Application Form 10A for Registration of Charitable Trust - Summary

Looking to register a charitable trust? The Application Form 10A for Registration of Charitable Trust is your essential first step in making a positive impact on society! This form is crucial for obtaining registration under section 12A(1)(aa) of the Income-tax Act, 1961, allowing your organization to benefit from important tax advantages.

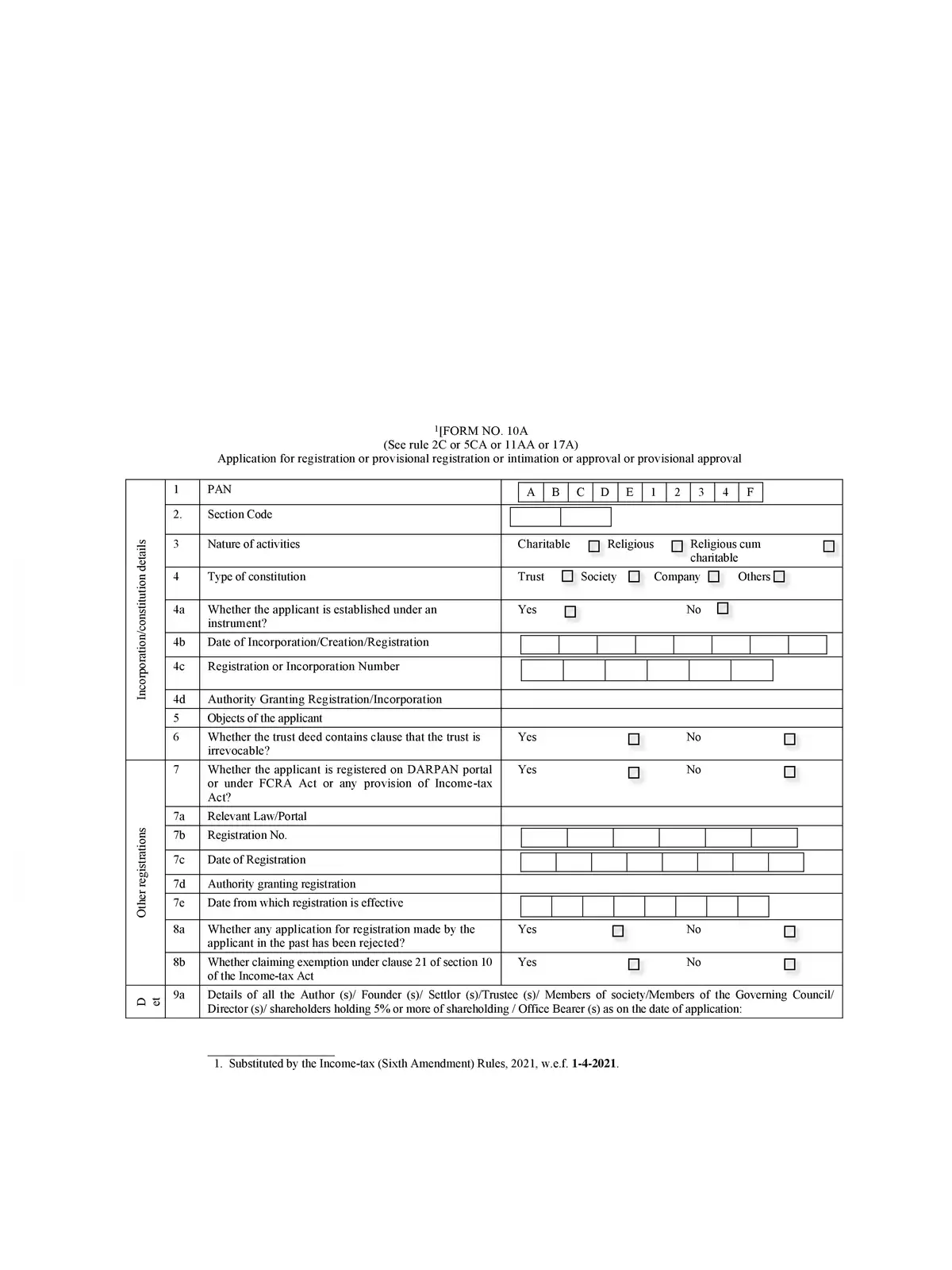

What is Application Form 10A?

Application Form 10A is specifically created for individuals or groups who want to set up a charitable or religious trust or institution. This application needs to be submitted to the income tax authorities for the purpose of registration.

Why Register a Charitable Trust?

Registering your trust comes with many benefits, such as tax exemptions and increased credibility. It helps your organization to operate efficiently while attracting donors and volunteers who are more likely to support a recognized body.

To make the application process smooth, ensure all required documents are prepared in advance. You can easily download the PDF version of the application form from our website and follow the instructions closely.

After completing the form, submit it along with the necessary attachments to the relevant authorities. This step is essential for obtaining your trust’s official status and enjoying the associated benefits.

For additional information, feel free to explore our resources or reach out with your questions. We are here to assist you with the PDF download and guide you through this important process! 😊