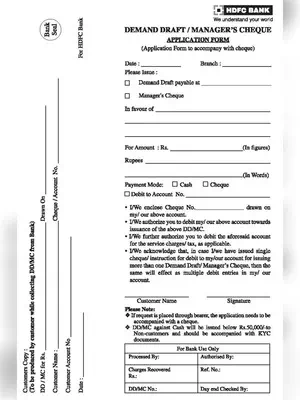

HDFC Bank DD Form

Demand draft also known as DD is still used by many institutions such as schools, colleges, exam conducting centers, etc., for their application or admission process. Demand draft is one of the safest modes of transaction. Demand Draft is a type of cheque drawn in favour of the payee and is payable in the city as requested by the customer. The customer requires to issue demand drafts for different purposes. The application allows customers to save the payee details of the draft through payee maintenance.

When a bank prepares a demand draft, the amount of the draft is taken from the account of the customer requesting the draft and is transferred to an account at another bank. The drawer is the person requesting the demand draft; the bank paying the money is the drawee; the party receiving the money is the payee.

How to Fill HDFC Bank DD Form

- Payment mode – cheque or cash,

- Make the demand draft under whose name,

- The total amount,

- Cheque number,

- Your bank account number,

- Encashment details and.

- Your signature.

HDFC Bank Demand Draft (DD) Validity

A demand draft is valid for a period of 3 months from the date of issue. If it is not presented within three months, the demand draft will not be valid, but money will not be refunded automatically. A different process must be followed for it.

- The purchaser of the draft should approach the concerned bank branch which has issued the draft and submit an application for revalidation of the draft

- The payee (the person named in the draft) cannot approach the bank for revalidation of the draft, or for that matter, any other person, it can only be the account holder

- The draft will be revalidated by the bank branch after verifying with their original records, and the validity of the draft will be extended by a period of another three months from the date of revalidation

- A draft, which has been revalidated once, cannot be revalidated any further. It means that you must present the draft to the bank within the revalidated period

HDFC Bank DD Charges

The bank will provide the demand draft once you submit the form along with the money/cheque and the demand draft charges. The charges vary from account to account

| Up to Rs. 50,000 | Rs. 75 |

| Above Rs. 50,000 & up to Rs. 1 Lakh | Rs. 2.50 per 1000 or part thereof (Min Rs. 100) |

| Above Rs. 1 Lakh | Rs. 2 per 1000 or part thereof (Min Rs. 250 & Max Rs. 5000) |

Download the HDFC Bank Demand Draft (DD)/ Manager Cheque Form in PDF format using the link given below or an alternative link.