Form 16B for TDS on Sale of Property - Summary

Understanding Form 16B for TDS on Sale of Property

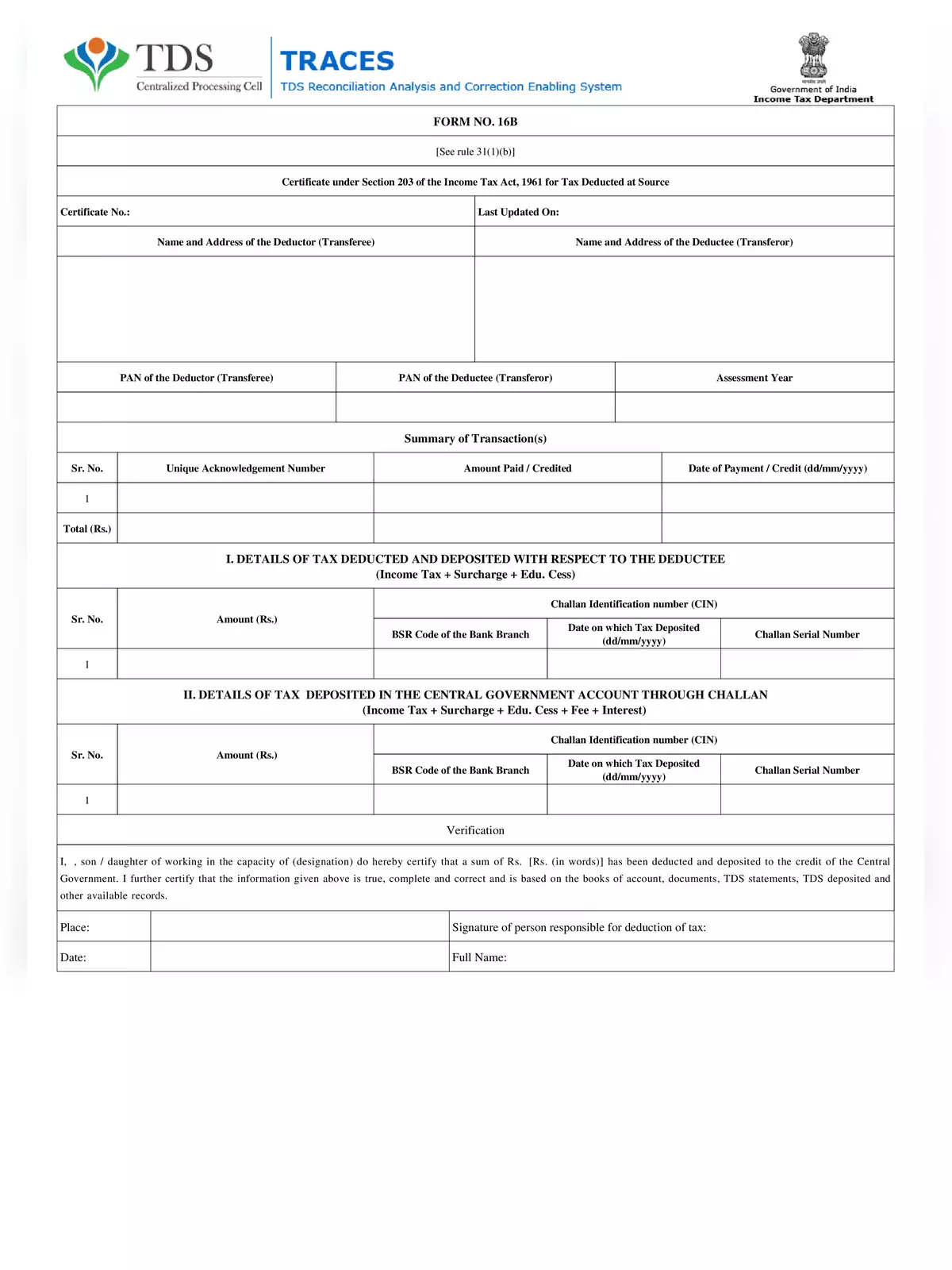

Form 16B is a crucial TDS certificate that highlights the amount deducted as TDS on the sale of property. This deduction is carried out by the buyer and then submitted to the Income Tax Department. It acts as vital proof of tax payment for the seller and plays an important role in property transactions.

When a property is sold, the buyer must deduct TDS before making any payment to the seller. This step is essential for following tax regulations in India. Hence, Form 16B is significant as it provides details about the tax deductions that occurred during the sale.

The Importance of Form 16B

Form 16B serves many essential purposes. It not only promotes transparency in property transactions but also protects the government’s interests by ensuring proper tax collection. For the seller, it confirms that the buyer has met their tax responsibilities, which helps make the transaction process smoother.

Moreover, Form 16B is vital for the seller when they file their income tax returns. It contains important details about the TDS deducted, making it simpler for them to claim credit for the tax paid. Therefore, keeping a copy of Form 16B is important for sellers and should be stored securely for future reference.

In conclusion, understanding Form 16B for TDS on sale of property is essential for both buyers and sellers. It not only ensures compliance with tax laws but also ensures a transparent real estate transaction. For more in-depth details, you can download our PDF on this topic.

By staying informed about Form 16B and its importance, you can navigate the real estate market with confidence. Regardless of whether you are a seller or a buyer, knowing the ins and outs of TDS deductions can significantly enhance your property transaction experience. 🌟🏠