Children Education Allowance Form for Central Government Employee - Summary

The Children Education Allowance Form PDF (CEA) is crucial for Central Government employees in India who are looking for financial support for their children’s education and hostel facilities. The allowance amount for a differently-abled child is twice that of a normal child, which shows the government’s dedication to helping all families. Central Government employees can claim educational expenses for both hostel and school under the Children Education Allowance (CEA). This form provides various components, allowances, and the latest updates concerning educational allowances under the CEA.

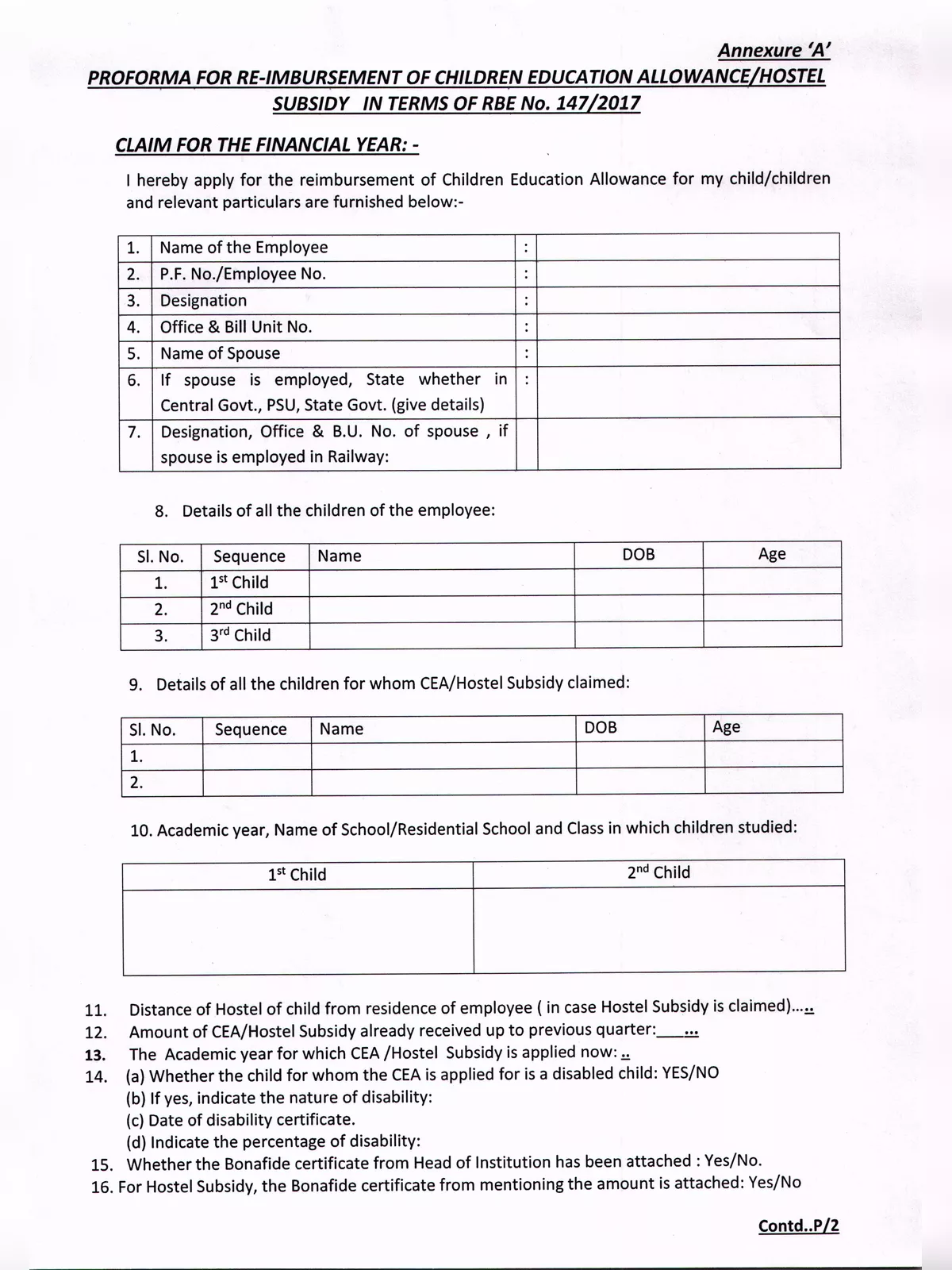

Requirements for Reimbursement

To get reimbursement for educational expenses, it is important to have a certificate from the head of the educational institution. This certificate must confirm that the child was enrolled in the school for the previous academic year. If parents want to claim a hostel subsidy, they will need a certificate from the institution’s head showing the actual costs incurred for lodging and boarding.

Exemption for Children’s Education and Hostel Expenditure

The following exemptions* are available for individuals employed in India:

- If you receive a children’s education allowance from your employer, you can claim a tax exemption under the Income-tax Act. The maximum exemption is Rs. 100 per month or Rs. 1200 per annum for a maximum of 2 children. Additionally, you can also claim deductions for school fees paid under section 80C.

- For Hostel Expenditure Allowance: INR 300 per month per child, applicable for a maximum of 2 children.

(*Expenses must be incurred in India as per Section 10(14) of the Income Tax Act)

Children’s Education Allowance Claim Amount

- CEA rate from Apr 17 to Jun 17 is Rs 1500/- PM (submission of school fees receipt and bills required).

- CEA rate from Jul 17 to Mar 18 is Rs 2250/- PM (fixed amount with no need for receipts/bills).

- For Hostel Subsidy, the rate is Rs 6750/- PM effective from 01 Jul 17.

- CEA for Specially Abled Children is Rs 4500/- PM effective from 01 Jul 17.

- To claim CEA, submit a certificate from the Head of Institution/School.

- For Hostel Subsidy, you will need a similar certificate that includes additional details about lodging and boarding expenses in the residential complex.

Download the Children Education Allowance Form

You can effortlessly download the Children Education Allowance Form for Central Government Employees in PDF format using the link below. This easy-to-use PDF download helps parents streamline the claims process and ensures they receive the necessary financial assistance without hassles.