Form 10BA - Summary

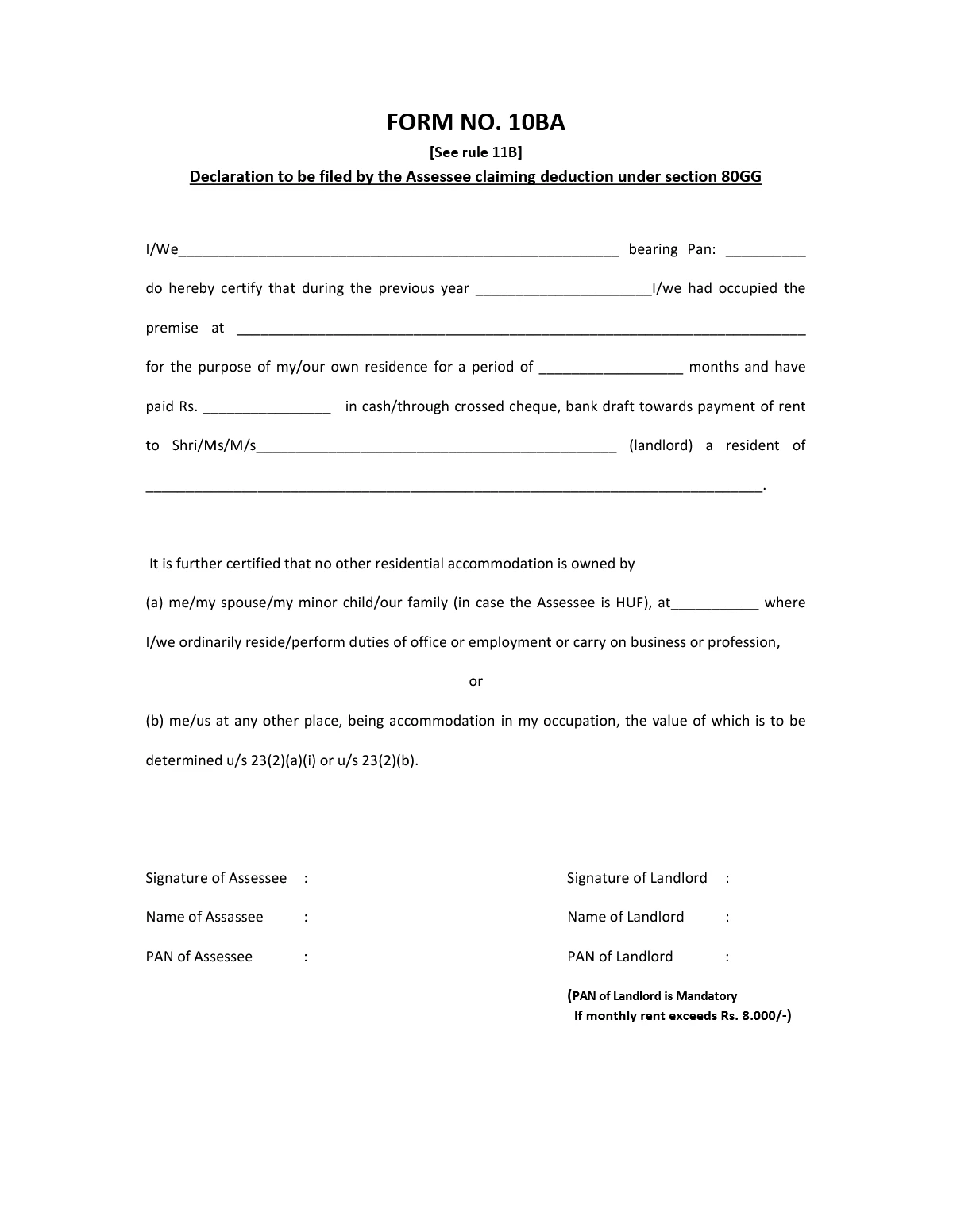

Form 10BA is a declaration submitted by the taxpayer for claiming deduction under section 80GG. To claim the deduction, the taxpayer must declare that they are not claiming the deduction for a self-occupied property in another location or the exact location where they are employed.

An individual must file Form 10BA to get the deduction for the rent paid for rental property under section 80GG. The section provides relief for individuals who don’t receive a house rent allowance (HRA). Self employed individuals, and HUF can also claim deduction under section 80G by filing Form 10BA. However, they will still have to pay the rent expenses for their residential accommodation.

What Details Are Needed in Form 10BA?

You have to write:

- Your name (the person paying rent),

- Landlord’s name and address (the owner of the house),

- Address of the rented house,

- How much rent you paid,

- The financial year (example: 2024–2025).

Form 10BA Applicability

The following points justify the Form 10BA applicability:

- The taxpayer can be salaried or self-employed; however, they should not receive a house rent allowance from an employer.

- If the taxpayer, their minor child, spouse, or the assessee is a member of a HUF (Hindu Undivided Family), then the HUF must not possess any self-occupied residential property.