Bank of Maharashtra Home Loan Application From - Summary

Bank of Maharashtra offers competitive home loan rates with the best EMI of ₹769 per lakh availed at a low-interest rate of 8.40% for a maximum tenure of 30 years.

If you are paying an EMI more than ₹769 per lakh, you should consider the option for a loan transfer to Bank of Maharashtra from your existing bank.

Bank of Maharashtra Home Loan – Types

Maharashtra bank offers three different types of home loans including

- Maha Super Housing Loan Scheme for Construction/Acquiring

- Maha Super Housing Loan Scheme for Purchase of Plot and Construction thereon

- Maha Super Housing Loan Scheme for Repairs

List of Documents Required for BOM Home Loan

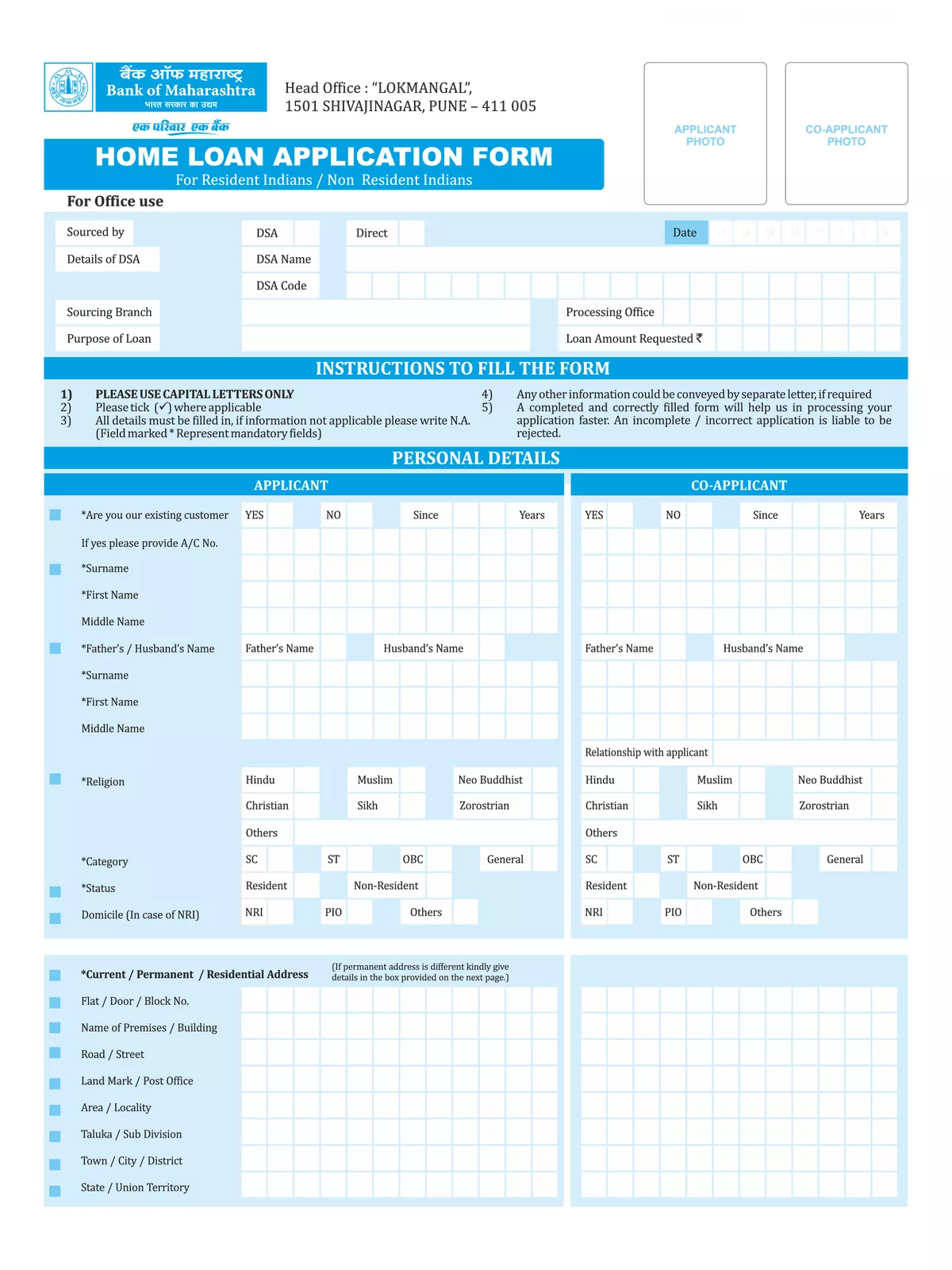

- Application form duly complete and signed.

