EPF Contribution Rate 2020-21 - Summary

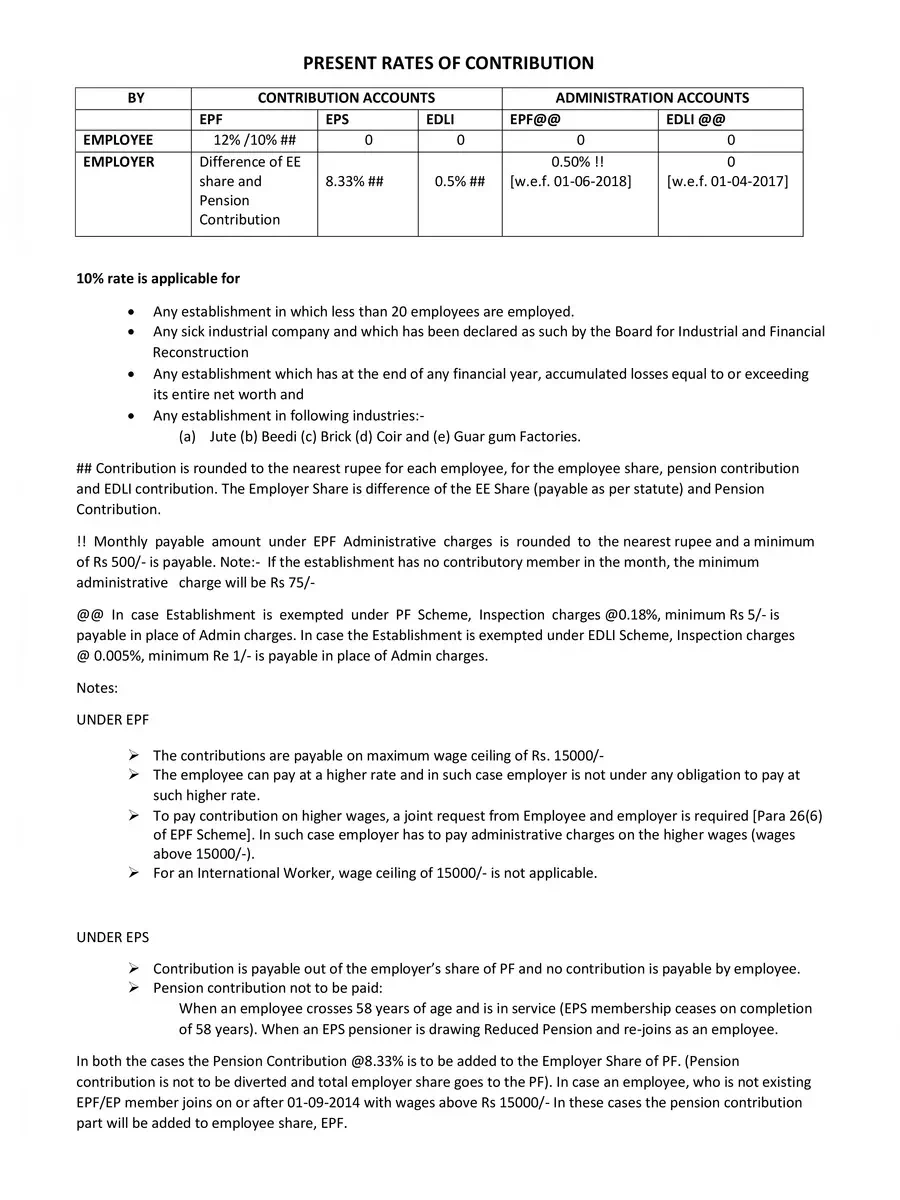

The employer makes a contribution of 8.33% towards the EPS (Employees’ Pension Scheme) account of the employee. Another 3.67% is added to the EPF account of the employee. The employer also makes 0.50% of contribution towards the EDLI (Employees’ Deposit Linked Insurance) account of the employee.

Employees’ Provident Fund (EPF) is a retirement benefits scheme where the employee contributes 12% of his basic salary and dearness allowance every month. The employer also contributes an equivalent amount (8.33% towards EPS and 3.67% towards EPF) in the employee’s account. The employee can withdraw the accumulated corpus at the time of retirement and also during the service period under some conditions and for specific purposes.

EPF Contribution

EPF Contribution consists of two parts depending on the entity that makes the contribution – Employee’s contribution and Employer’s contribution.

The employee makes a contribution of 12% of basic salary + dearness allowance towards his EPF account. The employee has to make a lower 10% contribution in case the establishment has less than 20 employees or for industries such as (a) Jute (b) Beedi (c) Brick (d) Coir and (e) Guar gum Factories.

The employer makes a contribution of 8.33% towards the EPS (Employees’ Pension Scheme) account of the employee. Another 3.67% is added to the EPF account of the employee. The employer also makes 0.50% of contribution towards the EDLI (Employees’ Deposit Linked Insurance) account of the employee.

The employer has to pay an additional charge for administrative accounts at a rate of 0.50% with effect from 1st June 2018. The minimum administrative charge is ₹ 500 and if there is no contribution for a specific month, the employer has to pay a fee of ₹ 75 for that month.

Important Points to be Considered

1) Employee Provident Fund (EPF)

- The maximum wage ceiling for the calculation of EPF contributions is ₹ 15,000

- The employee can make contributions at a higher rate but the employer is not bound to pay at the higher rate

- The employee and the employer has to submit a joint request for making higher contributions in the EPF account

- The employer, however, will have to pay higher administrative charges (at the rate including 0.50% of the employee’s wage above ₹ 15,000)

- There is no wage ceiling (₹ 15,000) for international workers

2) Employees’ Pension Scheme (EPS)

- The employer is not required to make the contribution when the employee reaches 58 years of age and is still in service

- The employer need not pay EPS contribution when the pensioner is drawing a reduced pension and re-joins as an employee

- The employee, who joins the service at an age of 50 or above and is not availing pension, does not have an option of not getting the pension contribution. The employee, or the employer, cannot say that the contribution should not be furnished as he will not be able to complete 10 years of service to avail pension benefits

3) Employees’ Deposit Linked Scheme (EDLI)

- The contribution to be made should be at a rate of the maximum wage ceiling of ₹ 15,000 even if the employee’s share is more than ₹ 15,000

- Each contribution is rounded off to the nearest rupee

- EDLI contribution has to be made even after the employee has completed the age of 58 years and should continue until the member is in service!