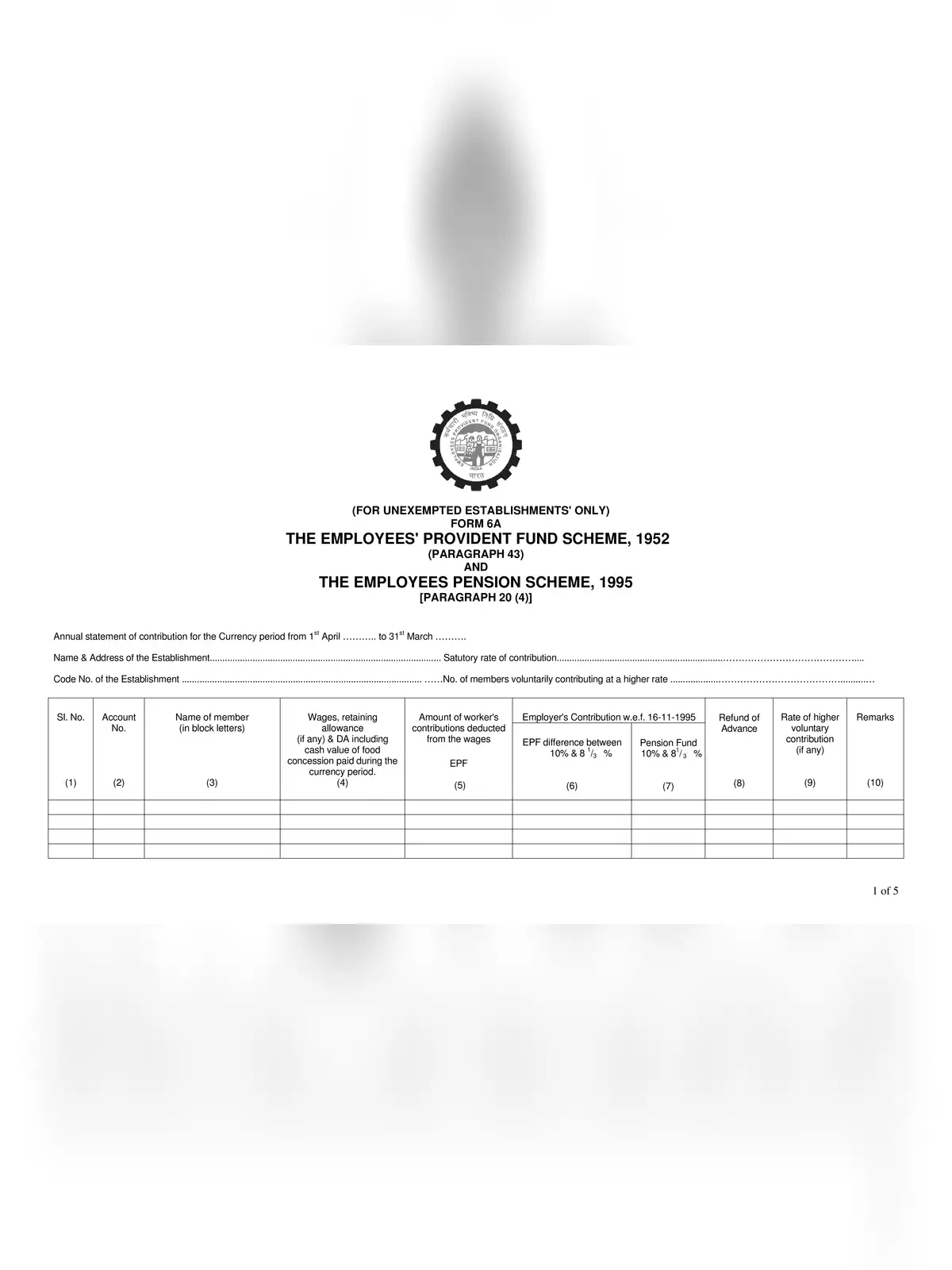

EPF Return Form 6A - Summary

EPF Form 6A is an important return form that employers use to share detailed information about their employees’ contributions to the Employees’ Provident Fund (EPF). The EPF is a vital social security scheme in India, designed to offer financial security and retirement benefits to eligible workers.

Consolidated Annual Contribution Statement

This form helps in creating a detailed annual contribution statement for each member of the establishment. It plays a crucial role in compiling the annual Provident Fund statement for all subscribers. Please note that this form must be submitted by 30th April every year.

EPF Return Form 6A (Required Details)

- Name & Address of the Establishment

- Statutory rate of contribution

- Code No. of the Establishment

- No. of members voluntarily contributing at a higher rate

- Signature of Employer

- Sl. No.

- Account No

- Name of member

- Wages, retaining allowance (if any) & DA including the cash value of food concession paid during the currency period.

- Amount of worker’s contributions deducted from the wages EPF

- Refund of Advance

- Rate of higher voluntary contribution (if any)

- Remarks

You can easily download the EPF Return Form 6A in PDF format from the official website link provided below or through our alternative link. Don’t miss out on securing your EPF details through our convenient PDF download! 📥