Income Tax Section 80 DDB Form - Summary

Discover the important details about Section 80DDB, which allows Individuals and HUFs to claim deductions for medical expenses related to specified diseases or ailments. This deduction can help reduce your Gross Total Income, making it easier for you to calculate your taxable income.

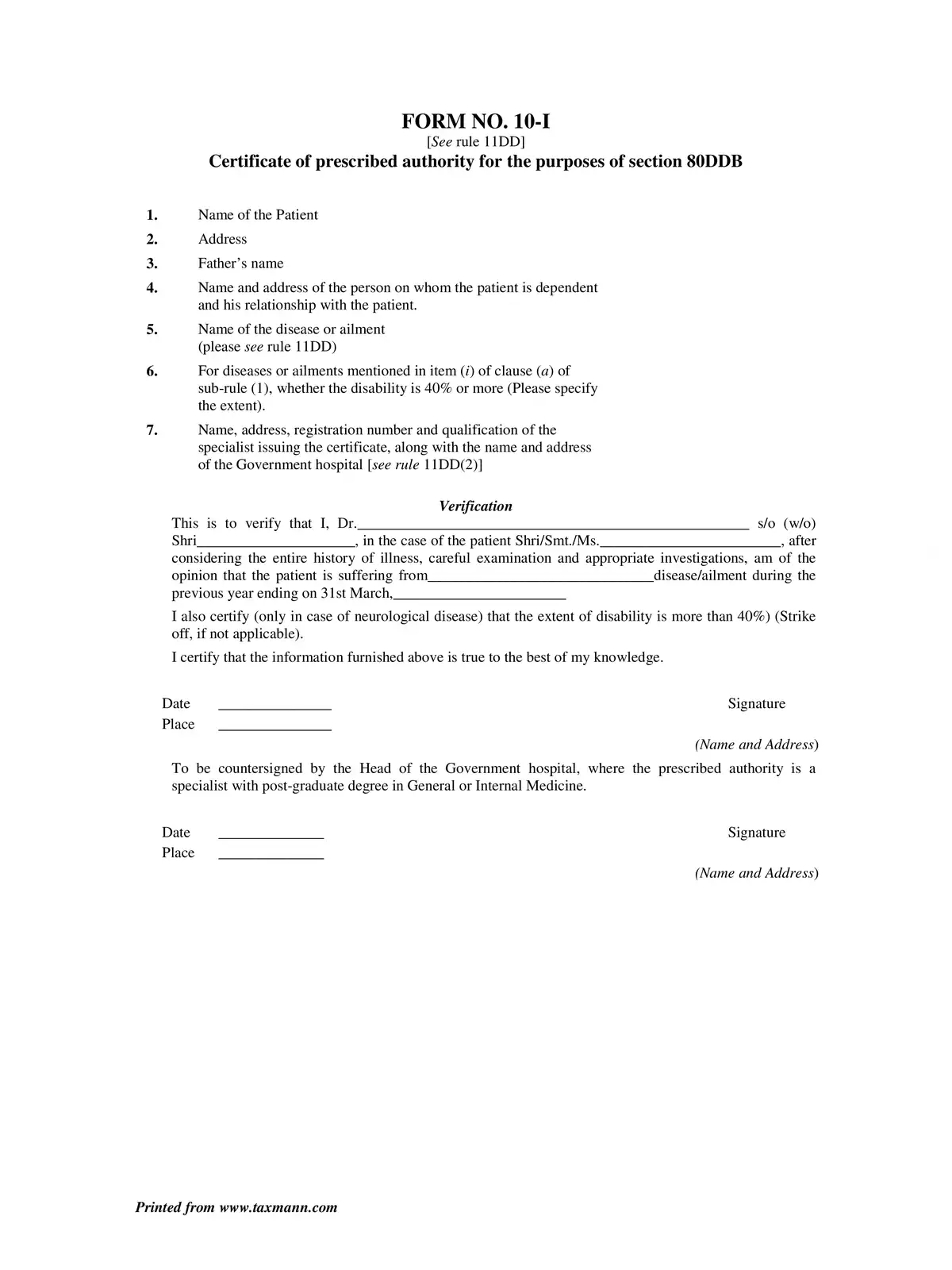

Understanding Section 80DDB

Section 80DDB is a beneficial provision in the Income Tax Act for taxpayers in India. It ensures that individuals and Hindu Undivided Families (HUFs) can avail tax relief on medical expenses incurred while treating serious illnesses. This provision applies to both the taxpayer and dependents receiving treatment.

Eligibility and Benefits

To qualify for the deduction under Section 80DDB, you must have incurred medical expenses on specified diseases listed by the tax department. By using this section effectively, you can lower your taxable income and ease your financial burden. The eligible medical expenses can also include costs related to medicines, hospital stays, and other treatments, making it a comprehensive relief option.

Make sure to keep all your bills and documents ready when claiming the deduction! This will help you claim your deduction smoothly and ensure all relevant expenses are accounted for.

For those seeking a deeper understanding of how to leverage this section for maximum benefit, a downloadable PDF is available for you. You can easily access it for detailed insights and tips about Section 80DDB and how you can benefit from it. Simply click the download link below to get your copy!