Axis Bank Demand Draft Form 2026 - Summary

Want to get a Demand Draft from Axis Bank? You’ll need an Axis Bank Demand Draft Form. A Demand Draft, or DD, is like a prepaid payment. The bank pays the money, not the person who requests it. Anyone can get an Axis Bank DD, even if they don’t have a bank account, by paying in cash. Axis Bank helps you send money securely from one place to another through a DD.

Why Use the Axis Bank Demand Draft Form PDF?

The best thing about an Axis Bank Demand Draft is that the money is paid upfront. This means there’s no chance of the Demand Draft bouncing, unlike a cheque sometimes. You can get the Axis Bank Demand Draft Form PDF at any Axis Bank branch, or you can also download the Axis Bank Demand Draft Form PDF easily online. After you fill in the form carefully with all the details, you need to submit it to the bank with the payment (cash or cheque) at your closest Axis Bank branch.

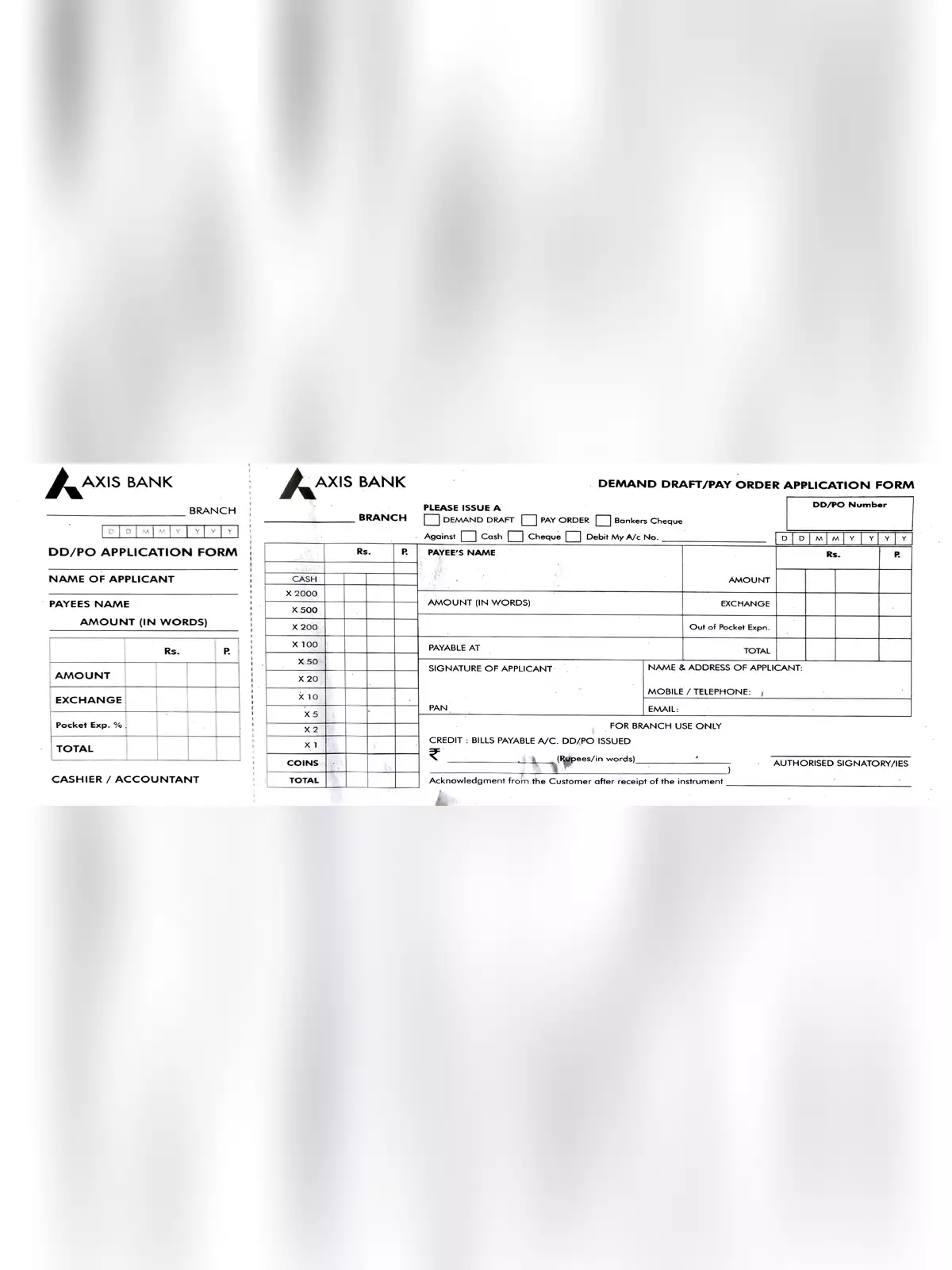

What to Fill in the Axis Bank Demand Draft Form

Here are the important details you need to fill in the Axis Bank DD Form:

- The name of the person or company who will get the money (Payee’s Full Name)

- The name of the bank branch where the money will be paid

- The place or city where the payment will be made

- The total amount you want to send, written in numbers and words

- If you are paying with cash, the cash details

- If you are paying with a cheque, the cheque details

- Any other extra information the bank may need

Cheques and Demand Drafts are both ways to pay, but they work differently. A cheque is an instruction to your bank to pay someone from your account. A Demand Draft is a guaranteed payment made by the bank itself. Since the bank guarantees the money, a Demand Draft is generally seen as safer and more trustworthy than a cheque.

Different Types of Demand Drafts from Axis Bank

Axis Bank provides a couple of common types of Demand Drafts:

- Sight Demand Draft: This DD can be paid right away when the person shows it to the bank with the correct papers. Without these, the bank won’t release the money.

- Time Demand Draft: This DD can only be cashed after waiting for a certain period. You can’t get the money before that time is over.

You can find the Axis Bank Demand Draft Form PDF download link below this article. Be sure to fill out the form correctly so your Demand Draft is made smoothly without any delays.