House Rent Allowance (HRA) Form - Summary

House Rent Allowance (HRA) form is an important document for salaried employees in India who pay rent. This allowance helps lower your taxable income, so you pay less tax. You can even claim tax benefits if you’re paying rent to your parents. Dont miss the chance to save money! You can easily get the House Rent Allowance (HRA) form PDF and learn how to use it well to get the most tax benefit. This simple guide will help you.

HRA is a part of your salary meant to help with rent costs. Its only for employees whose salary includes HRA. Many salaried people, such as government staff and school teachers, use the HRA form to show theyre eligible for this tax benefit and lower their taxable income for 2025.

To claim the HRA tax exemption, you need to give your employer proof of your rent payments. This can be rent receipts or a proper rental agreement. Your employer will check these documents and decide how much HRA can be exempted. Youll see this amount in your Form 16. According to Section 10 of the Income Tax Act, you might get the full or part of the HRA exempted, depending on how much rent you pay and your salary details.

How to Easily Fill and Use Your House Rent Allowance Form PDF for Tax Savings

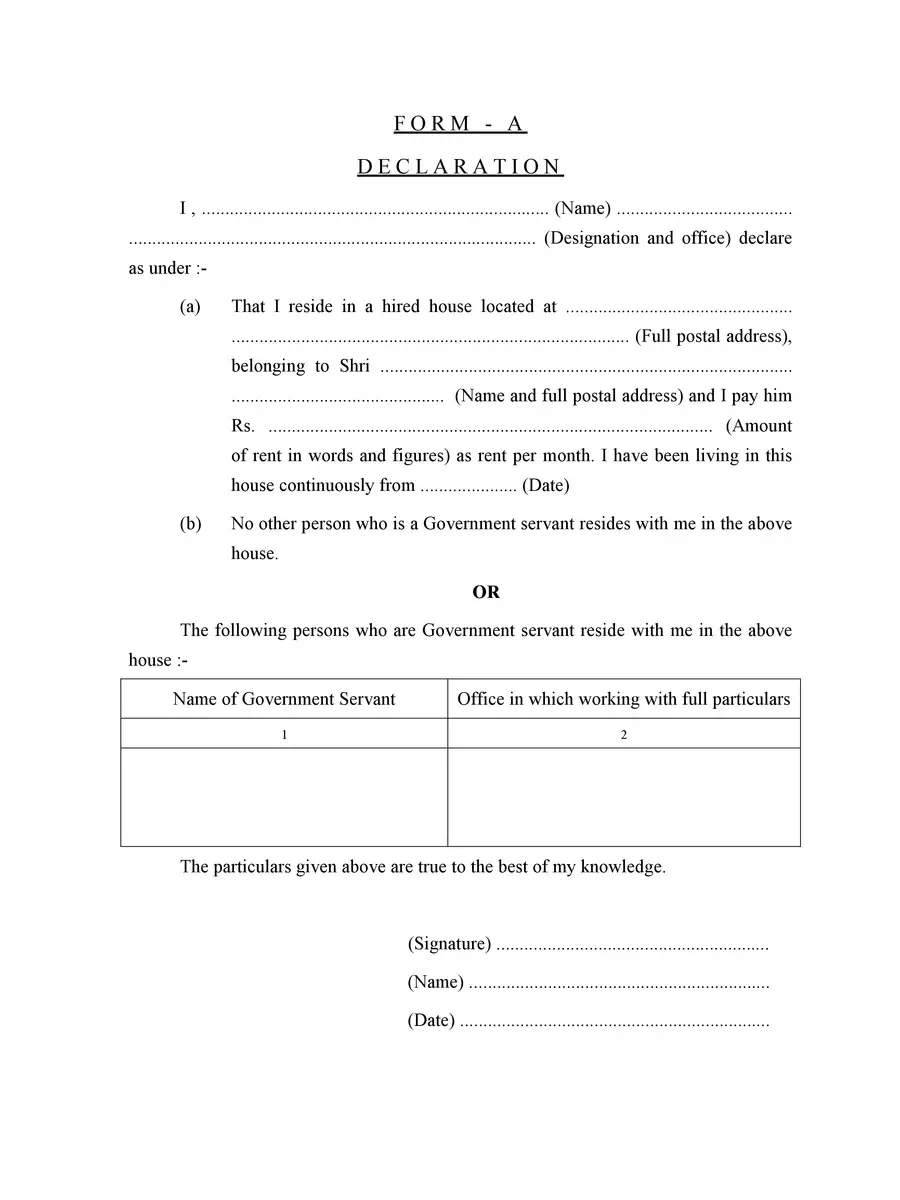

Its simple to claim your House Rent Allowance exemption. After collecting your rent receipts or rental agreement, you just need to fill out the House Rent Allowance form and give it to your employer. They will take care of the rest and reduce your taxable income according to the HRA rules.

Remember, using the House Rent Allowance Form PDF helps salaried employees save money on taxes while managing rent. Make sure to fill and submit your House Rent Allowance form on time to avoid any last-minute rush during tax season. You can download the latest House Rent Allowance form PDF now to make the process quick and easy!

Download the Official HRA Declaration Form in PDF format online from the link provided. Start saving on your taxes today!