CAMSKRA KYC Form - Summary

CAMS, or Computer Age Management Services Pvt Ltd, was established in 1988 with a vision to improve software development. In the 1990s, as the Mutual Funds Industry began to grow, CAMS shifted its attention to this area and became a prominent Registrar & Transfer Agent (R&T agent) for Mutual Funds. The role of an R&T agent is to handle all operations related to processing investor forms, managing redemptions, and much more for Mutual Funds.

CAMSKRA: Your Trusted KYC Registration Agency

CAMSKRA is your go-to KYC registration agency (KRA) in India, offering important KYC services for all Mutual Funds, SEBI-compliant stock brokers, and other financial companies. KYC, which means Know Your Customer, is a crucial process to verify the identity of customers and is a must-have for anyone wanting to buy products from any financial institution.

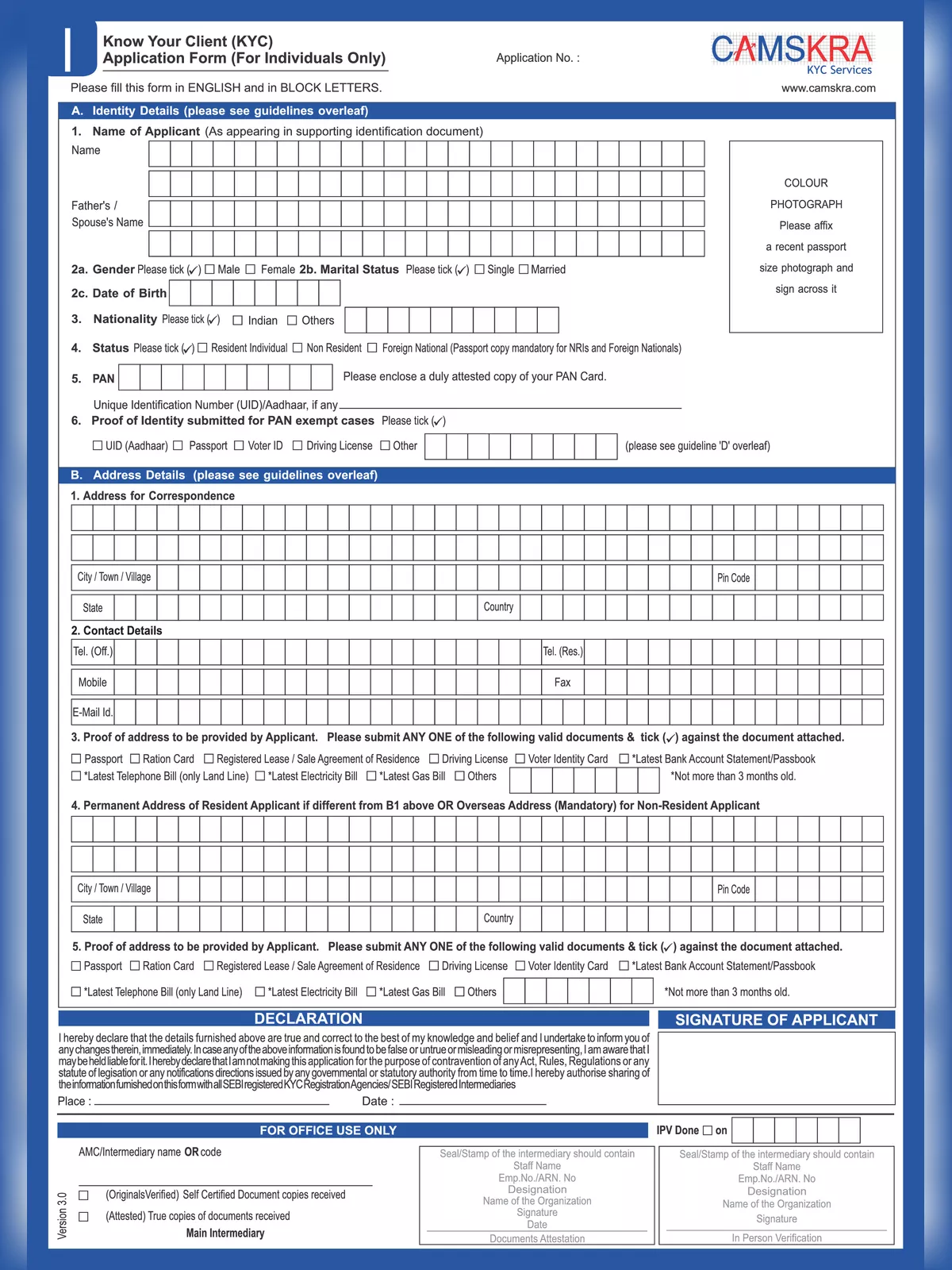

Understanding the CAMSKRA KYC Form

The CAMSKRA KYC Form is an important part of the Client Identification Process, helping to ensure compliance with SEBI’s KRA KYC regulations. These rules require intermediaries to confirm investors’ identity, address, and personal details through the KYC process. For every investor looking to invest in Mutual Funds, being KYC compliant is essential.

Documents Required for CAMSKRA KYC Form

- PAN Card

- Address Proof: Voter’s Identity Card or Driving License

- Telephone Bill

- Electricity Bill

- Bank Account Statement

You can easily download the CAMSKRA KYC Form PDF using the link provided below, so make sure you get your form today!