Form 10ID - Summary

Form 10ID PDF is essential for New Manufacturing Domestic Companies looking to benefit from a lower tax rate. This form can be conveniently downloaded from the link provided at the bottom of this page. Companies have the choice to pay tax at a concessional rate of 15% (plus applicable surcharge and cess) under Section 115BAA and 115BAB of the Income Tax Act, 1961, provided they meet specific conditions. It’s important to note that companies can start opting for these concessional tax rates from Assessment Year 2020-21 onwards.

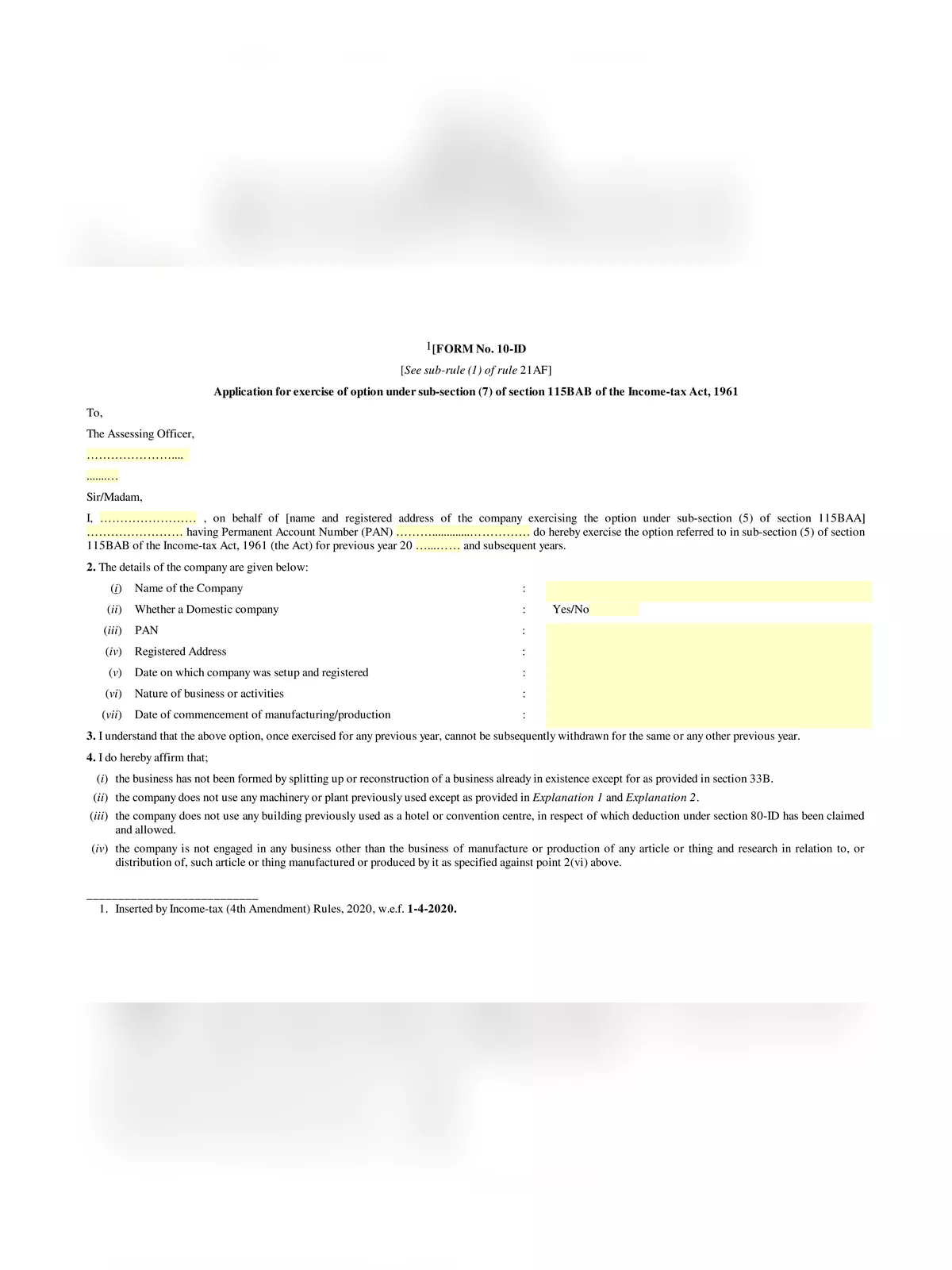

Why File Form 10ID?

To take advantage of the concessional tax rates under Section 115BAB, companies must file Form 10-ID before the due date specified under sub-section (1) of Section 139, which is for furnishing income returns for the first assessment year starting on or after 1st day of April 2020. This option, once chosen, will be valid for the following assessment years and cannot be reversed.

Form 10ID Details

You can download the Form 10-ID PDF using the link given below. This will help you in understanding and completing the necessary requirements effectively.