- Two Passport Size Photographs.

- Proof of Identification : (any one)

- Election ID Card

- Pan Card

- Aadhar Card

- Driving License

- Photo Identity card issued by the current Employer

- Passport

- Proof of Residence : (any one)

- Electricity Bill

- Election ID Card

- Telephone Bill (Landline)

- Aadhar Card

- Driving License

- Photo Identity card issued by the current Employer

- Passport

- For Salaried Persons

- Original/Certified copy of the latest salary slips for the past 3 months

- Copies of IT returns of last 2 years duly acknowledged by IT Dept/IT assessment orders or Form 16 for last 2 years from the Employer.

- Undertaking from employer for remittance of monthly installment, wherever feasible.

- Bank Account (Salaried Account) statement for the last 6 months (in case of other Bank)

- For Non-Salaried Class /Businessman /Professional

- Latest 3 years of IT returns (2 years in case of Professionals) including computation of income, profit and Loss Account, Balance sheet, Audit Report etc.

- Shop Establishment Act

- Tax Registration Copy

- Company Registration License

- Bank statement for past one year

- Guarantor forms along with net worth proof /income proof (if applicable)

- Guarantor’s IT return along with KYC documents as mentioned in point 3 & 4

- In case of Takeover(Refinance):

- Loan Outstanding statement as on date

- Loan account statement for last 12 months

- Documents Acknowledgement Receipt from Bank

- Property Documents:

- Receipts for payments made for purchase of the residential unit

- Copy of approved drawings of proposed construction/purchase

- Permission from competent authority for construction of flat/house

- Permission from competent authority under Urban Land ceiling & Regulation Act 1976

- Agreement of Sale/Sale Deed/Detailed cost estimate from Regd.Architect/Engineer for the property to be constructed.

- Allotment letter from the Builder/Co-operative Society/Development Authorities/Association of apartment owners etc.

- Other documents depending upon:

- Property to be purchased directly from Builder (Ready/Under-construction)

- Property belonging to a Registered Co-operative Housing Society

- Purchase in resale.

- Direct sale by any Development authority

- Construction of house on separate plot of land.

- Additional Documents for NRIs

- Copy of employment Contract (if the contract is in any language other than English, the same has to be translated into English and attested by Employer /Indian Embassy)

- Copy of Identity Card issued by the current Employer

- Continuous Discharge certificate, if applicable

- Copy of latest work permit

- Copy of Visa stamped on the passport

- NRE Bank account passbook or statement of account

- Overseas Bank account statements for last 6 months in which salary is credited

- A Salary certificate/income statement duly attested by out foreign office including subsidiary office/certified by the competent authority available in the country may be produced. This may also include Chartered /Certified Accountants, Officials of Inland Revenue dept.(similar to Income Tax Authorities in India) or any other agency specified for the purpose. Where ever attestation is not possible, this may be submitted duly notarized.

- Additional Documents for PIOs

- A photocopy of PIO card or any of the under noted documents:-

- Current Passport indicating birth place of India/Abroad

- Indian Passport, if held earlier

- Parents or grandparents passport with details there in substantiating his claim of being PIO.

Features and benefits of Bank of Maharashtra Home Loan

- Low EMI

- Higher Loan Amount

- Zero Processing Fee

- No Hidden Charges

- No Prepayement Penalty

- 0.05% concession to women and defence personal.

- Maximum Tenure up to 30 Years / up to 75 years of age.

- No Pre-Payment / Pre-closure / Part payment Charges.

- Concession in ROI for Housing Loan borrower in Car Loan & Education Loan.

- Bank of Maharashtra Offers Lowest Interest Rate on Home Loan in India

Home Loan Interest Rates

Home loan interest rates keeps changing for all the banks based on the RBI repo rate, hence check the latest interest rates of BOM at this link.

For more details such as loan application procedure, visit the official website of Bank of Maharashtra at bankofmaharashtra.in.