Companies Fresh Start Scheme 2020 - Summary

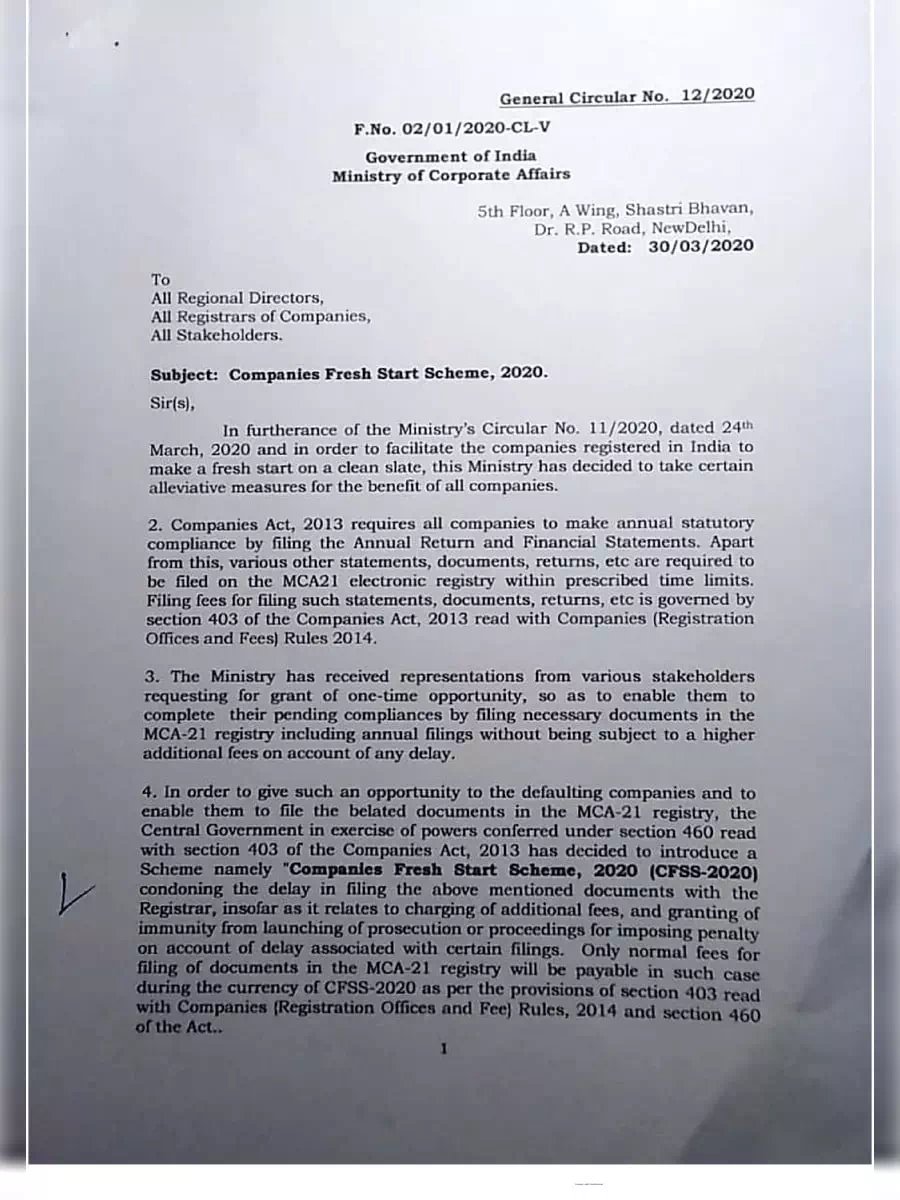

In order to facilitate the companies registered in India to complete their pending statutory filings with the Registrar of Companies (RoC) under the Companies’ Act 2013 (“the Act”) or the Companies’ Act 1956 (“1956 Act”) without being subject to higher additional fees on account of any delay, the Ministry of Corporate Affairs (MCA) has introduced a Scheme viz; “Companies Fresh Start Scheme 2020 (CFSS-2020)”. The Scheme benefits the defaulting companies by not charging additional fees and granting of immunity from the launching of prosecution or proceedings for imposing a penalty on account of such delay.

