2020-21 in Hindi

ITR 5 is for firms, LLPs (Limited Liability Partnership), AOPs (Association of Persons), BOI’s (Body of Individuals), Artificial Juridical Person (AJP), Estate of deceased, Estate of insolvent, Business trust, and investment fund.

This return form has to be filed online with the Income Tax Department in the following ways:

- By furnishing the return electronically under digital signature

- By transmitting the data in the return electronically and thereafter submitting the verification of the return in Return Form ITR-V

- When the return is filed online, the assessee should print out two copies of the ITR-V Form. One copy of ITR-V, duly signed by the assessee, has to be sent by ordinary post to Post Bag No. 1, Electronic City Office, Bengaluru–560500 (Karnataka). The other copy may be retained by the assessee for his record.

Key changes in the ITR-5 Form 2020-21

- In the details of investments in unlisted equity shares, the name, type of company, PAN, movement in the quantity and investment throughout the financial year should be provided.

- A separate schedule 112A for the calculation of the long-term capital gains on the sale of equity shares or units of a business trust which are liable to STT.

- The details of tax on secondary adjustments to transfer price under section 92CE(2A).

- The details of tax deduction claims for investments or payments or expenditure made between 1 April 2020 until 30 June 2020.

- A firm whose accounts are liable to audit under section 44AB must compulsorily furnish the return electronically under digital signature.

No document (including TDS certificate) should be attached to this return form while filing ITR-5. All such documents enclosed with this Return Form will be detached and returned to the person filing the return. Taxpayers are advised to match the taxes deducted/collected/paid by or on behalf of them with their Tax Credit Statement Form 26AS.

You can download the ITR-5 Form 2020-21 in PDF format online from the link given below or alternative link.

Also Check

- Advance Tax Income Tax Challan Form 280

- TDS/TCS Tax Challan Form 281

- ITR-4 Form 2020-21

- ITR-1 Sahaj Form 2020-21

- ITR 7 Form 2020-21 Hindi

- ITR 6 Form 2020-21 Hindi

- ITR 4 Form 2020-21 Hindi

- ITR 3 Form 2020-21 Hindi