EPFO Form 10C 2025 - Summary

Overview of EPFO Form 10C and Why It Matters

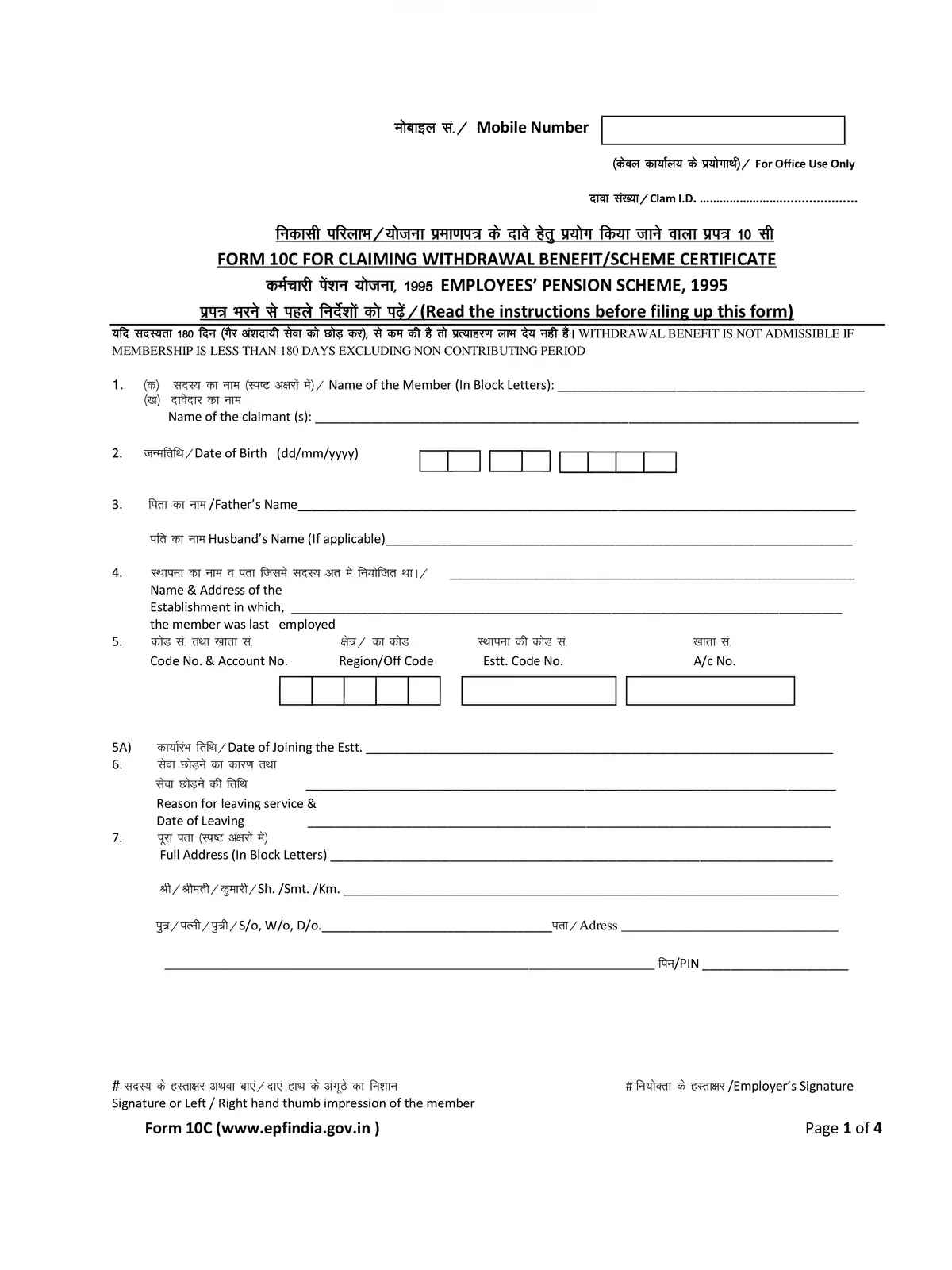

Form 10C is used to claim either the withdrawal benefit or a Scheme Certificate under the EPS. The withdrawal benefit is for those who leave their job before completing 10 years of service, while the Scheme Certificate helps you carry forward your pensionable service when you join a new employer and makes sure you stay eligible for a pension later.

Information You Need for EPFO Form 10C PDF

Getting your EPFO Form 10C ready is simple if you have the right details on hand. Make sure you gather the following information carefully before you start filling out the form:

- Your full name as per official records

- Your correct date of birth

- Father’s name or husband’s name (if applicable)

- Your employer’s address

- Your Provident Fund (PF) account number

- The date you joined your last employer

- The reason and date for leaving your job

- Your full residential address

- Details about your family members or nominees

- How you want to receive your payment or remittance

- Any other information that might be needed

Documents to Submit with EPFO Form 10C

When submitting your EPFO Form 10C, you’ll need to attach some documents to support your claim. Having them ready in advance will make the process smoother. Here’s a list of the documents usually required:

- A cancelled or blank cheque with your bank details clearly visible

- If you’re claiming a Scheme Certificate, you’ll need your date of birth certificate and details of your children

- If the member has passed away, a death certificate is needed

- If a legal heir is submitting the form, a succession certificate is required

- Don’t forget to affix a ₹1 revenue stamp on the form

Who Can Use EPFO Form 10C?

EPFO Form 10C is for specific groups of people who can claim EPS benefits or a Scheme Certificate. First, find out if you fall into one of these categories. Here are the people who can apply using this form:

- Individuals who left their job before completing 10 years of service and have reached 58 years of age before completing 10 years of service.

- Members who completed 10 years of service but are under 50 years old.

- Members who are between 50 and 58 years old and choose not to receive a reduced pension.

- The nominee or family member of a member who passed away before completing 10 years of service and was over 58 years old at the time of death.

Benefits You Can Claim with EPFO Form 10C

EPFO Form 10C lets you claim important benefits related to your pension. Knowing what you qualify for will help you fill out the form properly. Here are the main benefits you can claim by submitting this form:

- The amount you can withdraw from your EPS account. This applies if you meet the conditions for withdrawal instead of getting a monthly pension.

- A Scheme Certificate which is important if you’re changing jobs and want to continue your pensionable service with your new employer. This certificate proves your past service.

- In some cases, you can also claim a refund of the employer’s contribution made towards your pension.

Feel free to easily download the EPFO Form 10C PDF for 2025 and complete the process. This form is a simple way to claim your pension benefits without any hassle.