EPF Contribution Rate 2023 - Summary

Employee Provident Fund (EPF) is a retirement benefits scheme framed under the Employees Provident Fund & Miscellaneous Provisions Act, 1952. The scheme applies to those who are employed. As per the EPF scheme, the employer deducts a certain amount of contribution from the employee’s salary and deposits in his or her EPF account. An employer also contributes to the employee’s EPF account

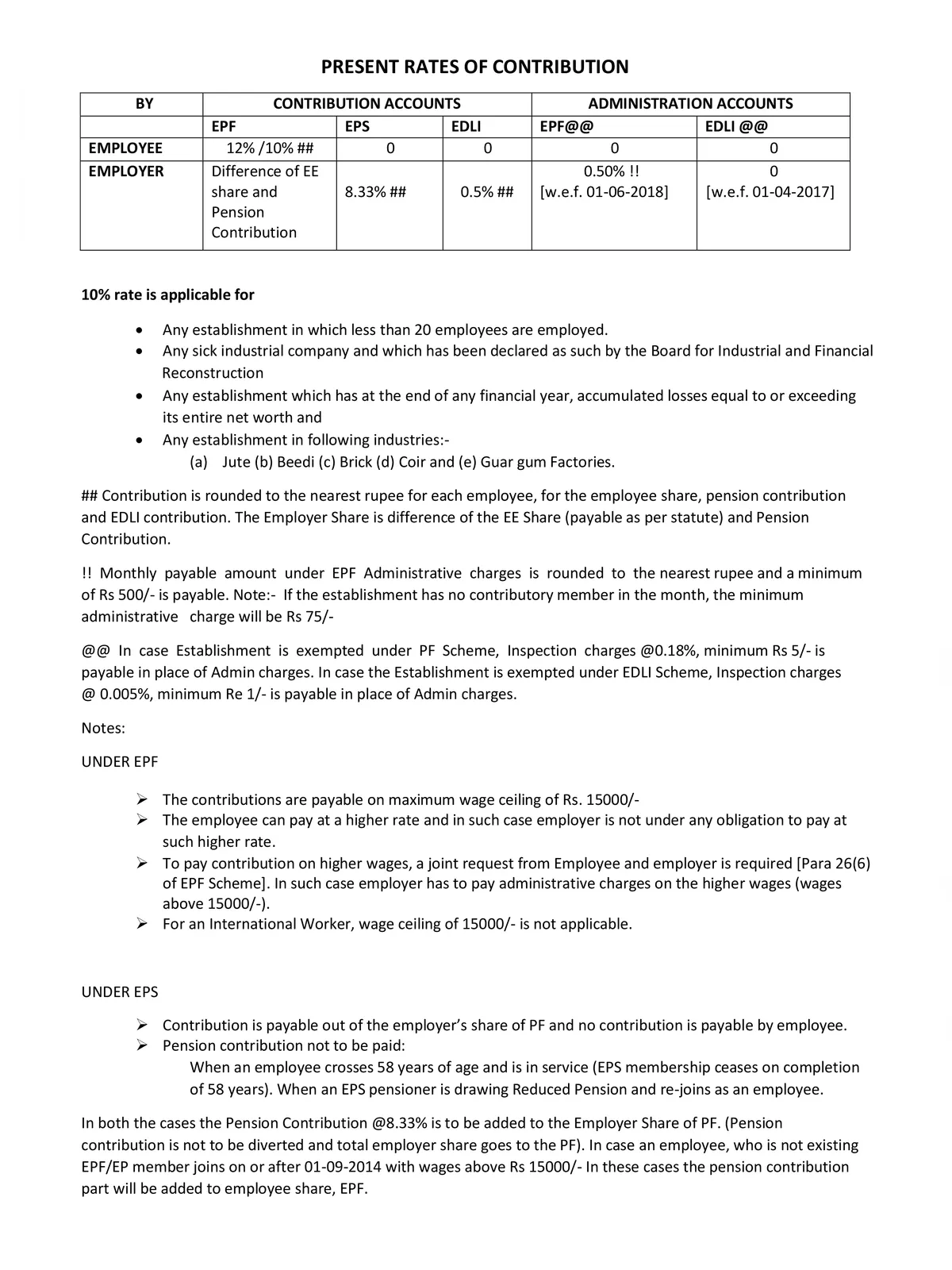

EPF Contribution Rate 2023 PDF – Rate is applicable for

- Any establishment in which less than 20 employees are employed.

- Any sick industrial company and which has been declared as such by the Board for Industrial and Financial Reconstruction.

- Any establishment which has at the end of any financial year,accumulated losses equal to or exceeding its entire net worth.

- Any establishment in following industries:-(a) Jute (b) Beedi (c) Brick(d) Coir and (e) Guar gum Factories.

Contribution is rounded to the nearest rupee for each employee, for the employee share,pension contribution and EDLI contribution. The Employer Share is difference of the EE Share (payable as per statute) and Pension Contribution.

You can download the EPF Contribution Rate in PDF format online from the link given below.