In Part III of our Company Law Update Series, we seek to deal with the nuances of the aforesaid scheme.

Key Takeaways of the Scheme

1. Applicability and Duration of the Scheme

A Company which has made a default in filing of any of the documents, statement, returns, etc. including annual statutory documents to the Registrar (hereinafter referred to as ‘defaulting company’) is permitted to file all its belated documents which were earlier not filed on its due date without any additional fee/penalty being levied under any relevant section upon the filing of such documents (except as stated in Point No. 6 below w.r.t Form No. SH-7 and charge related forms). The document/form can be relating to any period from the incorporation of the company.

The Scheme shall come into force w.e.f 1 April 2020 and shall remain force till 30 September 2020 (both days inclusive).

2. Application and grant of immunity

The application for seeking immunity under the scheme shall be made electronically in Form CFSS-2020 after the closure of the scheme and after the document(s) or forms are taken on file / on record / approved by the designated authority, within a period of 6 months from the date of closure of the scheme. Thus, the last date for filing the form is 31 March 2021. No fee shall be payable on filing Form CFSS-2020.

Based on the declaration made by the defaulting company, an immunity certificate in respect of the documents/forms filed under this Scheme shall be issued by the designated authority.

After granting the immunity, the designated authority concerned shall withdraw the pending proceedings before Courts or Adjudicating Officer (AO) u/s 454 of the Act after which the immunity granted shall be deemed to have been completed without any further action on part of the designated authority.

3. Withdrawal of appeal filed, if any, by the Company

Where a Company intends to avail the benefit under this scheme, the Company or its officer in default shall withdraw any appeal filed against any notice issued or an order passed by the court / any AO for any violation under the Act or 1956 Act, in respect of which an application is made under this scheme, then such applicant before filing such application for immunity under this scheme, shall withdraw the appeal and furnish proof of withdrawal along with the application made under this scheme.

4. Measures for cases where the order of adjudicating authority was passed but the appeal could not be filed

In cases wherein penalty has been imposed by AO for delayed filing of documents/return etc. and no appeal has been initiated by the company or its officer before the Regional Director (RD) as on 1 April 2020, (i.e date of commencement of the scheme), then the following would apply –

- Where the last day of filing the appeal falls between 1 March 2020 to 31 May 2020 (both days included) an additional period of 120 days shall be allowed from such last date to all companies and their officers for filing an appeal before the concerned RD.

- During such an additional period as stated above, prosecution for non-compliance of the order of adjudicating authority shall not be initiated against such companies or their officers.

5. Immunity not to be provided in certain cases

The immunity shall not be provided on the following –

- Any matter of appeal or management disputes pending before the court of law or tribunal.

- Any matter on which court has ordered conviction or an order imposing penalty passed by an AO and no appeal has been preferred against such order before this scheme has come into force.

The aforesaid Point No. 4 and Point No. 5 can be understood with the help of the below table: –

| Last day of filing appeal | Any Additional period of filing appeal | Whether appeal filed against the order passed on the Company within the last day/ additional period | Whether eligible for grant of immunity |

| 29-Feb-20 | No, since the last day of filing should fall between 1 March to 31 May 2020 | Yes | Yes, Provided the Company withdraws the appeal filed as stated in Point No. 3 above |

| 29-Feb-20 | No, since last day of filing should fall between 1 March to 31 May 2020 | No | No, since no appeal has been preferred against order passed, as per Point No. 5 above. |

| 31-Mar-20 | 29-Jul-20 (120 days as per Point No. 4 above) | Yes | Yes, Provided the Company withdraws the appeal filed as stated in Point No. 3 above |

| 31-Mar-20 | 29-Jul-20 (120 days as per Point No. 4 above) | No | No, since no appeal has been preferred against the order passed, as per Point No. 5 above. |

For more details download the Companies Fresh Start Scheme 2020 in PDF format using the link given below.