Form 12b Furnishing Detail of Income for Change in Employment - Summary

Understanding Form 12B: Furnishing Details of Income for Change in Employment

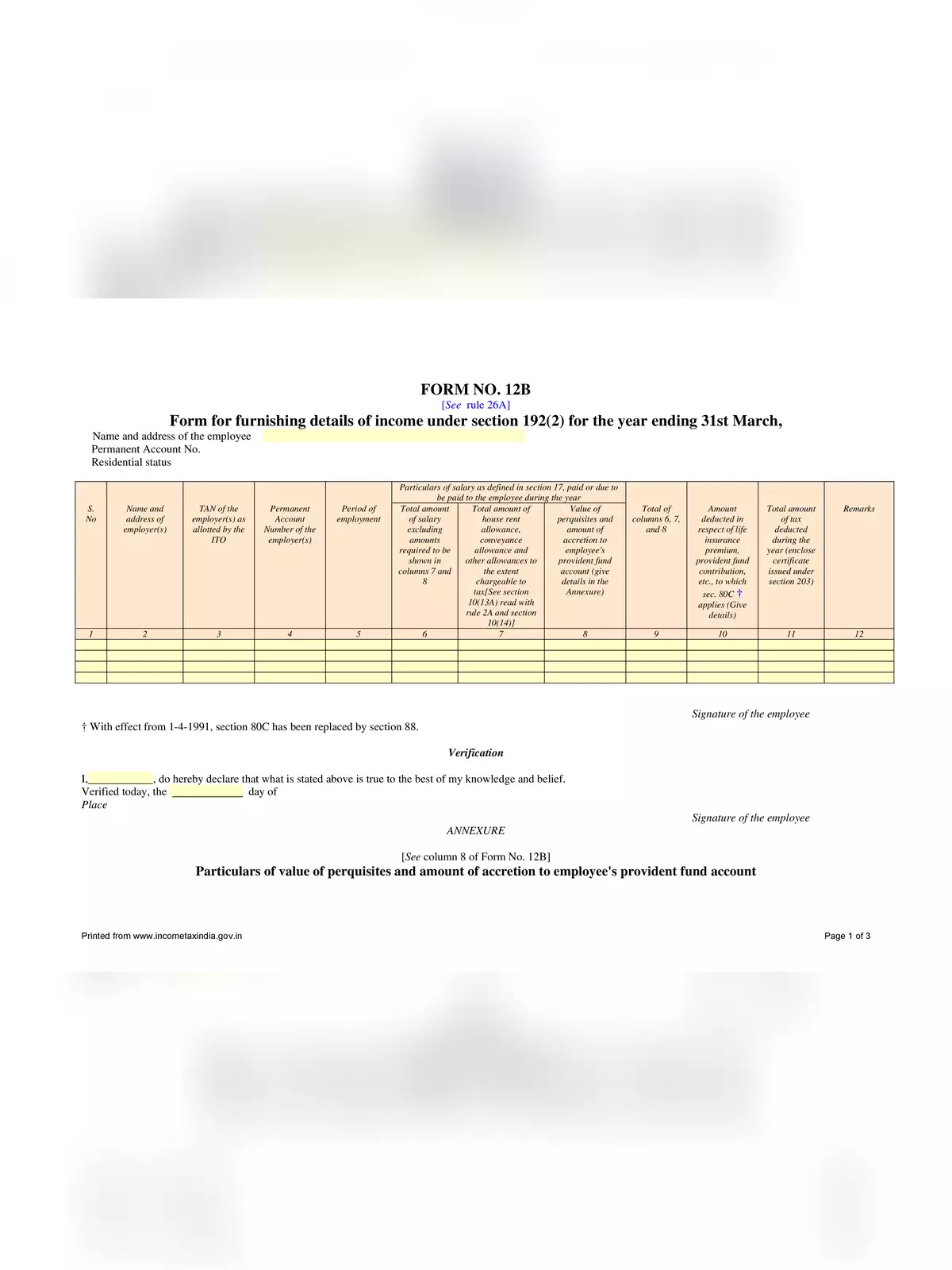

Form 12B is an essential income tax form that must be furnished according to Rule 26A. This is particularly important for individuals who join a new organization or company during the financial year. Ensuring that you accurately fill out Form 12B is crucial to report your income correctly and avoid any potential penalties from the tax authorities.

When you change your employment, it’s necessary to provide details of your previous income to your new employer. Form 12B allows you to disclose your earnings from the prior job, ensuring that the new employer can correctly deduct tax from your salary. This helps in maintaining the continuity of your tax records, and it avoids discrepancies that could arise otherwise.

Why is Form 12B Important?

Furnishing Form 12B holds significant importance for several reasons. Firstly, it enables your current employer to compute your tax liability correctly. Since your income from your previous employer is considered, Form 12B ensures that the tax deductions are not based on an inaccurate figure.

Moreover, by submitting this form, you can help your employer apply the correct tax rate based on your total income. If you neglect to furnish this form, you risk facing an incorrect tax deduction that could lead to an unexpected tax bill at the end of the financial year. Therefore, correctly filling out Form 12B is not only a regulatory requirement but a financial safeguard for yourself as well.

It is advisable for all employees transitioning to new jobs to download Form 12B and complete it at the earliest. This ensures a smooth transition and the correct reporting of your income. You can easily download the PDF of Form 12B from our website.

In summary, Form 12B is a critical document for anyone experiencing a change in employment. It streamlines the tax deduction process and helps maintain clarity in your financial responsibilities. 😊📄💼