Form 15 H For Senior Citizen - Summary

Understanding Form 15H for Senior Citizens

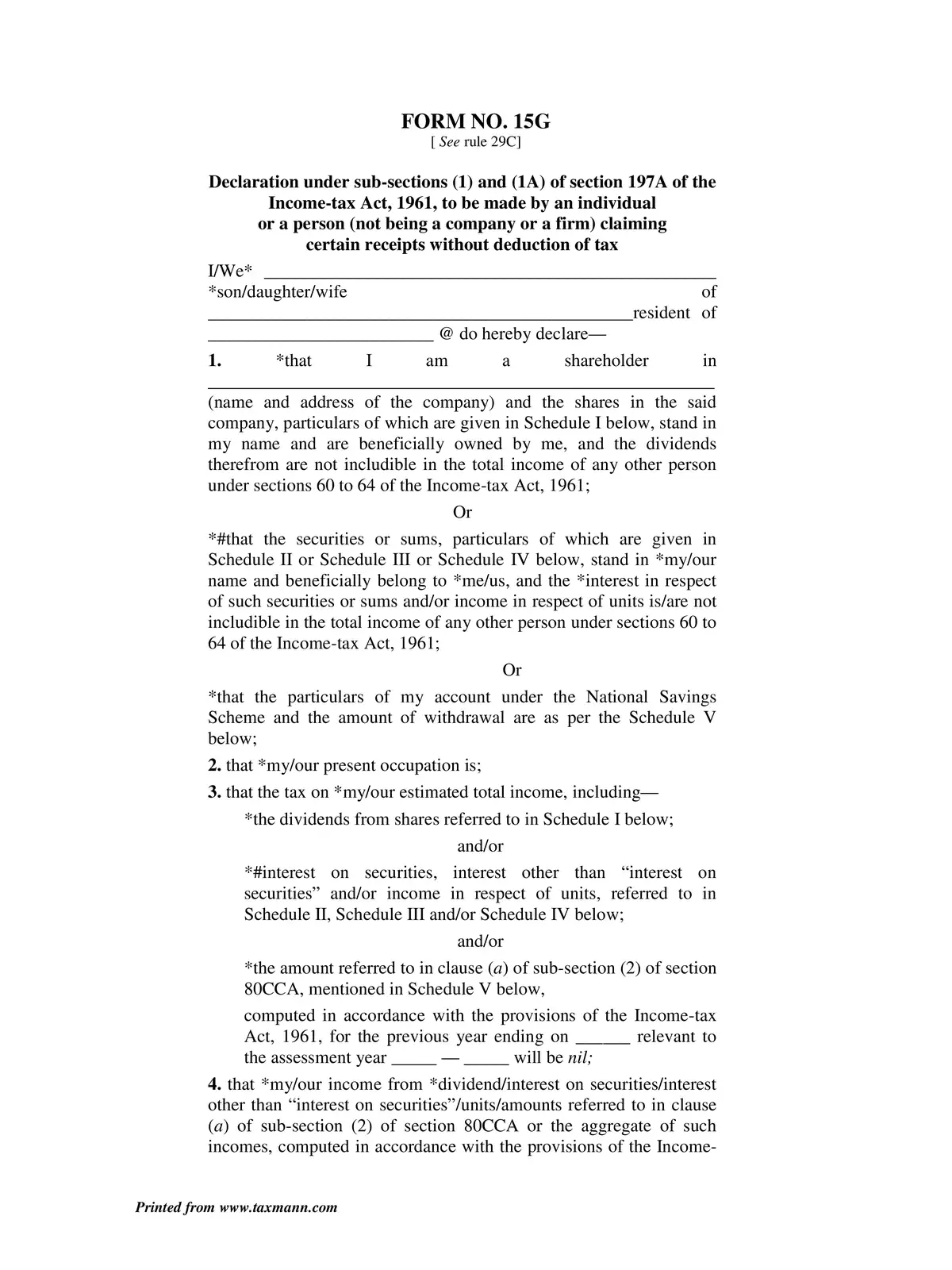

Form 15H is specifically designed for senior citizens, who are individuals aged 60 years or older. This important form is essential for managing finances in a tax-efficient manner. With Form 15H, seniors can declare that their total income is below the taxable threshold, ensuring that no Tax Deducted at Source (TDS) is charged on their income. 📄

Each Form 15H is valid for one entire financial year, giving senior citizens the convenience of submitting this self-declaration form every year. Once submitted, they won’t need to worry about TDS deductions as long as their income stays below the taxable limit.

How to Fill Out and Submit Form 15H

Filing Form 15H is a simple process. Senior citizens need to provide their personal details, such as PAN (Permanent Account Number), address, and income details. It is important to complete this form accurately to avoid any issues with tax authorities. Additionally, they should submit this form to the bank or financial institution where they receive interest income or other payments.

Senior citizens can gain significant benefits by understanding and using Form 15H. This empowers them to manage their finances without the worry of TDS deductions. It’s also essential to keep records of income to support the claims made in the form. This practice promotes transparency and ensures compliance with tax regulations. 📊

To make the process easier, many banks and financial institutions offer special assistance for form-filling. Seniors are encouraged to seek help if they have any doubts or need guidance, which makes the experience less intimidating.

In conclusion, Form 15H is crucial for senior citizens who wish to enjoy a tax-free income. By accurately completing this self-declaration form each year, they can greatly reduce their financial burdens. For more information and official instructions on filling out Form 15H, please take a moment to explore and download the relevant PDF linked below. 📥