E-Sanchit Document Code List - Summary

Understanding E-Sanchit Document Code List

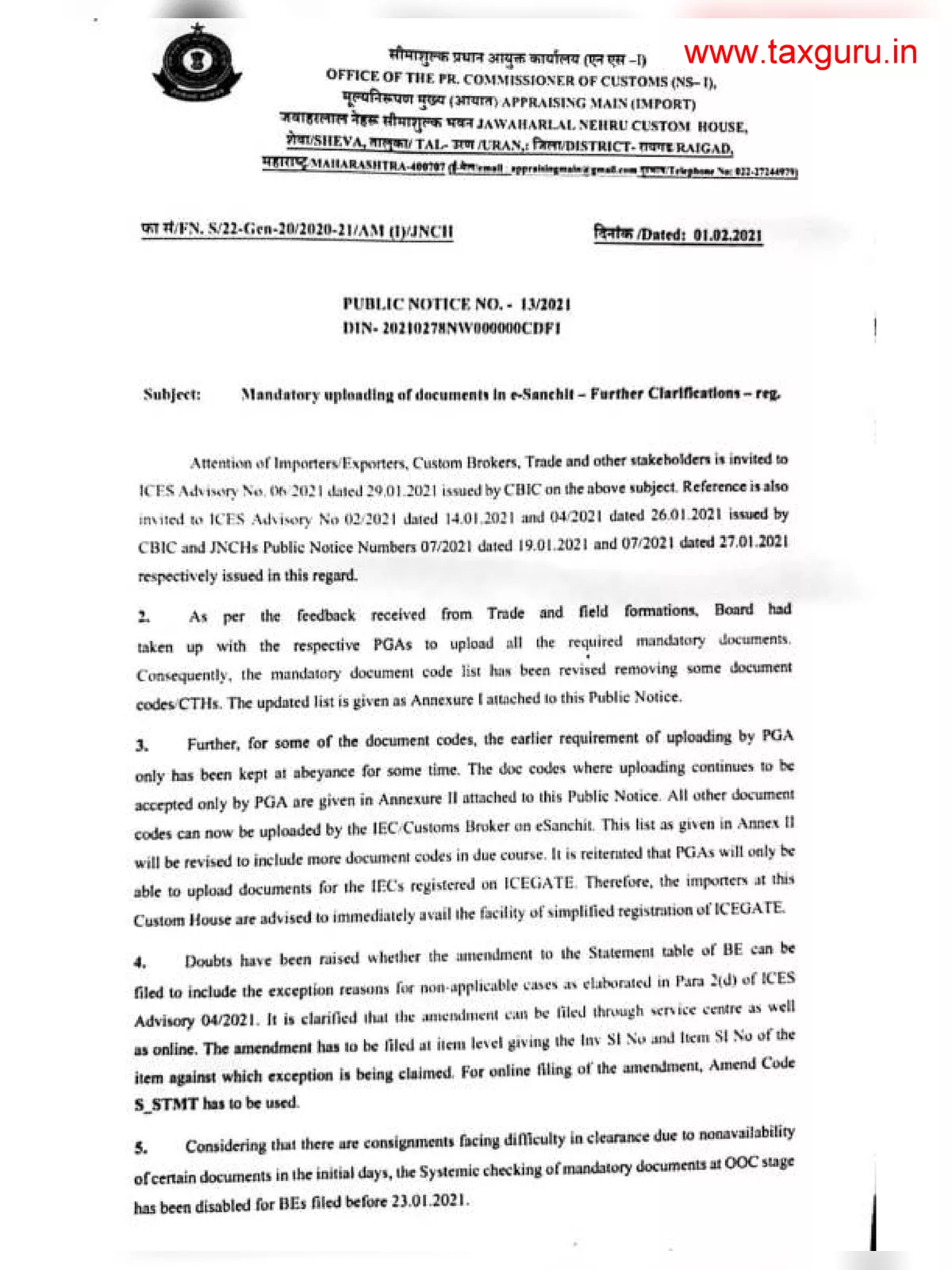

E-SANCHIT is designed to provide an electronic connection between taxpayers and customs officers for submitting import/export documents without any hassle. To make the most of eSanchit, users need to follow the simple steps outlined below. The E-Sanchit Document Code List PDF can be downloaded from the link provided at the bottom of this page.

E-Sanchit Document Code

E-SANCHIT was launched as part of SWIFT to promote paperless processing. e-SANCHIT stands for e-storage and computerised handling of indirect tax documents. It empowers traders by allowing them to upload all necessary supporting documents digitally to obtain clearances. This means that traders do not need to visit Participating Government Agencies (PGAs) to get various approvals. Thus, e-SANCHIT transforms the entire consignment clearance process into a paperless and easy experience.

E-Sanchit Benefits

- Paperless processing: e-SANCHIT enables traders to file supporting documents online through an ‘Integrated Declaration’. This declaration gathers all the data needed for clearances from multiple government agencies and can be digitally signed and submitted via the ICEGATE portal along with the documents.

- Increases the speed of clearance: Using a paperless approach minimizes the need to visit several government departments in person, which not only cuts costs but also enhances the efficiency of import/export processes.

Get Your E-Sanchit Document Code List

You can easily download the E-Sanchit Document Code List PDF using the link provided below.