Business Finance MCQ with Answer - Summary

Solving Business Finance MCQs with answers is really helpful for students and anyone working in companies who wants to understand how to manage money. Business finance is all about how businesses get and use money to keep things running smoothly. The finance manager plays a very important role because they plan, monitor, and control all money matters, usually working closely with the top leaders in the company. If you are preparing for exams or interviews, you can easily download the Business Finance MCQs with Answer PDF using the link below on this page.

Overview of Business Finance MCQs

Business finance mainly involves two ways of getting money: debt finance and equity finance. Debt finance means borrowing money that the business has to pay back later with extra charges (interest). Equity finance is when a business sells a small part of itself (called shares) to people who become part-owners.

Download Business Finance MCQs with Answer PDF for 2025

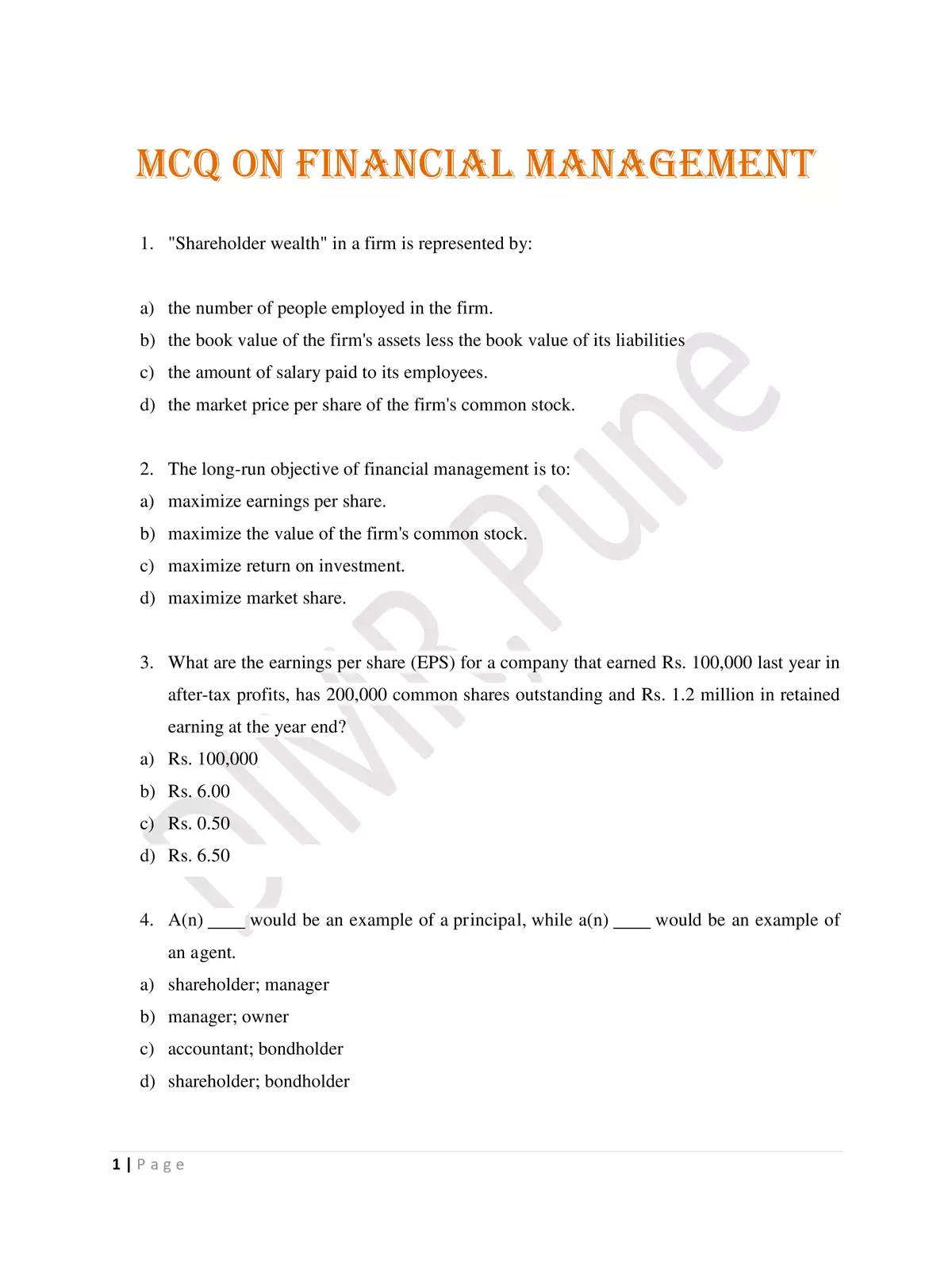

- “Shareholder wealth” in a firm is represented by:

- a) the number of people employed in the firm.

- b) the book value of the firm’s assets less the book value of its liabilities

- c) the amount of salary paid to its employees.

- d) the market price per share of the firm’s common stock.

- The long-run goal of financial management is to:

- a) maximize earnings per share.

- b) maximize the value of the firm’s common stock.

- c) maximize return on investment.

- d) maximize market share.

- What are the earnings per share (EPS) for a company that earned Rs. 100,000 last year in after-tax profits, has 200,000 common shares outstanding and Rs. 1.2 million in retained earnings at the year end?

- a) Rs. 100,000

- b) Rs. 6.00

- c) Rs. 0.50

- d) Rs. 6.50

- A(n) would be an example of a principal, while a(n) would be an example of an agent.

- a) shareholder; manager

- b) manager; owner

- c) accountant; bondholder

- d) shareholder; bondholder

- The market price of a share of common stock is determined by:

- a) the board of directors of the firm.

- b) the stock exchange where the stock is listed.

- c) the president of the company.

- d) individuals buying and selling the stock.

- The main focus of financial management in a firm is:

- a) the number and types of products or services provided by the firm.

- b) reducing the amount of taxes paid by the firm.

- c) creating value for shareholders.

- d) the dollar profits earned by the firm.

- ___________________ of a firm refers to the makeup of its long-term funds and its capital structure.

- a) Capitalisation

- b) Over-capitalisation

- c) Under-capitalisation

- d) Market capitalization

- In the _______________, the future value of all cash inflows at the end of a time period at a particular interest rate is calculated.

- a) Risk-free rate

- b) Compounding technique

- c) Discounting technique

- d) Risk Premium

- ______________ is the price at which the bond is traded in the stock exchange.

- a) Redemption value

- b) Face value

- c) Market value

- d) Maturity value

- _____________ increase the market value of shares and so equity capital is not free of cost.

- a) Face value

- b) Dividends

- c) Redemption value

- d) Book value

To help you study and revise quickly, you can download the Business Finance MCQs with Answer in PDF format from the link below. These MCQs are great for practicing and understanding important business finance concepts for 2025.