HRA Form 2026 – House Rent Allowance Application - Summary

House Rent Allowance (HRA) is an important part of your salary, especially when you move to a new city for work and need to pay rent. HRA is an extra amount given by employers along with your basic salary to help employees living away from their hometowns. Besides providing financial help, it also lowers your tax burden according to the Income Tax Act.

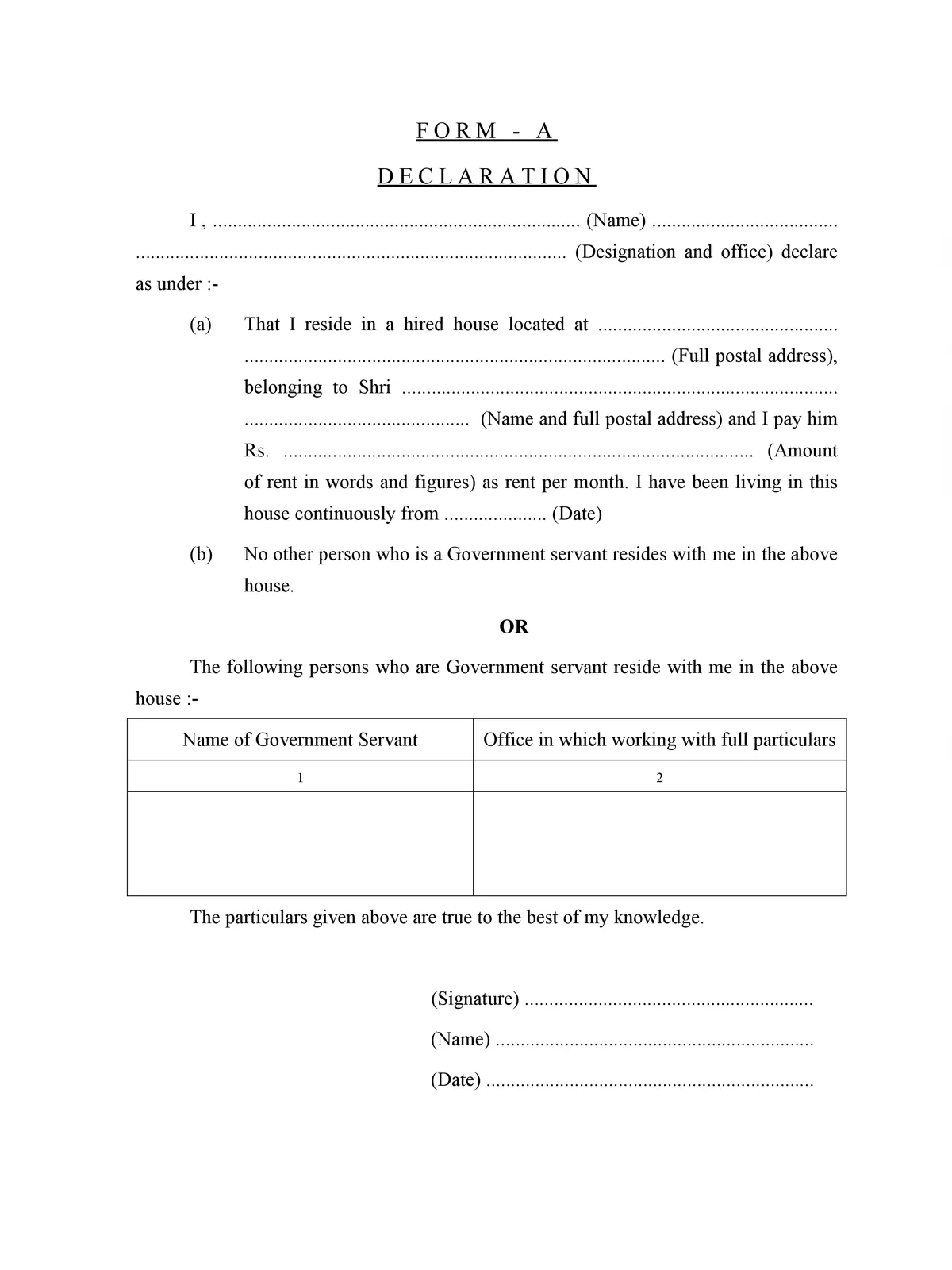

HRA Form is an official paper that helps employees claim their House Rent Allowance benefits and get tax exemptions under Section 10(13A) of the Income Tax Act. Filling out this form properly is important to make sure you get the right tax breaks on your HRA. You can easily download the HRA Form PDF from the link below to make your rent claims and tax filing simpler.

Main Details to Fill in the HRA Form

- Employee’s salary information including basic pay and allowances

- Monthly rent paid by the employee

- House Rent Allowance received from the employer

- Current city of residence and employer’s office location

HRA Tax Exemption Rules for Salaried Employees in 2025

Under Section 10(13A) of the Income Tax Act, salaried individuals can claim HRA tax exemption based on these limits. The exempt amount will be the smallest of these:

- The actual HRA amount you receive from your employer

- 50% of your salary if you live in metro cities like Delhi, Mumbai, Kolkata, and Chennai

- 40% of your salary if you live in other cities

- Rent paid by you minus 10% of your salary

Here, salary includes basic pay, dearness allowance, and any commission or bonus earned.

By submitting the completed HRA Form, employees can make sure their HRA claims are processed smoothly. You can download the HRA Form PDF using the link below and keep it ready for your salary and tax needs.